sangha

Senior Member

- Jun 1, 2010

- 5,997

- 179

- 48

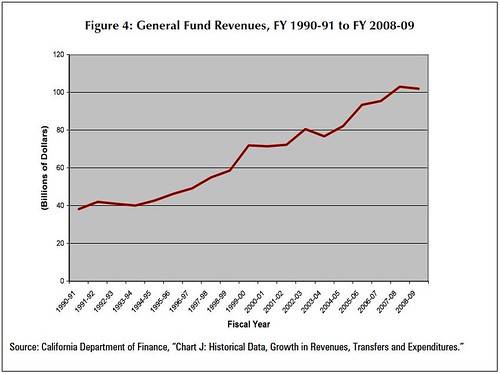

Texas doesn't have an income tax; CA has one of the highest in the country, as well as high sales taxes and property taxes (the latter due to property values, not rates).

The regulatory environment and growth of public employee unions in CA has also made in very hostile to business.

I wonder if the wingnut can explain how these high taxes, burdensome regulations, and growing unions explains why CA is growing faster than TX?

It's clear this moron can't even click on a link and look at data.

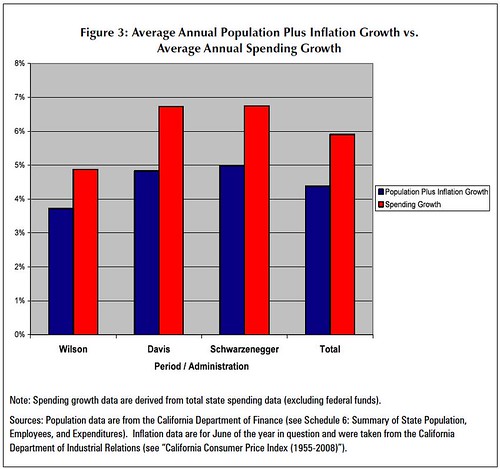

The time series is distorts the growth. CA grew like crazy during the dotcom era. Since that time, the areas of growth have been Real Estate, Health & Social Services, and the size of Government. Hi Tech and Professional Services have grown, but I'd like to know how much of the former is due to consolidated revenues from foreign subsidiaries.

Overall, CA's economy has basically flat lined since 2007, and there is out migration from the state as businesses leave the hostile climate. TX is benefitting from this out migration as more high tech is relocating there, and will see stronger growth as the economy recovers.

In contrast, CA is strangling itself with the Green Economy nonsense.

I asked for YOUR explanation, and unsurprisingly, the wingnut HAS NO EXPLANATION.

According to the wingnut (that would be you) CA has high taxes, lots of regulations, strong unions, and lots of govt spending, while TX has none of those impediments to business. In wingnut world, that should make CA a low growth state and TX a high growth state

Yet, CA has a higher growth rate than TX. I ask how the wingnut explains this, and predictably, the wingnut HAS NO EXPLANATION

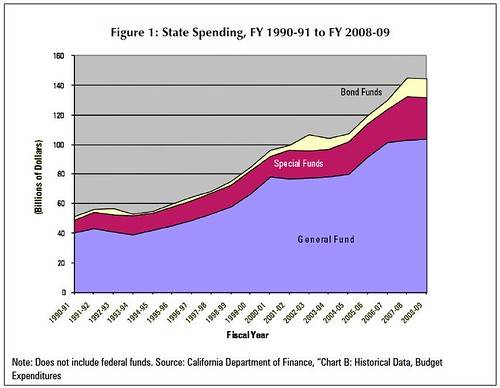

needlessly? so everything is hunky dory? so my readjusted 250 billion is no good either? okay, do you have a number? or is this all a about nothing?

needlessly? so everything is hunky dory? so my readjusted 250 billion is no good either? okay, do you have a number? or is this all a about nothing?