You do know that I have been an "official" analyst of the market for 48 years, don't you?

That means that you better know this kind of stuff better than I do, to have a hope of beating me in a debate!

Here is an explanation (according to AI) that will give you additional information that proves "you do not know what you are talking about and what you say is all misinformed thinking"

AI Overview

Learn more

The effects of the 2025 tariffs are becoming clearer, though their full impact is still unfolding and subject to ongoing legal challenges

.

Here's a summary of the known and predicted effects:

Economic Impacts:

- Reduced GDP Growth: Economists generally agree that the tariffs are negatively impacting US GDP growth. The Budget Lab at Yale estimated a 0.6% reduction in long-run GDP growth due to the tariffs. Other estimates, like those from the Penn Wharton Budget Model, project even larger reductions.

- Higher Consumer Prices: Tariffs are essentially taxes on imports, and a portion of these costs are being passed on to consumers in the form of higher prices. While the initial impact may be modest, economists expect a more sustained rise in consumer prices as tariffs continue.

- Potential for Job Losses: Some companies, particularly in industries reliant on imports, may reduce hiring or implement layoffs to manage increased costs.

- Uncertainty and Market Volatility: The unpredictable nature of tariff policy and the ongoing legal battles are creating uncertainty for businesses and investors, contributing to market volatility.

Trade Impacts:

- Reduced Imports: Businesses are reducing imports due to tariffs and uncertainty. This may boost GDP growth in the short term if inventories don't decline as much, but economists expect stockpiles to decrease, mitigating this effect.

- Shift in Supply Chains: Companies may adjust their supply chains to mitigate the effects of tariffs, potentially leading to a reconfiguration of global trade patterns.

- Retaliation: The imposition of tariffs has prompted retaliatory measures from other countries, further disrupting trade flows and negatively impacting the global economy.

Important Considerations:

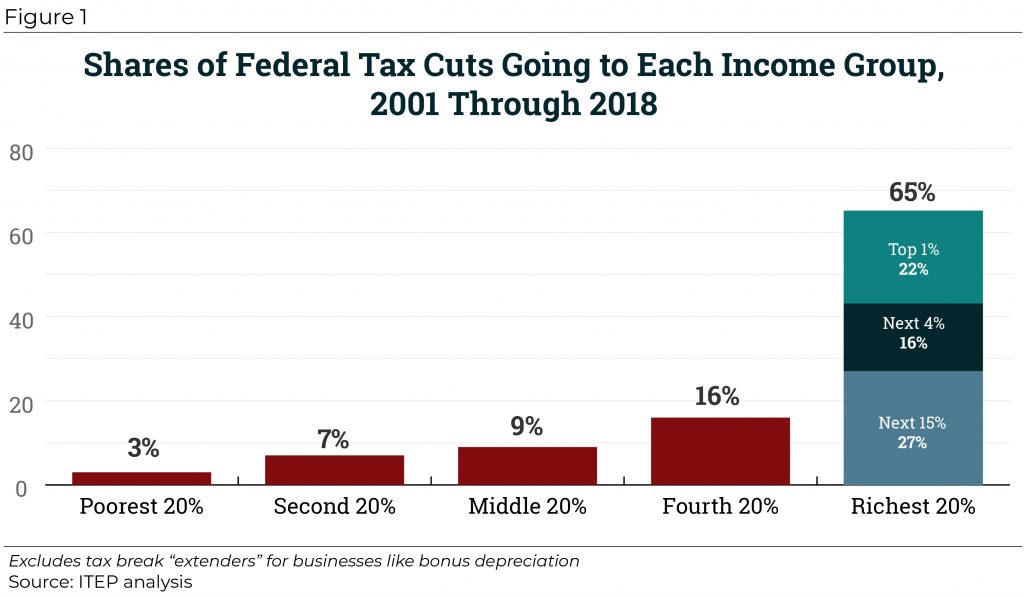

- Distributional Effects: Tariffs tend to disproportionately impact lower-income households as a larger share of their income is spent on goods.

- Legal Challenges: The legality of some tariffs is being challenged in court, creating uncertainty about their future and potential impact.

- Reshoring: While tariffs are intended to incentivize domestic production, the effectiveness of reshoring manufacturing remains to be seen, and it may come at a higher cost.

In Conclusion:

While the full extent of the tariffs' effects is still unfolding, early indications suggest a negative impact on US economic growth, consumer prices, and trade. The uncertainty surrounding trade policy and legal challenges adds to the complexity of the situation.