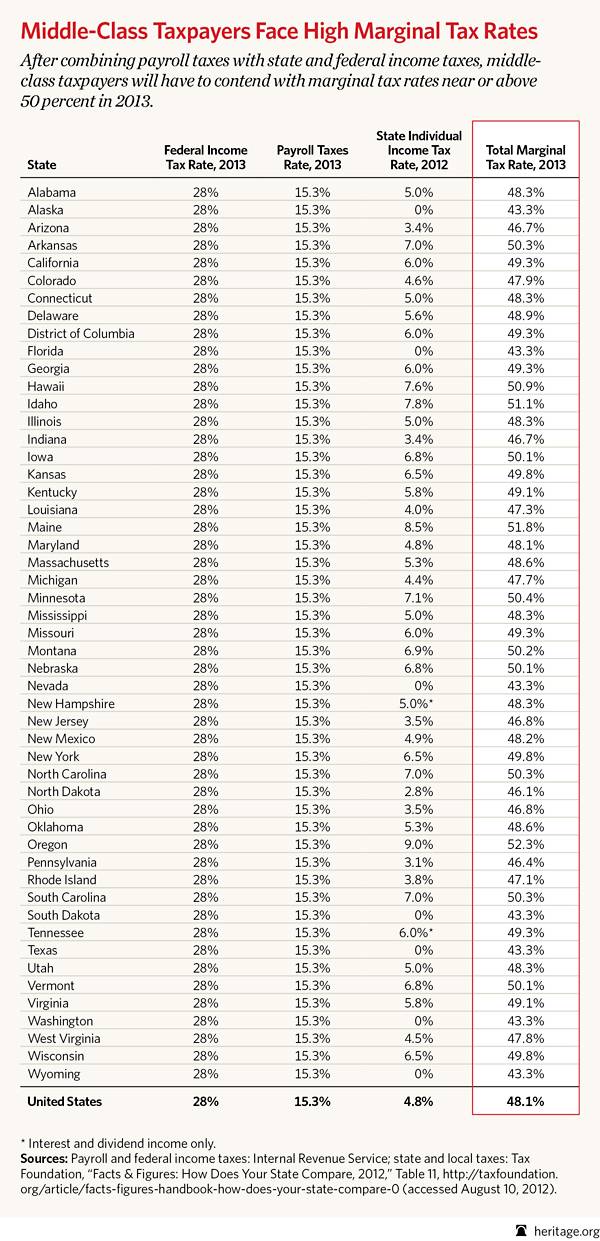

How high is the marginal tax rate on each additional dollar the average American earns? In other words, if you got a raise of one dollar, how much of that dollar would be taxed away? These rates are already high, and theyre getting higher next year.

Government Will Take Almost Half Your Paycheck in 2013