FA_Q2

Gold Member

Did you even read your own link. It does not state anywhere that the top 1% payed 13% tax.... The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent). ...

Since when? In 2018 the upper 1% payed 13.3% and the bottom 90% payed 61%.

source: How Much Income Puts You in the Top 1%, 5%, 10%?

On the other side the top 1% own $35.5T and the bottom 90% own $44.4T. (in 2Q 2019)

source: Richest 1% of Americans Close to Surpassing Wealth of Middle Class

So the bottom 90% pay 4.6 times more income tax - although they have only 1.25 times more assets.

"The bottom 90% earned 69.8% of all earnings in 1979 but only 61% in 2018. In contrast the top 1% increased its share of earnings from 7.3% in 1979 to 13.3% in 2018, a near-doubling."

We do not have a flat tax, citing flat earning has very little connection with actual paid taxes.

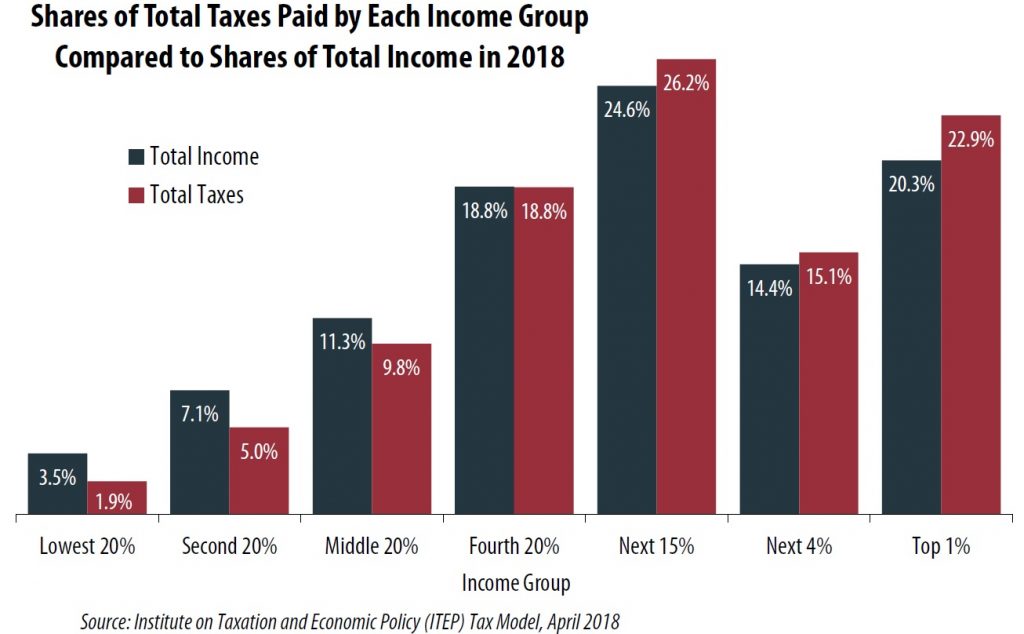

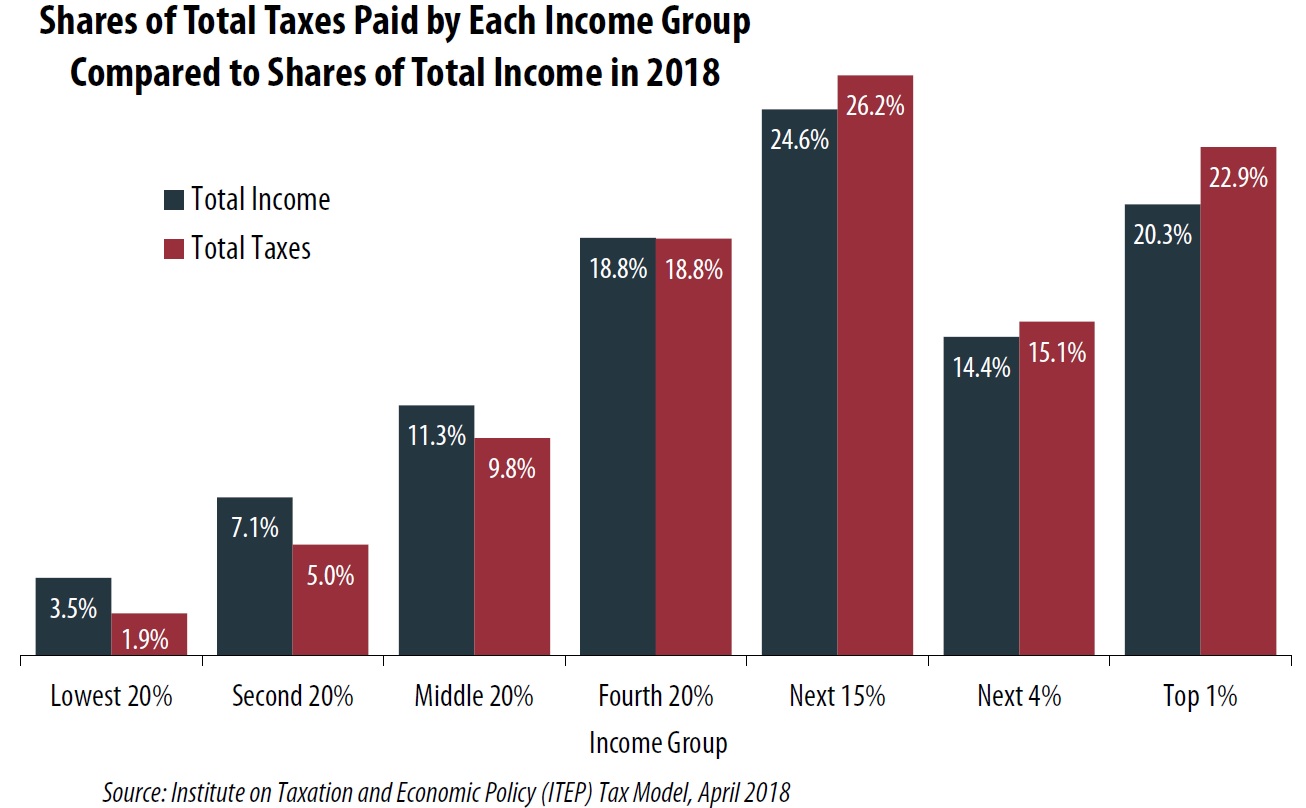

Who Pays Taxes in America in 2018?

America’s tax system overall is marginally progressive. The share of all taxes paid by the richest Americans slightly exceeds their share of the nation’s income. Conversely, the share of all taxes paid by the poorest Americans is slightly smaller than the share of the nation’s income going to...

The top 1% does pay a far larger share than the rest of income brackets, that really should be blatantly obvious. That does not necessarily mean it is enough or the correct amount but pretending they do not is not helpful in any shape or form.