Missourian

Diamond Member

- Thread starter

- #181

Hey, when you're going to make up stories to impress people on the internet, I might as well make my story a big one.Stupid Reply of yours. Doesn't deserve an answer

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Hey, when you're going to make up stories to impress people on the internet, I might as well make my story a big one.Stupid Reply of yours. Doesn't deserve an answer

Well, so much for that doom and gloom talk. The economy is on fire...

FEDERAL RESERVE NOW PREDICTS 3.8% GDP GROWTH IN Q2.

I never make up stories. I do thorough research, and I publish the research, the same I have been doing for 48 years.............and I should also say that I have been doing with more positive results than not.Hey, when you're going to make up stories to impress people on the internet, I might as well make my story a big one.

The question then to ask is, are the adjustments both up and down, which we would expect from chance? Or are they all one direction, which would imply a guiding intelligence?Results adjust every month/qtr, with all presidents...A prelim first, then with all aspects and numbers calculated, the adjusted final results.

If? hahaIf Trump hadn't dropped the 145% tariffs against China, then the economy would be total disaster right now.

"Trump Always Chickens Out" -- TACO....the new Wall Street term for Trump's economic idiocy.

I believe, how the initial results are gathered, it can go either way....and I believe it has gone in the different directions previous times...but don't quote me on that, it is just on memory and I haven't researched it lately to confirm my belief...(and I am getting older...)The question then to ask is, are the adjustments both up and down, which we would expect from chance? Or are they all one direction, which would imply a guiding intelligence?

Where did Dr. Phosphorous run off too?Link us up to the “LARGEST MIDDLE CLASS TAX CUT IN HISTORY” Obama implemented , Dr. Phosphorous

Betcha can’t.

Hey Dr. Phosphorous are you still going to claim Obama didn’t extend the Bush tax cuts, liar?Here, educate yourself, moron.

After a protracted debate, Congress and President Obama agreed at the end of 2010 to extend the Bush tax cuts for two years, 2011 and 2012. They allowed the Making Work Pay Credit to expire but replaced it with a payroll tax “holiday,” which reduced Social Security payroll taxes paid in 2011, and this was eventually extended through 2012. Lawmakers also extended expansions in the EITC and Child Tax Credit for two years.

After another protracted debate, Congress and President Obama agreed at the start of 2013 to make most, but not all, of the Bush tax cuts permanent. The same legislation extended the expansions of the EITC and Child Tax Credit for five years.

Federal Tax Cuts in the Bush, Obama, and Trump Years

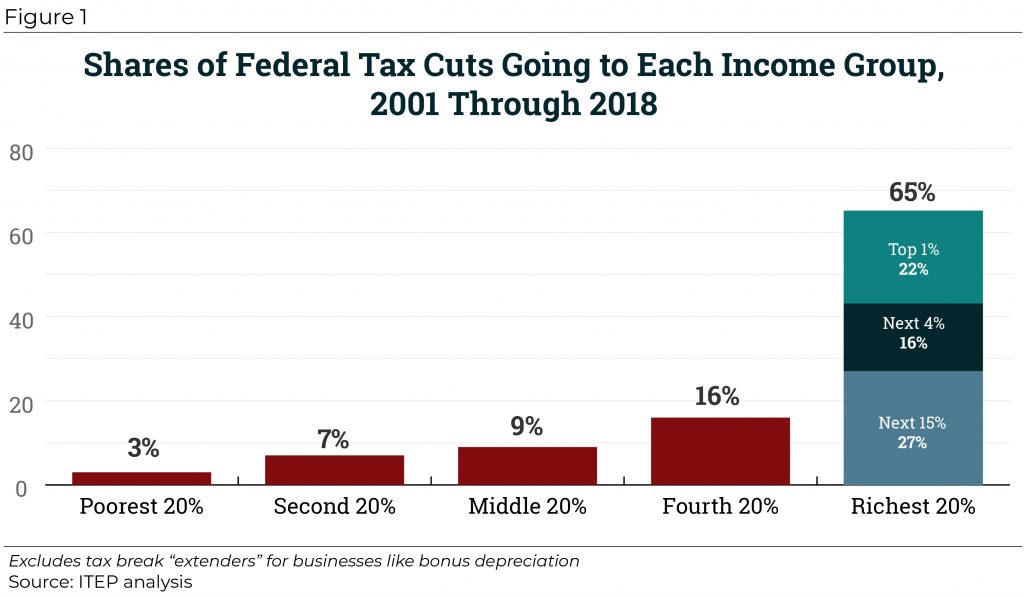

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.itep.org

It was a massive lie, had he been honest he would of lost the 2020 election and the country would have avoided the four year horror show that was his adminHe didn't lie.

And this "lie" is a gnat on an elephant's ass compared to Trump's lies about the 2020 election, simp.

Oh no....look:

Where's postman and joeBS?You were not supposed to notice that.

Well, so much for that doom and gloom talk. The economy is on fire...

Federal Reserve now predicts Q2 Gdp growth of 3.8%

Wrong, simp. Not for people making above $400K. --Hey Dr. Phosphorous are you still going to claim Obama didn’t extend the Bush tax cuts, liar?

So now you admit he extended the Bush tax cuts.Wrong, simp. Not for people making above $400K. --

During the Obama administration, the Bush tax cuts were partially extended. Specifically, the 2001 Economic Growth and Tax Relief Reconciliation Act (EGTRRA) and the 2003 Jobs and Growth Tax Relief Reconciliation Act (JGTRRA) were extended for individuals earning below $400,000 (or $450,000 for married couples). This meant that income tax rates, and some associated rules for itemized deductions and personal exemptions, were continued for these lower-income earners. However, capital gains, dividend, and estate tax rates were increased for higher-income individuals and wealthy households, meaning the tax cuts were not fully extended for those groups.

In addition, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 included measures to patch the Alternative Minimum Tax (AMT) and extend the 2001 EGTRRA and 2003 JGTRRA dividends and capital gains rates for two years. The 2010 act also included an extension of the EGTRRA 2001 income tax rates for two years.

In essence, Obama's administration chose to extend the Bush tax cuts for most taxpayers while also increasing taxes on some higher earners and implementing other tax-related measures.

Inflation is at 2.3% and dropping

Basically, this proves the federal government both incompetent, and having conspired for decades to hold back America in order to facilitate the development of other countries.