- Aug 8, 2016

- 26,102

- 25,170

- 2,445

It's a rather timely op-ed, I think. Particularly since so much of the recent discussion involving the market problems is so misguided.

Anyway...

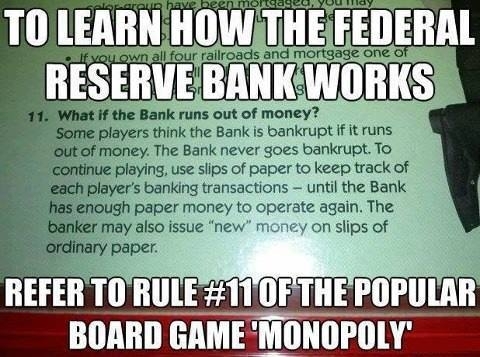

Last week, the Federal Reserve responded to Wall Street’s coronavirus panic with an “emergency” interest rate cut. This emergency cut failed to revive the stock market, leading to predictions that the Fed will again cut rates later this month. More rate cuts would drive interest rates to near, or even below, zero. Lowering interest rates punishes people for saving, thus encouraging consumers and businesses to spend every penny they make. This may give the economy a short-term boost. But, it inhibits long-term economic growth by depleting the savings necessary for investments in businesses and jobs. The result of this policy will be more pressure on the Fed to indefinitely maintain low interest rates and on the Congress and president to create another explosion of government “stimulus” spending.

The essence of socialist economics is government allocation of resources either by seizing direct control of the “means of production” or by setting prices business can charge. Federal Reserve manipulation of interest rates is an attempt to set the price of money. Federal Reserve attempts to set interest rates distort the signals sent by the rates to investors and business. This results in a Fed-created boom, which is inevitably followed by a Fed-created bust.

Boston Federal Reserve President Eric Rosengren has suggested that Congress allow the Federal Reserve to add assets of private companies to the Fed’s already large balance sheet. Allowing the central bank to buy assets of, and thus assume a partial ownership interest in, private companies would give the Federal Reserve even greater influence over the economy.

Economic elites benefit when the Federal Reserve pumps new money into the economy because they have access to the money created before there are widespread price increases. Artificially low interest rates also facilitate the growth of the welfare-warfare state. The Federal Reserve’s inflationary policies harm the average American by eroding the dollar’s purchasing power. This forces consumers to rely on credit cards and other forms of debt to maintain their standard of living...

Continued - Central Banking is Socialism

Anyway...

Last week, the Federal Reserve responded to Wall Street’s coronavirus panic with an “emergency” interest rate cut. This emergency cut failed to revive the stock market, leading to predictions that the Fed will again cut rates later this month. More rate cuts would drive interest rates to near, or even below, zero. Lowering interest rates punishes people for saving, thus encouraging consumers and businesses to spend every penny they make. This may give the economy a short-term boost. But, it inhibits long-term economic growth by depleting the savings necessary for investments in businesses and jobs. The result of this policy will be more pressure on the Fed to indefinitely maintain low interest rates and on the Congress and president to create another explosion of government “stimulus” spending.

The essence of socialist economics is government allocation of resources either by seizing direct control of the “means of production” or by setting prices business can charge. Federal Reserve manipulation of interest rates is an attempt to set the price of money. Federal Reserve attempts to set interest rates distort the signals sent by the rates to investors and business. This results in a Fed-created boom, which is inevitably followed by a Fed-created bust.

Boston Federal Reserve President Eric Rosengren has suggested that Congress allow the Federal Reserve to add assets of private companies to the Fed’s already large balance sheet. Allowing the central bank to buy assets of, and thus assume a partial ownership interest in, private companies would give the Federal Reserve even greater influence over the economy.

Economic elites benefit when the Federal Reserve pumps new money into the economy because they have access to the money created before there are widespread price increases. Artificially low interest rates also facilitate the growth of the welfare-warfare state. The Federal Reserve’s inflationary policies harm the average American by eroding the dollar’s purchasing power. This forces consumers to rely on credit cards and other forms of debt to maintain their standard of living...

Continued - Central Banking is Socialism

Last edited: