This page tracks the federal oil and gas leasing pause and related litigation. For more on these leasing programs, see our Onshore Leasing Page and Offshore Leasing Page. If you’re a reporter and would like to speak with an expert on this rule, please email us. Quick Take The IRA makes it hard...

eelp.law.harvard.edu

BIDEN ADMINISTRATION

Read More

Jan. 20, 2021 DOI issues Secretarial Order No. 3395, announcing that the agency is temporarily

suspending its authority to issue any onshore or offshore fossil fuel authorizations, including new lease sales, for 60 days.

Jan. 20, 2021 In

Executive Order 13990, President Biden revokes the Trump

Executive Order 13783 titled “Promoting Energy Independence and Economic Growth.” EO 13783 directed federal agencies to streamline the oil and gas leasing process and suspend, revise, or rescind regulations that burdened the development of domestic energy resources.

Jan. 27, 2021 President Biden signs

Executive Order 14008, which pauses all new federal offshore and onshore oil and gas leasing pending a comprehensive review of the leasing and permitting program. The order also revokes Trump’s EO 13795.

Jan. 27, 2022 Western Energy Alliance petitions the District of Wyoming to review President Biden’s suspension of the oil and gas leasing program. Western Energy Alliance v. Biden, No. 0:21-cv-00013 (D. Wyo.).

March 15, 2021 The Biden administration

asks the Ninth Circuit to dismiss the case reviewing President Obama’s withdrawing certain Arctic and Atlantic coastal areas from oil and gas leasing in light of President Biden revoking President Trump’s EO 13795 (the EO challenged in this case). The Biden administration asks the court to vacate the lower court ruling and remand with instructions to dismiss the case.

League of Conservation Voters v. Trump, No. 19-35460 (9th Cir.).

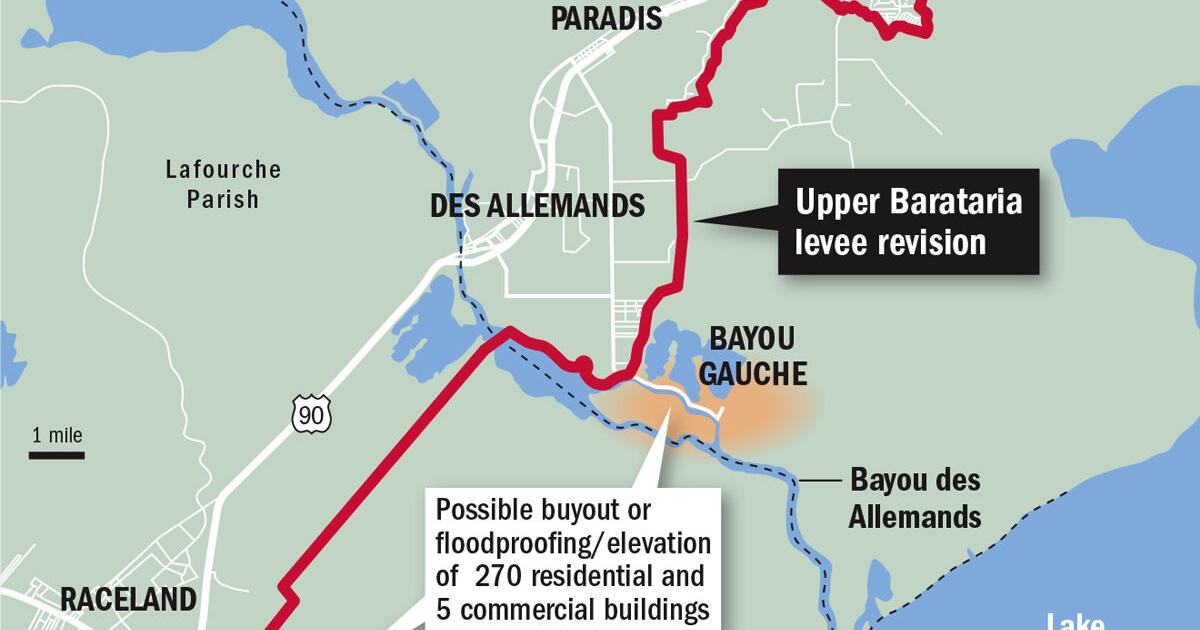

March 24, 2021 Louisiana and twelve other

states file a lawsuit challenging President Biden’s pause on new federal oil and gas lease sales arguing that the Outer Continental Shelf Lands Act (OCSLA) and

the current 5-year Leasing Program prohibit the moratorium.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

April 13, 2021 The Ninth Circuit

dismisses the appeal of the March 29, 2019 decision by a federal judge to reinstate President Obama’s withdrawals of Arctic and Atlantic areas from oil and gas leasing because President Biden’s

Executive Order 13990 revoking Trump’s EO 13795 rendered the appeal moot.

League of Conservation Voters v. Trump, No. 19-35460 (9th Cir.).

June 15, 2021 A federal judge in the Western District of Louisiana

issues a preliminary injunction blocking President Biden’s pause on oil and gas lease sales. The court holds that the leasing moratorium violates statutory authority given to DOI, the Bureau of Land Management, and BOEM under the Outer Continental Shelf Lands Act and the current 5-year leasing program. The judge further holds that the immediate impact of the pause renders the preliminary injunction an appropriate remedy and that the DOI may not continue to pause upcoming Lease Sales 257 or 258.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

Aug. 9, 2021 Plaintiff states file

a motion asking the court to order Lease Sale 257 and asking the federal government to show why its failure to make the sale does not put it in contempt of the preliminary injunction.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

Aug. 16, 2021 The

Biden administration appeals the preliminary injunction that blocked the moratorium on new federal oil and gas leasing.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

Aug. 24, 2021 DOI announces that it will continue to prepare lease sales during the appeal process.

Aug. 24, 2021 The

Department of Justice (DOJ) files a memorandum in response to the plaintiff states’ August 9 motion. DOJ argues that DOI had restarted the leasing program and was therefore complying with the preliminary injunction. DOJ further argues that the preliminary injunction did not require the Lease Sale to occur on any timeline, and the government was therefore entitled to complete a new environmental review.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

Aug. 31, 2021 Environmental groups file a

lawsuit challenging DOI’s decision to hold Lease Sale 257 in the Gulf of Mexico, seeking vacatur and injunction of the sale. The groups argue that the sale of Lease 257 violates the NEPA and the APA and estimate that the sale “will result in the production of up to 1.12 billion barrels and 4.4 trillion cubic feet of fossil fuels over the next 50 years.”

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 1:21-cv-02317 (D.D.C.).

Sept. 17, 2021 Plaintiff states

withdraw their motion to compel Lease Sale 257.

Louisiana v. Biden, Docket No. 2:21-CV-00778 (W.D. La.).

Oct. 4, 2021 BOEM publishes

a notice in the federal register that it will open and publicly announce bids received for oil and gas leases in the Gulf of Mexico Outercontinental Gas Lease Sale 257 on Nov. 17, 2021.

Oct. 29, 2021 BOEM publishes a

draft environmental impact statement (DEIS) for Lease Sale 258, which would offer leasing for oil and gas in Cook Inlet in the Gulf of Alaska. BOEM also

announces a 45-day public comment period on the DEIS.

Nov. 17, 2021 BOEM holds its largest sale ever, the

Gulf of Mexico Lease Sale 257 for 308 tracts, covering 1.07 million acres of federal waters in the Gulf. In approving the sale, the DOI claimed it was acting “consistent with a U.S. District Court’s preliminary injunction.” However,

environmental groups argue that this sale was not required by the

June 15 preliminary injunction. These groups contend that by not conducting a new environmental review like the

DOJ memo suggested was allowed, the federal government sped up the lease sale and worked against its decarbonization goals.

Nov. 26, 2021 DOI issues a report reviewing the federal oil and gas leasing process and making recommendations for reform. The report finds, among other things, that the current system does not give taxpayers fair returns and does not fully account for environmental harm, and that the current system encourages speculation by and decreases competition among oil companies. The report outlines recommendations to fix these problems and concludes that DOI is deciding how it will act on these recommendations and encourages Congress to pass reforms to the oil and gas leasing process.

Dec. 3, 2021 Democratic members of the House Committee on Natural Resources

file an amicus brief in support of environmental groups challenging the Gulf of Mexico lease sale, arguing that the administration’s environmental review “substantially underestimates” the environmental harms of the lease sale. The brief also argues that the nationwide injunction issued by the District Court for the Western District of Louisiana “in no way excused” DOI’s obligations under NEPA and the APA.

Friends of the Earth, et al., v. Haaland, et al., No. 21-cv-02317-RC (D.D.C.).

Jan. 19, 2022 Over

360 environmental groups sent a legal petition to the Biden administration to reduce oil and gas drilling to 98% lower than current levels by 2035. The petition explains that, without action, it will be difficult for the United States to keep its pledge to keep global temperatures from rising beyond 1.5℃.

Jan. 20, 2022 Over

80 environmental organizations sign and send a letter to the Biden administration, which urges the Department of the Interior to write a new 5-year Offshore Lease Program that bans lease sales starting in 2022. The letter also calls on Secretary Haaland to repudiate Lease Sale 257.

Jan. 27, 2022 The

District Court for the District of Columbia blocks Lease Sale 257 in the Gulf of Mexico because the Department of the Interior failed to take a “hard look” at the environmental impact of the project or to account for the effect of overseas fossil fuel use when calculating climate impacts, which violated the National Environmental Policy Act.

Friends of the Earth, et al., v. Haaland, et al., No. 21-cv-02317-RC (D.D.C.). For more background on the ruling, see

EELP’s overview of the NEPA Review Process or visit our

NEPA Tracker Page for the most up to date review requirements.

Feb. 1, 2022 The

Department of the Interior mistakenly posted language on its oil and gas webpage that indicated royalty fees for leases would increase to 18.75%. The Department later removed the language, and a spokesperson for the Department said the decision to increase royalty rates was not yet final.

Feb. 8, 2022 310 environmental groups file a petition asking the Department of the Interior to immediately stop new drilling in the Gulf of Mexico.

Feb. 8, 2022 Intervenor defendant, the

American Petroleum Institute files a notice of appeal with the D.C. Circuit, challenging the D.C District Court’s decision to block Lease Sale 257 in the Gulf of Mexico.

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 1:21-cv-02317 (D.D.C.).

Feb. 14, 2022 Louisiana, another intervenor defendant, files a notice of appeal in the D.C. Circuit case that blocked Lease Sale 257.

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 22-05037 (D.C. Cir).

Feb. 14, 2022 The Biden administration asks the 5th Circuit to reverse the Western District of Louisiana’s decision that blocked the Biden administration’s moratorium on new oil and gas drilling on federal lands and waters. Among other issues, the Biden administration argues that Biden’s Executive Order 14008 is both lawful and unreviewable and that the plaintiffs relied on erroneous interpretations of the Outer Continental Shelf Lands Act and the Mineral Leasing Act.

Louisiana v. Biden, Docket No. 21-30505 (5th Cir.)

Feb. 18, 2022 Environmental groups file a motion to dismiss for lack of jurisdiction in the D.C. Circuit case that blocked Lease Sale 257.

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 22-05037 (D.C. Cir).

Feb. 22, 2022 A federal judge in the Western District of Louisiana blocks the Biden administration’s application of an interim social cost of carbon metric.,

Louisiana v. Biden, No. 21-cv-01074 (W.D. La.). For updates on the metric and this litigation, see our

Social Cost of Greenhouse Gases tracker page. In light of this decision,

the Biden administration announces that it will delay decisions on new oil and gas drilling on federal lands.

Feb. 28, 2022 The

Biden administration announces that it will not appeal the District Court’s decision that canceled Lease Sale 257 in the Gulf of Mexico.

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 1:21-cv-02317 (D.D.C.).

Mar. 8, 2022 The

Court of Appeals for the District of Columbia Circuit denies an emergency motion by American Petroleum Institute to expedite t

he appeal of the District Court decision that canceled Lease Sale 257.

Friends of the Earth, et al. v. Haaland,

et al., Docket No. 22-05037 (D.C. Cir).

Apr. 15, 2022 To comply with the preliminary injunction issued by the court in

Louisiana v. Biden, the DOI

announces that the BLM will issue notices for lease sales that will increase in royalty rates from 12.5% to 18.75% and limit the acreage available for leasing. Though this round of lease sales will move forward, the Biden administration continues its appeal of that injunction.

Louisiana et al v Biden et al, Docket No. 2:21-cv-00778 (W.D. La.).

April 18, 2022: The BLM publishes

final environmental assessments and sale notices for June 2022 lease sales. The final sale notices reduces the acreage of land available for leasing on public lands by 80% and increased royalty rates. For offshore leases,

the current 5-year program is scheduled to end on June 30, 2022.

Apr. 19, 2022: The plaintiffs in

Western Energy Alliance v. Biden assert that the notice put forward by the Bureau of Land Management still violates the Mineral Leasing Act because BLM did not establish a reliable and predictable leasing system in the future. A hearing in that case is scheduled for May 13.

Western Energy Alliance v. Biden, No. 0:21-cv-00013 (D. Wyo.).

Apr. 29, 2022 Republican states attorneys general ask the Western District of Louisiana to grant summary judgment in the case challenging leasing pause. The states also challenge the cancellation of lease sales, including the cancellation of Lease Sale 257.

Louisiana v. Biden, Docket No. 2:21-cv-00778 (W.D. La).

May 10, 2022 The

Fifth Circuit hears oral arguments on the preliminary injunction that halted the Biden administration’s leasing pause.

Louisiana v. Biden, Docket No. 21-30505 (5th Cir.).

May 12, 2022 BOEM cancels upcoming offshore Lease Sales 258, 259, and 261, citing “lack of industry interest” and “conflicting court rulings” as reasons for the cancellations.

May 19, 2022 During

a hearing in front of the Senate Energy & Natural Resources Committee, Secretary Haaland says the DOI will propose a new 5-year offshore leasing plan by June 30, 2022, when the current 5-year plan is set to expire.

May 19, 2022 The states in

Louisiana v. Biden write a letter to the Fifth Circuit to inform the court about the three cancelled lease sales. No. 21-30505 (5th Cir.).

May 24, 2022 BOEM writes a letter to the Fifth Circuit Court of Appeals explaining its decision not to hold the upcoming lease sales. No. 21-30505 (5th Cir.).