I

Itsthetruth

Guest

SO-CALLED "PRICE INDEXING" PROPOSAL WOULD RESULT IN

DEEP REDUCTIONS OVER TIME IN SOCIAL SECURITY BENEFITS[*]

by Robert Greenstein

Increasing attention is being accorded to a proposal to make a major change in how Social Security benefits levels are set. Under a proposal that President Bushs Social Security Commission put forward in 2001, Social Security benefits would shrink dramatically over time as a share of workers' pre-retirement wages, replacing a much smaller share of pre-retirement wages for workers who retire farther into the future than for workers who retire sooner. The gap between Social Security benefits and pre-retirement wages thus would widen over time.

This proposal is sometimes referred to, in shorthand, as a proposal to change the Social Security benefit structure from wage indexing to price indexing. In reality, the proposal would maintain wage indexing, but would change the Social Security benefit formula by lowering the programs replacement rates by the difference between wage growth and price growth.

The Effect on Social Security Benefits

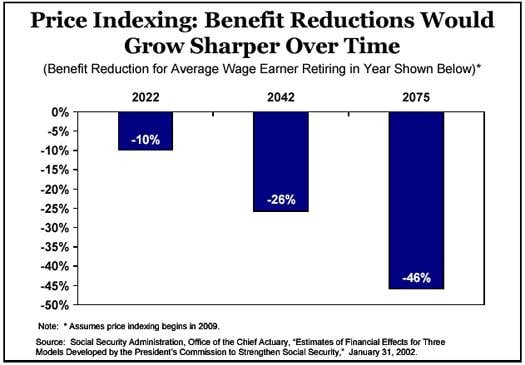

Advocates of this proposal have sometimes sought to portray it as not representing a benefit reduction and as simply curbing excessive growth in Social Security benefits. But the change would, in fact, represent a substantial reduction in benefits, as compared to the benefits payable under the current benefit structure. According to estimates from the Social Security Administrations Office of the Chief Actuary:

Under the proposal, a worker born in 1977 who earned average wages throughout his or her career and retired at age 65 in 2042 would receive monthly Social Security benefits 26 percent lower than under the current benefit structure. Instead of this workers annual benefit being $19,423, the benefit would be $14,432, a $4,992 reduction. (These figures are in 2004 dollars)

http://www.cbpp.org/12-17-04socsec.htm

DEEP REDUCTIONS OVER TIME IN SOCIAL SECURITY BENEFITS[*]

by Robert Greenstein

Increasing attention is being accorded to a proposal to make a major change in how Social Security benefits levels are set. Under a proposal that President Bushs Social Security Commission put forward in 2001, Social Security benefits would shrink dramatically over time as a share of workers' pre-retirement wages, replacing a much smaller share of pre-retirement wages for workers who retire farther into the future than for workers who retire sooner. The gap between Social Security benefits and pre-retirement wages thus would widen over time.

This proposal is sometimes referred to, in shorthand, as a proposal to change the Social Security benefit structure from wage indexing to price indexing. In reality, the proposal would maintain wage indexing, but would change the Social Security benefit formula by lowering the programs replacement rates by the difference between wage growth and price growth.

The Effect on Social Security Benefits

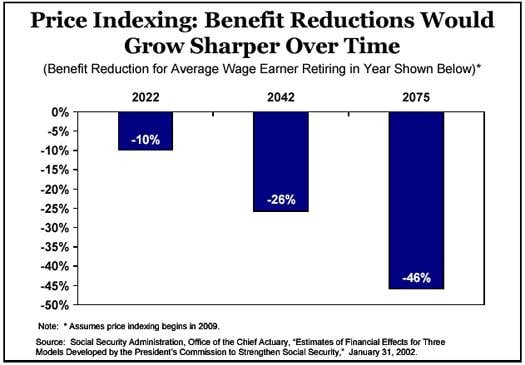

Advocates of this proposal have sometimes sought to portray it as not representing a benefit reduction and as simply curbing excessive growth in Social Security benefits. But the change would, in fact, represent a substantial reduction in benefits, as compared to the benefits payable under the current benefit structure. According to estimates from the Social Security Administrations Office of the Chief Actuary:

Under the proposal, a worker born in 1977 who earned average wages throughout his or her career and retired at age 65 in 2042 would receive monthly Social Security benefits 26 percent lower than under the current benefit structure. Instead of this workers annual benefit being $19,423, the benefit would be $14,432, a $4,992 reduction. (These figures are in 2004 dollars)

http://www.cbpp.org/12-17-04socsec.htm