- Apr 12, 2011

- 3,814

- 758

- 130

You made that up because Total Products has only been compiled since '72 (39 years)....The fact we're at 2005 levels means it has not grown in 6 years, that would be about the worst showing in 60 years...

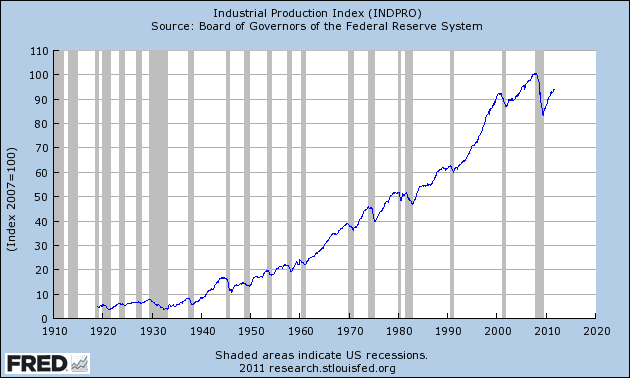

Then again if someone went to the trouble to tote the numbers back six decades we'd probably see that you're right because the Industrial Production Index goes back to 1919 and--

--it shows that while we're still where we were in '05, and it also shows how much production had soared after the '03 tax-cuts and how being up at the '05 level is really pretty good. It also shows that we've done a lot better with Clinton's competition from cheap foreign labor than without.