presonorek

Gold Member

- Thread starter

- #21

Why not try to spend less than 6.1 trillion first?

I don't know. It wasn't my idea.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Why not try to spend less than 6.1 trillion first?

Wife and I and other family members who also work and live in same household. Everyone's combined income added up and household income falls in the middle 44.9% and we can't still can't pay our bills. Even with 5 adults in one household, 4 working and 1 on disability in one house we still struggle.

Share of households by income in the U.S. 2024| Statista

In 2024, just over 45 percent of American households had an annual income that was less than 75,000 U.S.www.statista.com

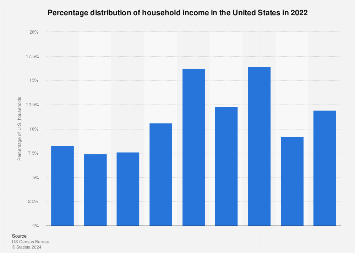

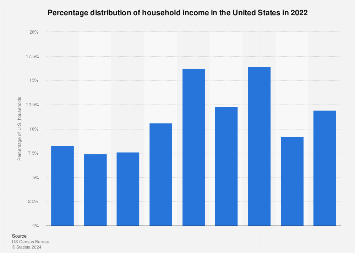

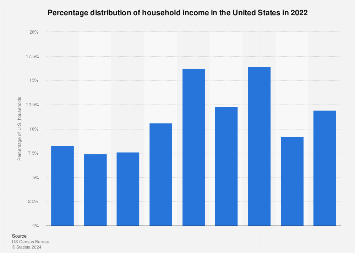

According to this data 8.3% of the population make less than $15,000. 11.8% of the population make more than $200,000. There are 7 other categories in between. I think that the data from this chart can be used to make a workable tax policy.

This is what I have come up with.

The lower 33.9% of the population made less than $50,000 in 2022.

The middle 44.9% of the population made between $50,000 and $149,999 in 2022.

The higher 21.1% of the population made $150,000 or more.

This is out of 148,300,000 households. The Federal budget for 2023 was $6.1 trillion. Let's unpack this mess and create a simplistic tax code that generates $6.1 trillion.

I worked for the federal govt for ONE year and then left for the private industry, even though I was losing lifetime job security. I couldn’t stand seeing all the waste, all the people hanging around doing nothing - and I wanted to do work that would, in its own small way, contribute to society and make use of my abilities.Really? I worked in the ATF&E headquarters building and i saw plenty of non essential personnel sitting around net surfing, gorging their pieholes, and when the government closed 95% of the staff went home. If all agencies have this quota of worthless people, then fire every last one of them, because they are Non-Essential.

Maybe you need to move to a smaller place, or train for better-paying jobs. You’re telling me that 4 adults are only bringing in $100,000 combined?Wife and I and other family members who also work and live in same household. Everyone's combined income added up and household income falls in the middle 44.9% and we can't still can't pay our bills. Even with 5 adults in one household, 4 working and 1 on disability in one house we still struggle.

We definitely need higher taxes on the very wealthy.

Cut spending, stupid.

Share of households by income in the U.S. 2024| Statista

In 2024, just over 45 percent of American households had an annual income that was less than 75,000 U.S.www.statista.com

According to this data 8.3% of the population make less than $15,000. 11.8% of the population make more than $200,000. There are 7 other categories in between. I think that the data from this chart can be used to make a workable tax policy.

This is what I have come up with.

The lower 33.9% of the population made less than $50,000 in 2022.

The middle 44.9% of the population made between $50,000 and $149,999 in 2022.

The higher 21.1% of the population made $150,000 or more.

This is out of 148,300,000 households. The Federal budget for 2023 was $6.1 trillion. Let's unpack this mess and create a simplistic tax code that generates $6.1 trillion.

In some states minimum wage is $7.25 an hour. 40 hours a week that comes up to $15,080 per year. If you multiply that by 4 then the total is $60,320. If three of them make double the minimum wage then the total comes up to $105,560.Maybe you need to move to a smaller place, or train for better-paying jobs. You’re telling me that 4 adults are only bringing in $100,000 combined?

Lol Yeah. Have you ever met an American who wouldn't lose their ever-loving mind if you suggested cutting a government program?Cut spending, stupid.

Cut spending, stupid.

How about we cut the PORK out of government (PORK representing the non-essential personnel) because if they arent needed, then they shouldnt be on the government tits, sucking the life out of the golden cow. Cut it by 50% the first year, then 50% the second year and soon the US would be surplus of tax revenue enough to pay down the debt in 10 years......

Eventually we’re going need to elect someone who will get the budget in order.

Neither side is particularly interested in that.

Take everything out of the budget that is unnecessary or unnecessary to have or do right now and I would give odds that we could get the budget down to 3 trillion or less and that would still require roughly $1,000 from every living man, woman, child in America to cover. And every adult and working minor, even those on welfare, should be paying at least something in taxes so that consequences of tax policy affect them too. Then you won't have half the population that pays little or nothing in income taxes not caring how much in taxes the other half of the population pays.

Share of households by income in the U.S. 2024| Statista

In 2024, just over 45 percent of American households had an annual income that was less than 75,000 U.S.www.statista.com

According to this data 8.3% of the population make less than $15,000. 11.8% of the population make more than $200,000. There are 7 other categories in between. I think that the data from this chart can be used to make a workable tax policy.

This is what I have come up with.

The lower 33.9% of the population made less than $50,000 in 2022.

The middle 44.9% of the population made between $50,000 and $149,999 in 2022.

The higher 21.1% of the population made $150,000 or more.

This is out of 148,300,000 households. The Federal budget for 2023 was $6.1 trillion. Let's unpack this mess and create a simplistic tax code that generates $6.1 trillion.

Eventually we’re going need to elect someone who will get the budget in order.

Neither side is particularly interested in that.

One can only hope it will be taken seriously one day.Nobody will vote for such a person.

And every adult and working minor, even those on welfare, should be paying at least something in taxes so that consequences of tax policy affect them too.

He is speaking in rhetoric. He is not speaking in mathematics or logic. You can make sense all day. If he doesn't break out a calculator (and he won't) then you are wasting your time discussing it unless you enjoy discussing it.Total compensation for all Federal, non-military, employees is about 300 billion a year. Cut that by 50% and you are saving 150B a year. That would not even make a dent in the current deficits, let alone remove them and give a surplus.

They will and it will be much uglier than if they would have addressed it head-on.One can only hope it will be taken seriously one day.

Show me where I suggest anybody should be taxed at 90%? I swear those on the left must drink something often to create that much reading dysfunction.Show me the math sir. How much revenue would it generate to tax the lowest 50% of incomes at 90%? Poor people have nothing to offer to help with the federal government's revenue problem.

That wasn't my point. Plug in any number you wish. You can use any number between 1 and 100. Currently the lower 50% of taxpayers pays 2.5% of the income taxes collected.Show me where I suggest anybody should be taxed at 90%? I swear those on the left must drink something often to create that much reading dysfunction.

Are you talking to ME?In some states minimum wage is $7.25 an hour. 40 hours a week that comes up to $15,080 per year. If you multiply that by 4 then the total is $60,320. If three of them make double the minimum wage then the total comes up to $105,560.

I can understand having an above-average income/lifestyle. What I don't understand is why you expect others to have that same luxury. What kind of princess fairy tale life are you living that separates you so far from reality? You do know that companies prefer paying the lowest wage possible just like consumers prefer paying the lowest price possible for goods. People don't pay people salaries because they are nice. They pay salaries because they have to do it.

I really can't understand why somebody thinks it is normal to make $50,000 a year. Can I have some insight on how you missed so much of reality?