Is there any commodity price change that is not all, or part, speculation?

Oil and Natural Gas are both commodities.

Oil is priced at historical highs

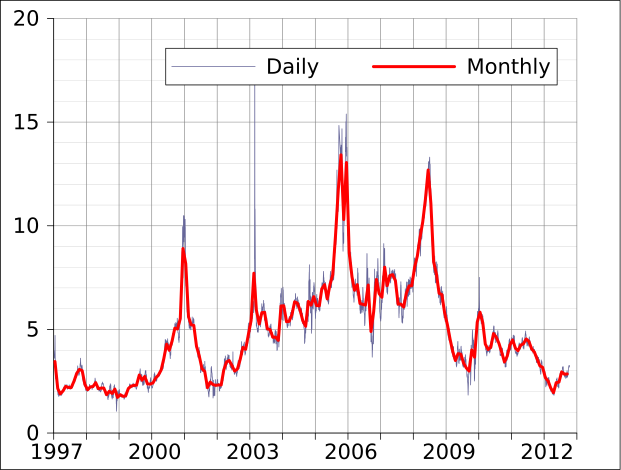

But not NG? Why?

Busses run on NG.

Why don't we build cars to run on NG?

There's a difference between the speculation you are likely thinking of and what was going on in Wall Street. I'll find a link to explain what I'm talking about.

If you want my honest opinion, Congress should implement once again the regulations that safeguard the commodities market from these sort of things. It wasn't until fairly recently after a fair amount of deregulation was Wall Street allowed to speculate the way they have.

Natural Gas is interesting to say the least. It certainly seems to be the future for at least the short term. ExxonMobil seems to think so since they recently once again became the largest Natural Gas company in the world.

"short term?"

Hate to break it to you, but there is no energy source that will sustain our current consumption on Earth forever.

However, commodities are traded, worldwide.

Its a little silly to believe that the US Congress is going to regulate their price.