Ravi

Diamond Member

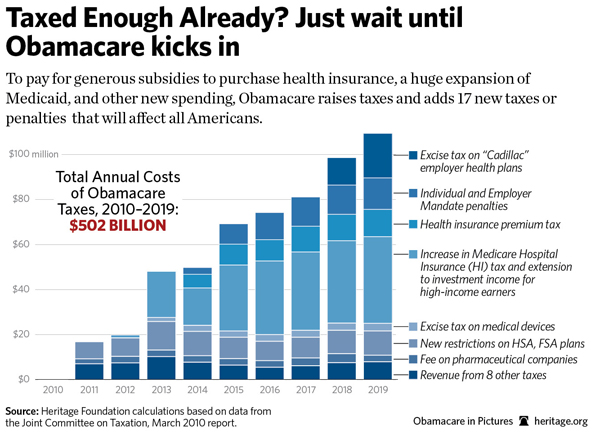

What huge tax increases across the board?I keep hearing Obamacare is a massive tax increase because it was upheld on a tax basis.

I'm well aware of the HUGE tax increases across the board to pay for the program but why is everyone suddenly claiming because of the penalty portion it a new unknown tax increase? Is there somehow a new tax exposed or is this just a play on words?

Be honest

Be honest.