JohnDB

Diamond Member

- Jun 16, 2021

- 13,068

- 9,168

- 2,138

Nope...just studied economics in college.my friend, did you any academic book on ww1 - Moscow empiresubject ? this all sounds like 1916-1917 , and back than they used our credit lines , today they dont have them

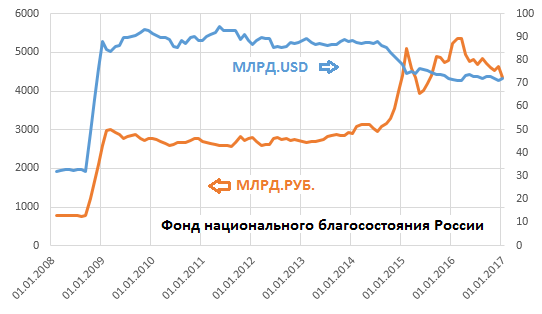

⅔of Russian financial reserves are gone. Oil prices have dropped due to worldwide recession. The toughest round of sanctions have fallen into place and the effect is that Russian economy is down by half.

So....this means that if Putin stopped the war today his nation would still literally fall apart anyway financially. But much like a bug without a head...Russia is going to continue to function for a while. Even with no reserves. Meaning it's already dead even if it keeps moving

And then one day it won't have anything....and it's entire system will collapse. War is extremely expensive and difficult. Anything at this point can cause a cascading failure across the country....something simple like a lack of insulin.