Not surprised.

. . . . there were, after all, rumors.

View attachment 1056225

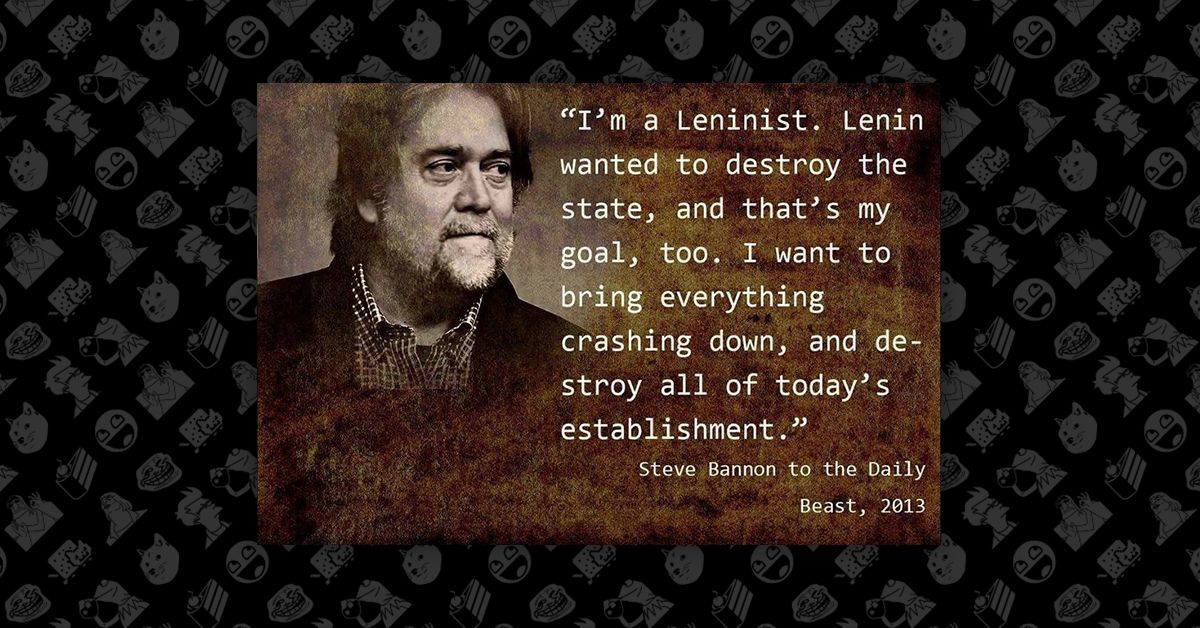

Bannon says he’s a Leninist: that could explain the White House’s new tactics

This article is more than 7 years old

Victor Sebestyen

Trump’s top political adviser says he wants to destroy the state, like the Bolshevik leader, and some of his ideas certainly echo the Russian revolutionary

www.theguardian.com

After reports about the quote emerged, President Donald Trump's chief strategist told journalists that he did not recall the conversation.

www.snopes.com

I may agree with you on many things, but you have Marxism and Leninism wrong.

They are NOT oriented as power coming from the state.

They are the most democratic republic form of government possible, considering how powerful and dangerous the capitalist and monarchist greed and power are.

After the invention of edged weapons, the wealthy elite took over and created monarchies through capitalism.

The invention of firearms brought back the opportunity for democratic republics again, but then the industrial revolution took away individual freedom once again.

So Marxists and Leninists who want collective means of production are correct.

Whenever you allow the capitalists to exert their control over a monopoly on capital, then everyone without enough personal capital becomes a feudal serf.

Anti-trust laws and unions cannot save us since save us since the wealthy elite control the media, and therefore the elections.

It is obvious only public resources can work to protect individuals.

Just look at public schools for example, and imagine how horrific would be without them.

We only have to look at how badly the insurance companies have taken over and ruined health care in the US to see that the profit motive cannot possibly work.

People try to use car makers to show how great competition is, and it's a total failure.

US cars are twice as big and twice as expensive as they should be and are everywhere else in the world.

That is because the profit margins are much better on big SUVs than they are in reasonable minimalist cars.

But private car makes have lead to unsafe working conditions, all car manufacturing being offshored, dozens of domestic car companies gone bankrupt, whole cities abandoned, etc. Brazil, Iceland, and Sweden show that socialization can produce far better and cleaner cars that can run on things like ethanol, hydrogen, palm oil, etc., that do not pollute.

The US democratic republic cannot survive global capitalism.