If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

Nutjob,

Are you aware that more corporate subsides and tax credits, and SPENDING, have happened Barry Obama?

Corporatism is not a party issue. It is a modern political issue that infects both sides.

Rather than mire yourself in the shallowness of party BS., why not instead embrace the movement that wants to end it all? Got a clue????

Please tell us how the "income gap" (a wedge issue born from jealously, envy and political leverage/fear-mongering) actually hurts anyone?

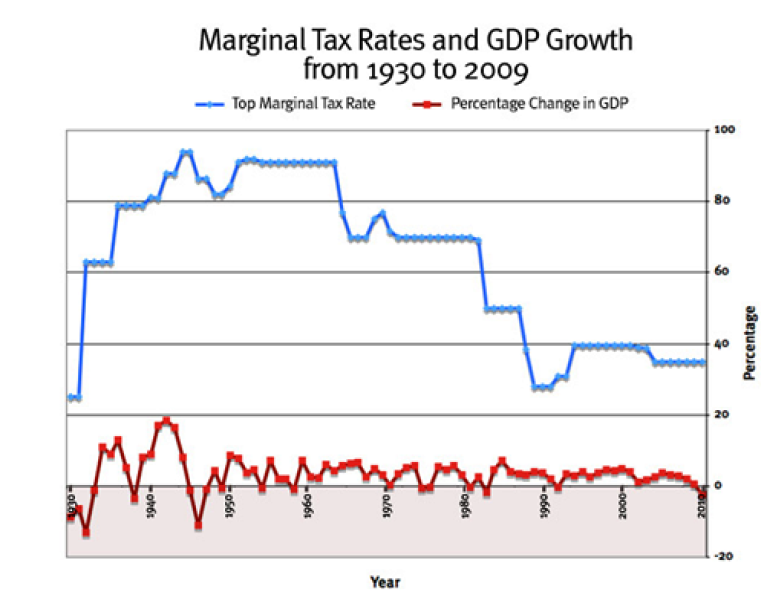

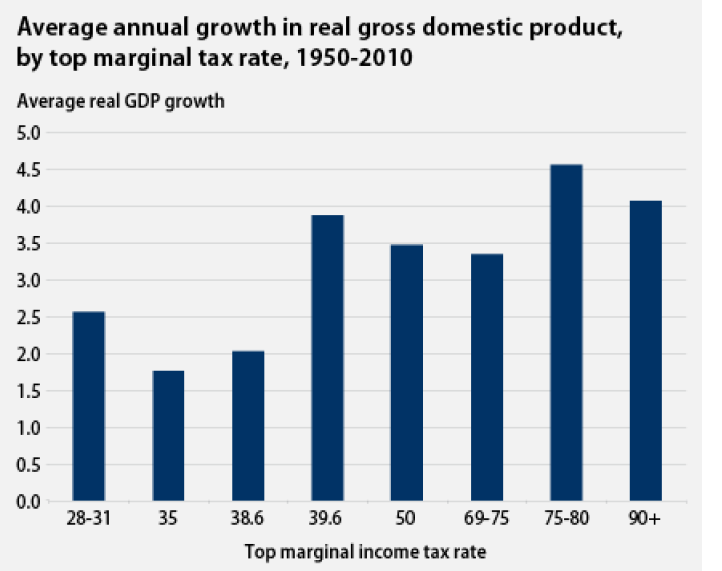

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory

The conclusion?

Lowering the tax rates on the wealthy and top earners in America do

not appear to have any impact on the nation’s economic growth.

This paragraph from

the report says it all—

“The reduction in the top tax rates appears to be uncorrelated with saving, investment and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory-GOP Suppresses Study - Forbes

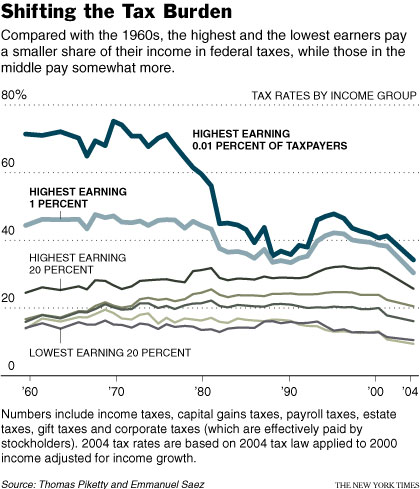

The share of total income going to the top 0.1 percent hovered around 4 percent during the 1950s, 1960s and 1970s, then rose to 12 percent by the mid-2000s. During this period, the average tax rate paid by the 0.1 percent fell from more than 40 percent to below 25 percent.

The study said that "as top tax rates are reduced, the share of income accruing to the top of the income distribution increases" and that "these relationships are statistically significant."

In other words, cutting taxes on the rich may not grow the economic pie. But the study found that those cuts can effect "how that economic pie is sliced."

Study: Tax Cuts for the Rich Don't Spur Growth

http://finance.yahoo.com/news/tax-cuts-rich-dont-spur-151649273.html

If I 'make' a million dollars, I accumulated money from other people. I'm not actually producing cash, I'm acquiring theirs. Therefore, others have collectively lost a million dollars of purchasing power to me.

These people can't go demand new money just because I have all of their money.

They go broke, I get rich, and income inequality is a thing.

LOL.

Having read just the first paragraphs, I find several problems in their assumptions, and critical omissions in their analysis. Not only does it avoid the most obvious thing, that just because top marginal rates were 90% in the '50, it fails to admit that nobody paid that rate, as many, many loopholes and havens were purposely in play. Also, the analysis seems to ignore the more recent proof that reducing tax rates does indeed promote economic growth!!!........care to discuss when that was, and how it worked?

But hey, you sure are good and cutting and pasting....

Weird, you read the first couple paragraphs and refuted the study huh? lol

WHERE WAS THE ECONOMIC GROWTH WITH DUBYA'S TAX CUTS AGAIN?

The CRS report, by researcher Thomas Hungerford, concluded:

The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.

As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009.

Tax policy could have a relation to how the economic pie is sliced—lower top tax rates may be associated with greater income disparities.

Congressional Research Service Report On Tax Cuts For Wealthy Suppressed By GOP UPDATE

EFFECTIVE TAX RATES BUBBA

A 2011 study by the CBO found that the top earning 1 percent of households gained about 275% after federal taxes and income transfers over a period between 1979 and 2007

CBO finds that, between 1979 and 2007, income grew by:

275 percent for the top 1 percent of households,

65 percent for the next 19 percent,

Just under 40 percent for the next 60 percent, and

18 percent for the bottom 20 percent.

Trends in the Distribution of Household Income Between 1979 and 2007 Congressional Budget Office

STUDY: These Charts Show There's Almost No Correlation Between Tax Rates and GDP

These Charts Show There s Probably No Correlation Between Tax Rates and GDP - Business Insider

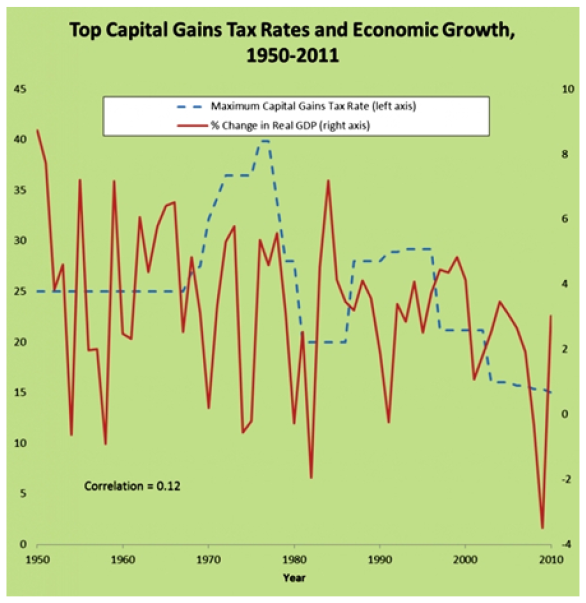

Capital Gains Tax Rates and Economic Growth (or not)

If you read the editorial page of the Wall Street Journal (or surf around the nether regions of Forbes.com), you may come to the conclusion that no aspect of tax policy is more important for economic growth than the way we tax capital gains. You’d be wrong

Capital Gains Tax Rates and Economic Growth or not - Forbes