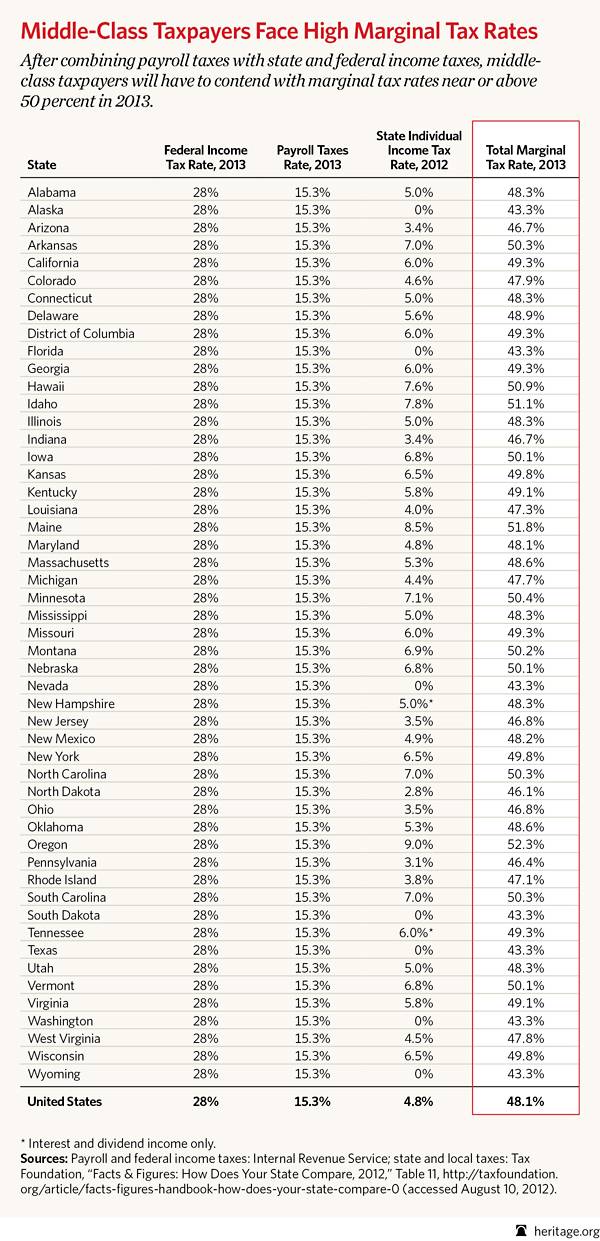

in all levels of taxation, the government has been confiscating close to or over 50% of my pay for a while...

I bet though, if the free loaders and entitlement junkies would be taxed to the same degree, suddenly they would be calling for lower tax rates and be worried about the wasteful and extensive government spending that facilitates the taxation

you have that exactly right. What we need is a fair flat tax. Everybody needs some skin in the game. and we should all be treated equally as far as taxation goes.

Good luck fighting the plutocrats over that issue, it is the lobby industry which guides this nation.