william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,405

- 280

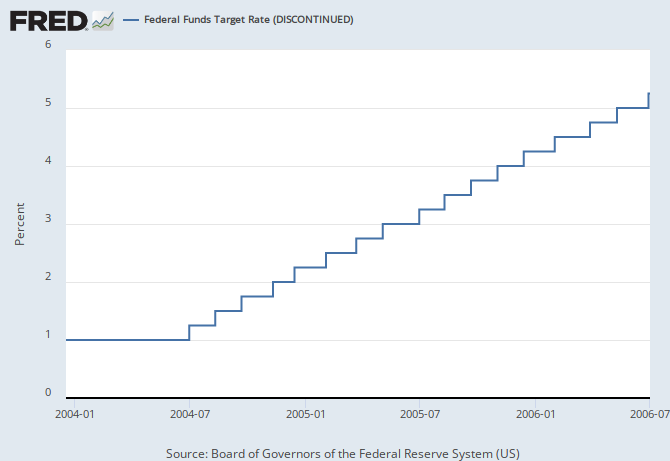

Normally three rate hikes in one year causes a severe market correction. The Fed is arguing currently that Negative interest rates in China, Japan and the EU have offset last year's rate hike. Therefore three hikes are effectively two.

Since negative nominal rates have never been seen previously as a monetary policy no matter what the Fed does it will be exploring unknown territory. I'm posting this thread just to see how many people think they know what is going to happen.

Will rent seeking investors worldwide, also known as yield whores, flood the country with enough hot money to make domestic rate hikes ineffectual?

Will rate hikes cause a market crash?

I assume that both above things will happen but I am clueless as to which order and the lag between one happening and then the other.

Please voice your opinion on the subject so the rest of us and can politely heckle you. This is after all CDZ

Since negative nominal rates have never been seen previously as a monetary policy no matter what the Fed does it will be exploring unknown territory. I'm posting this thread just to see how many people think they know what is going to happen.

Will rent seeking investors worldwide, also known as yield whores, flood the country with enough hot money to make domestic rate hikes ineffectual?

Will rate hikes cause a market crash?

I assume that both above things will happen but I am clueless as to which order and the lag between one happening and then the other.

Please voice your opinion on the subject so the rest of us and can politely heckle you. This is after all CDZ