JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,797

- 2,220

If you are poor and can get the subsidies, your prices wont go up by much, but if you are Middle Class and not eligible for subsidies? Well, FUCK YOU!

http://www.investors.com/news/obamacare-subsidies-to-explode-as-cheapest-bronze-plan-costs-surge-28/

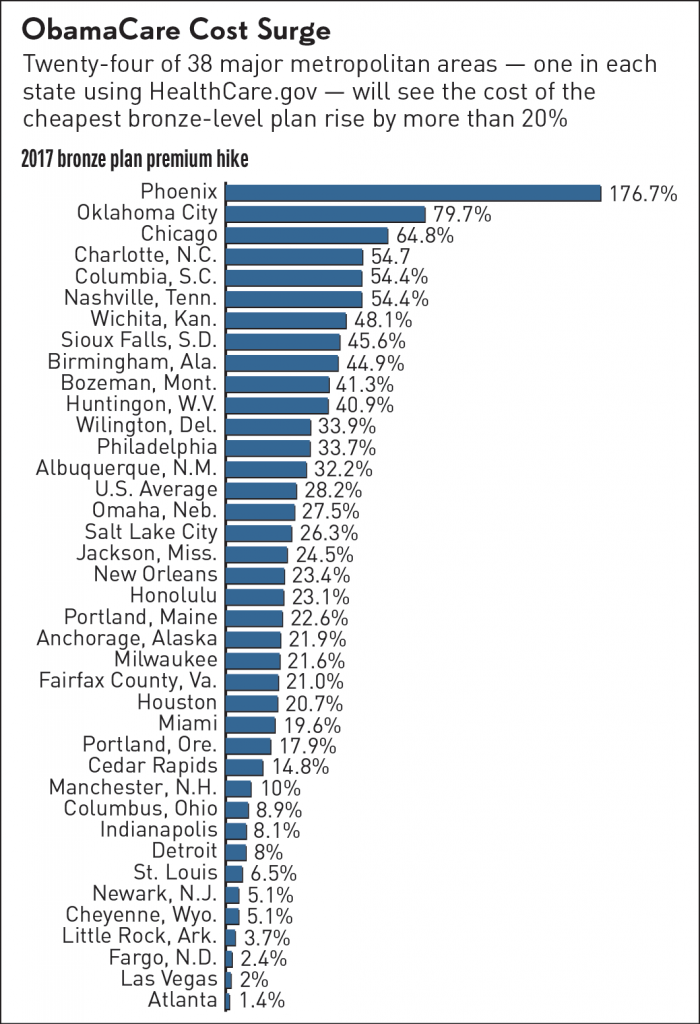

President Obama last week called for subsidies for the middle class who are excluded from the law's help. Yet IBD explained why Obama's ObamaCare prescription misses the law's most fundamental problem: Two in three people who earning a working-class income from 150% to 250% of the poverty level remain either uninsured or woefully underinsured.

Even consumers who are eligible for subsidies and don't face a premium increase may find other reasons to be unhappy about the new offerings at HealthCare.gov. Plan choice is down dramatically as UnitedHealth (UNH), Aetna (AET) and Humana (HUM) exited most exchanges where they are doing business this year, and many nonprofit co-ops went out of business. Even if people can get a plan at the same after-subsidy cost, it may force them to change doctors.

UnitedHealth lost 0.5% to 144.69 on the stock market today. Aetna gained 0.7% to 112.02 while Humana ticked up 0.2% to 176.27.

The average deductible for the cheapest bronze plan in each of these 38 markets will rise to $6,358, up 5% from $6,045 this year. But that's nothing compared to the rise in deductibles among the cheapest silver plan, which will jump 18% to $4,261 from $3,613 in 2016. That jump is no small part due to the impact of Ambetter plans from Centene (CNC), which carry silver-plan deductibles of up to $7,050. Although the plans do offer some predeductible benefits, most big-ticket items aren't covered until the deductible is exhausted.

http://www.investors.com/news/obamacare-subsidies-to-explode-as-cheapest-bronze-plan-costs-surge-28/

President Obama last week called for subsidies for the middle class who are excluded from the law's help. Yet IBD explained why Obama's ObamaCare prescription misses the law's most fundamental problem: Two in three people who earning a working-class income from 150% to 250% of the poverty level remain either uninsured or woefully underinsured.

Even consumers who are eligible for subsidies and don't face a premium increase may find other reasons to be unhappy about the new offerings at HealthCare.gov. Plan choice is down dramatically as UnitedHealth (UNH), Aetna (AET) and Humana (HUM) exited most exchanges where they are doing business this year, and many nonprofit co-ops went out of business. Even if people can get a plan at the same after-subsidy cost, it may force them to change doctors.

UnitedHealth lost 0.5% to 144.69 on the stock market today. Aetna gained 0.7% to 112.02 while Humana ticked up 0.2% to 176.27.

The average deductible for the cheapest bronze plan in each of these 38 markets will rise to $6,358, up 5% from $6,045 this year. But that's nothing compared to the rise in deductibles among the cheapest silver plan, which will jump 18% to $4,261 from $3,613 in 2016. That jump is no small part due to the impact of Ambetter plans from Centene (CNC), which carry silver-plan deductibles of up to $7,050. Although the plans do offer some predeductible benefits, most big-ticket items aren't covered until the deductible is exhausted.