On no issue is the Dunning-Kruger Effect better illustrated than Trumpsters trying to discuss economics/markets.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Joe Biden Destroyed the Stock Market

- Thread starter Doc7505

- Start date

Tom Paine 1949

Diamond Member

- Mar 15, 2020

- 5,407

- 4,503

- 1,938

The topic is about the Stock Market, and Biden supposedly “destroying it.” It is not about inflation, which is a totally different subject.

In one sense (not normally accepted by the economics “profession”) the rapid decline of artificially inflated stock asset values is a good sign of deflation, just as higher wages for workers (which is feared by Fed bankers like Powell even though it simply reflects supply and demand and is not much effected by unions as in the past) is salutory in many ways. In this way of looking at the matter, the destruction of “money” invested in bloated stocks caused by a market decline is also salutory in present conditions.

Indeed, major U.S. inflation historically is disconnected from stock collapses — but highly connected to war (WWI & II and Vietnam) and outside “black swan” events like the Arab oil boycotts of the 70s and Covid disruptions.

The talk about the Fed or Wall Street or “capitalism in general” being “Democratic” is utter nonsense. Of course being suspicious of Trump is another matter.

Since Trump when President ridiculously and unsuccessfully pressured his own Republican appointee Jerome Powell to adopt “ZIRP” (Zero Interest Rate Policy) at just the time Powell was (belatedly) proposing to begin a less accommodationist policy, most of the banking community and the Fed in particular has responded by protecting its traditional independence. But with any less self-seeking Republican in office, the Fed and financial capitalism would likely revert to its historic norm of being generally — but certainly not fanatically — conservative pro-business, pro-Wall Street and pro-Republican.

In one sense (not normally accepted by the economics “profession”) the rapid decline of artificially inflated stock asset values is a good sign of deflation, just as higher wages for workers (which is feared by Fed bankers like Powell even though it simply reflects supply and demand and is not much effected by unions as in the past) is salutory in many ways. In this way of looking at the matter, the destruction of “money” invested in bloated stocks caused by a market decline is also salutory in present conditions.

Indeed, major U.S. inflation historically is disconnected from stock collapses — but highly connected to war (WWI & II and Vietnam) and outside “black swan” events like the Arab oil boycotts of the 70s and Covid disruptions.

The talk about the Fed or Wall Street or “capitalism in general” being “Democratic” is utter nonsense. Of course being suspicious of Trump is another matter.

Since Trump when President ridiculously and unsuccessfully pressured his own Republican appointee Jerome Powell to adopt “ZIRP” (Zero Interest Rate Policy) at just the time Powell was (belatedly) proposing to begin a less accommodationist policy, most of the banking community and the Fed in particular has responded by protecting its traditional independence. But with any less self-seeking Republican in office, the Fed and financial capitalism would likely revert to its historic norm of being generally — but certainly not fanatically — conservative pro-business, pro-Wall Street and pro-Republican.

They're not told how the Fed's trillions completely buoyed Trump's economy (which was at only 2.3% GDP when the virus hit), or how Trump begged the Fed for even MORE inflationary stimulus and the inflationary ZIRP to which you refer.Since Trump when President ridiculously and unsuccessfully pressured his own Republican appointee Jerome Powell to adopt “ZIRP” (Zero Interest Rate Policy) at just the time Powell was (belatedly) proposing to begin a less accommodationist policy, most of the banking community and the Fed in particular has responded by protecting its traditional independence. But with any less self-seeking Republican in office, the Fed and financial capitalism would likely revert to its historic norm of being generally — but certainly not fanatically — conservative pro-business, pro-Wall Street and pro-Republican.

All that information is readily available to them, but they literally, aggressively, don't want to know.

Trump calls on Fed to cut rates by 1% and urges more quantitative easing

In a two-part tweet, the president says more easing would make the economy "go up like a rocket."

AntonToo

Diamond Member

- Jun 13, 2016

- 30,456

- 8,808

- 1,340

The topic is about the Stock Market, and Biden supposedly “destroying it.” It is not about inflation, which is a totally different subject.

I'm going to disagree here - It's not totally different topic, because it's inflation that Fed is trying to cool off by raising interest rates and cutting it's balances (un-QE).

These monetary policies are deflating the stock market as predictably as doing the opposite inflated it in 2020-2021.

Nobody911

Gold Member

- Nov 26, 2022

- 422

- 213

- 203

My views :

No one can control everything in the world. So that's why plan B or C exists. Blaming politicians is just like talking to wackos. Yeah, waste of time & energy! lol.

Facts:

1)What Does Move Markets?

One thing is certain: The stock market doesn’t like uncertainty. On Sept. 5 of this year(2017), the Dow dropped 234 points amid a series of potentially volatile political events, including the debate over raising the debt ceiling, a possible government shutdown, and threats from Trump over trade policy with China.

2) No investment risk?

When investors invest their money in different types of securities or investment options, they expect a certain percentage of return on their investments. But as it happens, there is always the possibility of gain and risk of loss on the fund invested. The risk of occurrence of loss on the investment or return less than the expectation is termed investment risk. Sometimes investors lose their real money if investment risk is not managed effectively.

Source:

1) How Do Political Conditions Affect the Stock Market? | GOBankingRates – How Do Political Conditions Affect the Stock Market?/

2) Investment Risk | Examples and Types of Investment Risk – Investment Risk | Examples and Types of Investment Risk

No one can control everything in the world. So that's why plan B or C exists. Blaming politicians is just like talking to wackos. Yeah, waste of time & energy! lol.

Facts:

1)What Does Move Markets?

One thing is certain: The stock market doesn’t like uncertainty. On Sept. 5 of this year(2017), the Dow dropped 234 points amid a series of potentially volatile political events, including the debate over raising the debt ceiling, a possible government shutdown, and threats from Trump over trade policy with China.

2) No investment risk?

When investors invest their money in different types of securities or investment options, they expect a certain percentage of return on their investments. But as it happens, there is always the possibility of gain and risk of loss on the fund invested. The risk of occurrence of loss on the investment or return less than the expectation is termed investment risk. Sometimes investors lose their real money if investment risk is not managed effectively.

Source:

1) How Do Political Conditions Affect the Stock Market? | GOBankingRates – How Do Political Conditions Affect the Stock Market?/

2) Investment Risk | Examples and Types of Investment Risk – Investment Risk | Examples and Types of Investment Risk

Tom Paine 1949

Diamond Member

- Mar 15, 2020

- 5,407

- 4,503

- 1,938

Of course Fed policy has significance. You can always find some relation between Fed policies aimed at “fighting inflation” or “fighting the threat of deflation” (justification for QE and ZIRP), but the Fed’s tools are limited banking tools only. They do not determine industrial policy, or effect taxes and expenditures directly. They have been pumping out trillions of dollars into the U.S. economy for decades, which U.S. world finance dominance has allowed them to do while still maintaining historically very low levels of inflation. Much of that went into “asset inflation” for the wealthy and our new .0001% of oligarchs.

“Pushing on a string” doesn’t normally work. It doesn’t encourage domestic industry, and at best allows a de-industrialized middle class to enjoy some of the fruits of global supply chains (and rising asset values). Foreign labor has worked to keep inflation down for all sorts of imported commodities, while technological advances helped too. But these are disappearing now with global decoupling and trade war — the real cause of global long-term inflation.

The real economy and the stock market have some connection of course, but most are looking at it way too narrowly. There was no significant inflation of commodities before (or indirectly causing) the market collapses of the Great Depression, the Dot.com collapse or the Financial Crisis. There is today no certainty that a further stock market or fiscal collapse will occur. The Fed is not being pressured by the Biden administration and seem to be “on the job,” so far as their limited tools allow them to be. The greatest threats are probably exogenic. Of course any oft-proposed MAGA “civil war” would also create economic collapse.

One time Trump and Biden “money printing” for Covid (mostly depression-avoidance expenditures) were not very well targeted to help the poorest, or businesses really at threat, but this is old news. These funds have mostly already been absorbed back into uncirculating or unproductive capital. They served at most as a “trigger” of sorts. After years of much greater money expansion without inflation, the Fed was caught a bit flatfooted. But Trump and Biden Covid checks did not cause worldwide inflation — as some conservatives suggest. The strength of the dollar (internationally) actually increased in this period.

“Pushing on a string” doesn’t normally work. It doesn’t encourage domestic industry, and at best allows a de-industrialized middle class to enjoy some of the fruits of global supply chains (and rising asset values). Foreign labor has worked to keep inflation down for all sorts of imported commodities, while technological advances helped too. But these are disappearing now with global decoupling and trade war — the real cause of global long-term inflation.

The real economy and the stock market have some connection of course, but most are looking at it way too narrowly. There was no significant inflation of commodities before (or indirectly causing) the market collapses of the Great Depression, the Dot.com collapse or the Financial Crisis. There is today no certainty that a further stock market or fiscal collapse will occur. The Fed is not being pressured by the Biden administration and seem to be “on the job,” so far as their limited tools allow them to be. The greatest threats are probably exogenic. Of course any oft-proposed MAGA “civil war” would also create economic collapse.

One time Trump and Biden “money printing” for Covid (mostly depression-avoidance expenditures) were not very well targeted to help the poorest, or businesses really at threat, but this is old news. These funds have mostly already been absorbed back into uncirculating or unproductive capital. They served at most as a “trigger” of sorts. After years of much greater money expansion without inflation, the Fed was caught a bit flatfooted. But Trump and Biden Covid checks did not cause worldwide inflation — as some conservatives suggest. The strength of the dollar (internationally) actually increased in this period.

Last edited:

Resnic

Diamond Member

- May 2, 2021

- 10,702

- 12,405

- 2,288

Nice spin, too bad that President Biden isn't responsible for the deficit in our Markets:

- The Pandemic

- Fiscal Conservative

- Local City and Town Councils

- Greed

- World Markets too

- McConnell & his bitches

- Trump

- And, people like you.

The pandemic was over a year ago and everything has opened back up.

If saying the president has nothing to do with it then you can't say trump either. Besides that was 2 years ago.

All your other examples are just vauge hand waving that don't really mean anything without a whole lot more specific description and linked examples showing exactly how they effected the stock market.

People like him? How exactly did he ruin stocks for the whole country? That doesn't even make any sense.

high taxes, massive spending, govt lockdowns, war on fossil fuels....bascially the war on the working classWhich ones?

AntonToo

Diamond Member

- Jun 13, 2016

- 30,456

- 8,808

- 1,340

Democrats were in charge for two years, what "high taxes"?high taxes, massive spending, govt lockdowns, war on fossil fuels....bascially the war on the working class

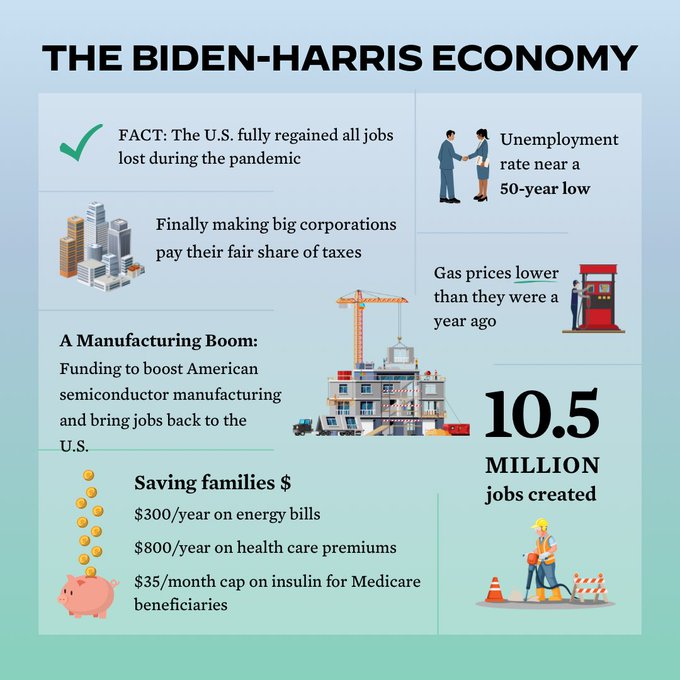

During Trump's last year in office FY2020 spending shot up to 6.5T from 4.4T in 2019. Clearly your Republicans had no problem at all with massive spending.

Democrats were in charge for two years, during which all lockdowns were phased out.

In those two years fossil fuel production INCREASED.

So let me ask you - do you sniff glue every morning? Because you are clearly having a lot of problems with reality at this point.

Last edited:

Americans lost 9 trillion in the market in 2022. Buuuuuuuuuuuut, according to some of the posters here, it was a "great year" for Biden.

AntonToo

Diamond Member

- Jun 13, 2016

- 30,456

- 8,808

- 1,340

Was 2021 great year for Biden? Lets just set a consistent standard here.Americans lost 9 trillion in the market in 2022. Buuuuuuuuuuuut, according to some of the posters here, it was a "great year" for Biden.

Was 2021 great year for Biden? Lets just set a consistent standard here.

I don't know, you tell me.

2021 and 2022 sucked for most Americans, but as long as it was good for Biden, you guys celebrate.

Was 2021 great year for Biden? Lets just set a consistent standard here.

By the way, don't give me a 'fake news' citation!

Read for yourself!

Stock market losses wipe out $9 trillion from Americans' wealth

Falling stock markets have wiped out $9 trillion in wealth from U.S. households, putting pressure on family balance sheets and spending.

the cult puts party before countryI don't know, you tell me.

2021 and 2022 sucked for most Americans, but as long as it was good for Biden, you guys celebrate.

If you bought stocks on Trump’s second year’s Jan 3rd for $100,000 they’d be worth $130,000 under Joe today on his second year’s Jan 3rd. If you bought $100,000 on April 1st of Trump’s third year it would be worth $195,000 under Joe today.

Go Joe!!

Go Joe!!

AntonToo

Diamond Member

- Jun 13, 2016

- 30,456

- 8,808

- 1,340

By the way, don't give me a 'fake news' citation!

Read for yourself!

Stock market losses wipe out $9 trillion from Americans' wealth

Falling stock markets have wiped out $9 trillion in wealth from U.S. households, putting pressure on family balance sheets and spending.www.cnbc.com

Your link:

From the market lows of 2020 to the peak at the end of 2021, America’s stock wealth nearly doubled, from $22 trillion to $42 trillion.

So 13 Trillion gain (50%+) in three years and all you could think about is now is how to shit on Biden.

how much would you of had if joe and the demafasict didn’t record the market and have the worst year since 2008 this past year?If you bought stocks on Trump’s second year’s Jan 3rd for $100,000 they’d be worth $130,000 under Joe today on his second year’s Jan 3rd. If you bought $100,000 on April 1st of Trump’s third year it would be worth $195,000 under Joe today.

Go Joe!!

Your link:

From the market lows of 2020 to the peak at the end of 2021, America’s stock wealth nearly doubled, from $22 trillion to $42 trillion.

So 13 Trillion gain (50%+) in three years and all you could think about is now is how to shit on Biden.

This last year was horrible, stocks, inflation, border invasion, gas prices, lending rates. It sucked, PERIOD!!

Similar threads

- Replies

- 109

- Views

- 875

- Replies

- 282

- Views

- 2K

- Replies

- 22

- Views

- 481

Latest Discussions

- Replies

- 38

- Views

- 431

- Replies

- 48

- Views

- 214

Forum List

-

-

-

-

-

Political Satire 8051

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-