The United States uses approximately 390 million gallons of

gasoline every day,a large proportion of which comes from

imported oil.

While the price fluctuates, the average price of

gasoline is about $2.65 per gallon.

There is an additional hidden cost to our gasoline

something that isnt included in the price at the pump.

The added cost is the $215.4 billion each year that the

U.S. military spends of our tax dollars to secure access

to imported energy.

This means, in addition to the $2.65/gallon

price of gasoline, we pay an extra $0.57

for each of the 142 billion gallons of

gasoline we use every year.

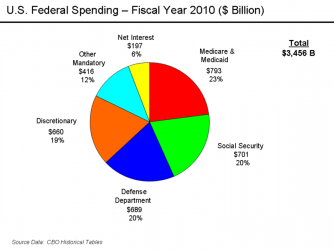

$215.4 billion represents nearly 30% of the federal defense

budget just to gain access to foreign energy. This is one

years worth of troops, weaponry, and most of the Iraq

war funded by taxpayer dollars.

What if that money instead paid for What if that money instead paid for What if

renewable energy technology and

jobs here at home?

National Priorities Project

gasoline every day,a large proportion of which comes from

imported oil.

While the price fluctuates, the average price of

gasoline is about $2.65 per gallon.

There is an additional hidden cost to our gasoline

something that isnt included in the price at the pump.

The added cost is the $215.4 billion each year that the

U.S. military spends of our tax dollars to secure access

to imported energy.

This means, in addition to the $2.65/gallon

price of gasoline, we pay an extra $0.57

for each of the 142 billion gallons of

gasoline we use every year.

$215.4 billion represents nearly 30% of the federal defense

budget just to gain access to foreign energy. This is one

years worth of troops, weaponry, and most of the Iraq

war funded by taxpayer dollars.

What if that money instead paid for What if that money instead paid for What if

renewable energy technology and

jobs here at home?

National Priorities Project