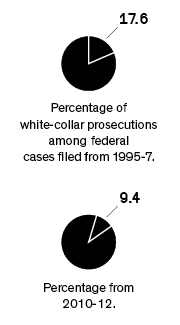

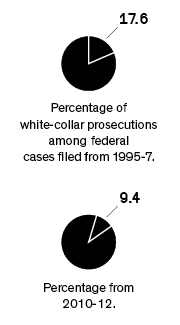

What's changed over the past generation that explains why over 1100 bankers faced charges for the Saving and Loan looting, and only one second-tier banker has been convicted as part of an "epidemic of mortgage fraud" the FBI warned about in 2004?

"On the evening of Jan. 27, Kareem Serageldin walked out of his Times Square apartment with his brother and an old Yale roommate and took off on the four-hour drive to Philipsburg, a small town smack in the middle of Pennsylvania ..."

Serageldin was heading towards a 30 month sentence handed down for his role in the "epidemic of mortgage fraud", yet he was only one relatively small fish among a vast pool of parasites who could have faced prosecution.

"Still, the fact that the only top banker to go to jail for his role in the crisis was neither a mortgage executive (who created toxic products) nor the C.E.O. of a bank (who peddled them) is something of a paradox, but it’s one that reflects the many paradoxes that got us here in the first place."

http://www.nytimes.com/2014/05/04/magazine/only-one-top-banker-jail-financial-crisis.html?_r=0

"On the evening of Jan. 27, Kareem Serageldin walked out of his Times Square apartment with his brother and an old Yale roommate and took off on the four-hour drive to Philipsburg, a small town smack in the middle of Pennsylvania ..."

Serageldin was heading towards a 30 month sentence handed down for his role in the "epidemic of mortgage fraud", yet he was only one relatively small fish among a vast pool of parasites who could have faced prosecution.

"Still, the fact that the only top banker to go to jail for his role in the crisis was neither a mortgage executive (who created toxic products) nor the C.E.O. of a bank (who peddled them) is something of a paradox, but it’s one that reflects the many paradoxes that got us here in the first place."

http://www.nytimes.com/2014/05/04/magazine/only-one-top-banker-jail-financial-crisis.html?_r=0