excalibur

Diamond Member

- Mar 19, 2015

- 22,765

- 44,343

- 2,290

Go, Brandon!

This is the result of incompetent and foolish leftoid policies that began on day 1 of this [mal]administration and have gone on unabated.

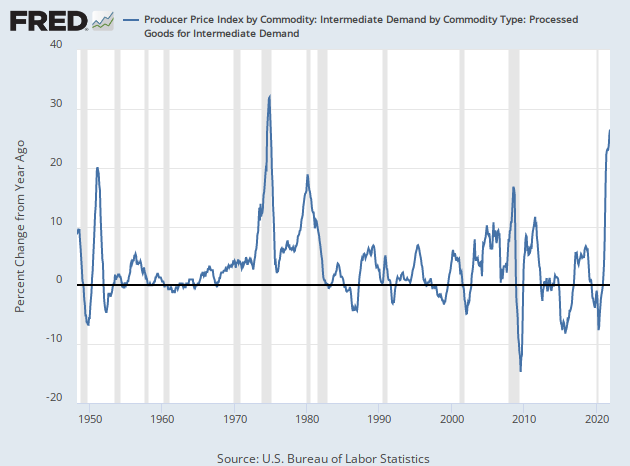

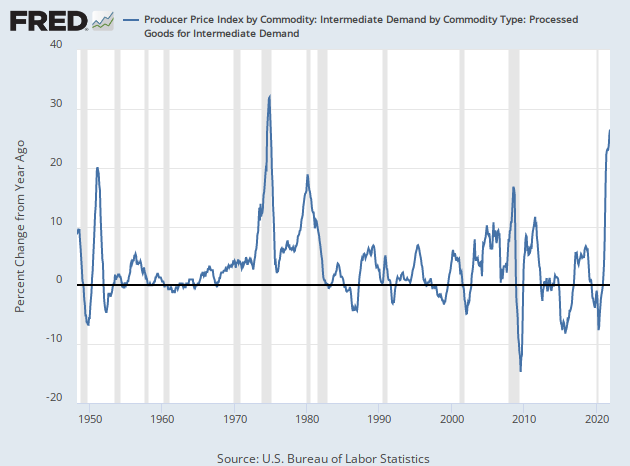

The record-shattering 9.6 percent rise in producer prices indicates a startling level of inflation inflicting the U.S. economy.

Things are even worse once you get beyond the headlines. Further out on the supply chains, prices are rising even more rapidly, suggesting that product shortages and even more inflation are yet to come.

When you look at goods that are processed by U.S. manufacturers for sale to other businesses, such as an appliance manufacturer selling to a retailer or a software maker selling to an digital game store, prices are up by more than 26 percent.

...

The PPI report also measures goods sold for “intermediate demand,” those sold from one business to another along the chain of production of goods and services. When a manufacturer of appliances sells to a retail store, that gets counted in the intermediate demand category, while the sale of the appliance to the household sector is final demand (and also gets counted in the CPI gauge). Services are also sold into the market for “intermediate demand.” Corporate lawyers, consultants, advertising, and investment bankers are examples of business-to-business services.

This creates visibility into how prices are flowing through the economy. Often when inflation builds up in the intermediate stage, it flows through to the final demand stage later as companies seek to pass along price increases. Alternatively, when production becomes too costly, businesses can cut back on production, which can lead to shortages or higher prices. But unless consumers are willing and able to pay more, it’s often difficult for businesses to pass along increased costs, resulting in smaller profits.

The index for processed goods for intermediate demand jumped 1.5 percent in November, which is a slowdown from the 2.4 percent rise in October. This is no longer a case of the volatile food and energy categories pushing up the index. In November, over half the increase was for materials excluding food and energy. The intermediate foods and feeds index actually dropped 0.2 percent. The energy index climbed 3.6 percent.

It’s the year-over-year number that is really eye-catching. Prices for intermediate processed goods are up 26.5 percent, the largest 12-month increase since December 1974, when the index rose 28.9 percent.

...

www.breitbart.com

www.breitbart.com

This is the result of incompetent and foolish leftoid policies that began on day 1 of this [mal]administration and have gone on unabated.

The record-shattering 9.6 percent rise in producer prices indicates a startling level of inflation inflicting the U.S. economy.

Things are even worse once you get beyond the headlines. Further out on the supply chains, prices are rising even more rapidly, suggesting that product shortages and even more inflation are yet to come.

When you look at goods that are processed by U.S. manufacturers for sale to other businesses, such as an appliance manufacturer selling to a retailer or a software maker selling to an digital game store, prices are up by more than 26 percent.

...

The PPI report also measures goods sold for “intermediate demand,” those sold from one business to another along the chain of production of goods and services. When a manufacturer of appliances sells to a retail store, that gets counted in the intermediate demand category, while the sale of the appliance to the household sector is final demand (and also gets counted in the CPI gauge). Services are also sold into the market for “intermediate demand.” Corporate lawyers, consultants, advertising, and investment bankers are examples of business-to-business services.

This creates visibility into how prices are flowing through the economy. Often when inflation builds up in the intermediate stage, it flows through to the final demand stage later as companies seek to pass along price increases. Alternatively, when production becomes too costly, businesses can cut back on production, which can lead to shortages or higher prices. But unless consumers are willing and able to pay more, it’s often difficult for businesses to pass along increased costs, resulting in smaller profits.

The index for processed goods for intermediate demand jumped 1.5 percent in November, which is a slowdown from the 2.4 percent rise in October. This is no longer a case of the volatile food and energy categories pushing up the index. In November, over half the increase was for materials excluding food and energy. The intermediate foods and feeds index actually dropped 0.2 percent. The energy index climbed 3.6 percent.

It’s the year-over-year number that is really eye-catching. Prices for intermediate processed goods are up 26.5 percent, the largest 12-month increase since December 1974, when the index rose 28.9 percent.

...

Supply Chain and Wholesale Inflation Hits 26.5%, Hottest Since 1974

Inflation in the prices of goods and services purchased by businesses soared in November. | Economy