presonorek

Gold Member

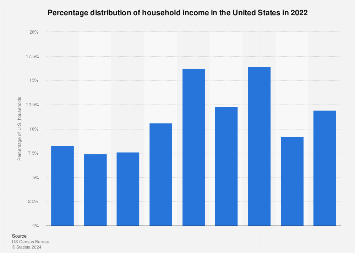

Distribution of household income U.S. 2022 | Statista

In 2022, just over 50 percent of Americans had an annual household income that was less than 75,000 U.S.

According to this data 8.3% of the population make less than $15,000. 11.8% of the population make more than $200,000. There are 7 other categories in between. I think that the data from this chart can be used to make a workable tax policy.

This is what I have come up with.

The lower 33.9% of the population made less than $50,000 in 2022.

The middle 44.9% of the population made between $50,000 and $149,999 in 2022.

The higher 21.1% of the population made $150,000 or more.

This is out of 148,300,000 households. The Federal budget for 2023 was $6.1 trillion. Let's unpack this mess and create a simplistic tax code that generates $6.1 trillion.