A family business can just be put in a closed corporation, and there's no tax."There are going to be 2.6 million people [who] die this year in the United States," but there will be only about 5,000 tax returns that will owe estate taxes, he said in a wide-ranging interview.

Buffett said because the estate tax impacts only a small percentage of Americans, getting rid of it would not cause widespread problems.

"If they pass the bill they're talking about, I could leave $75 billion to a bunch of children and grandchildren and great-grandchildren. And if I left it to 35 of them, they'd each have a couple billion dollars," Buffett said. He then asked rhetorically, "Is that a great way to allocate resources in the United States?"

World's second richest man Warren Buffett thinks it's a mistake to eliminate the estate tax

$S-E-V-E-N-T-Y F-I-V-E- B-I-L-L-I-O-N ...

Buffet's wealth, just like that of all .01%ers, is sheltered is tax avoiding trusts.

The estate tax mostly hits upper middle class people who worked hard and saved (and already paid taxes on) money or built family businesses.

Yes, the estate tax is a death tax, and should be eliminated.

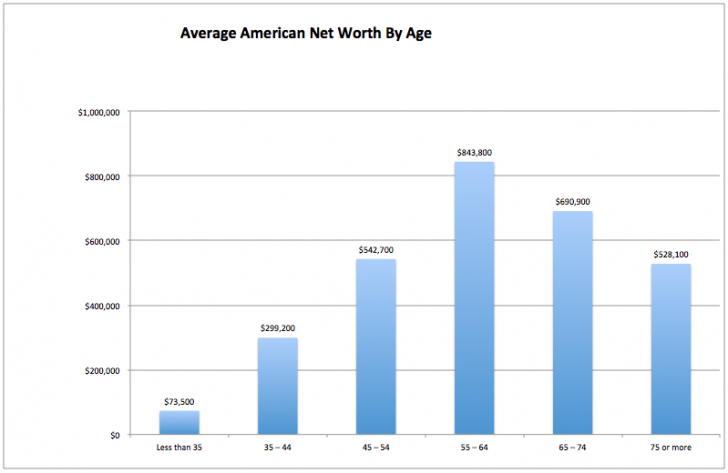

In fact, households affected fall somewhere between the 95th and 99th percentile of all U.S. households: According to the Wall Street Journal, the top 1% of households have a net worth of at least $6.8 million, while the top 5% have a net worth of at least $1.9 million.

How Many People Pay the Estate Tax?

it's about passive income.