Kimura

VIP Member

- Thread starter

- #21

That's an edited "Cliff Notes" version --boiling down the ramble in an effort to make sense out of it. Unfortunately there was so little sense to be found there after the boiling, so what we're left with is that he admits we're over taxed and he admits that his solution is probably more taxing....am a strong proponent of making the Fed's current near 0 percent interest rate policy permanent. A low-rate policy encourages long-term investments for businesses to expand and become more efficient, and for households to invest in new homes...

... lowering rates removes interest income and therefore acts much like a tax increase, and this hurts the economy...

... the economy is grossly overtaxed and starved for income. The remedy is quite simple. We can, again, either cut taxes (I've proposed a full payroll tax holiday, which would increase the average working family's take home pay by over $600 per month) and/or increase public spending...

...what about the budget deficit? Well, with a permanent 0 percent rate policy, there is no interest to speak of being paid...

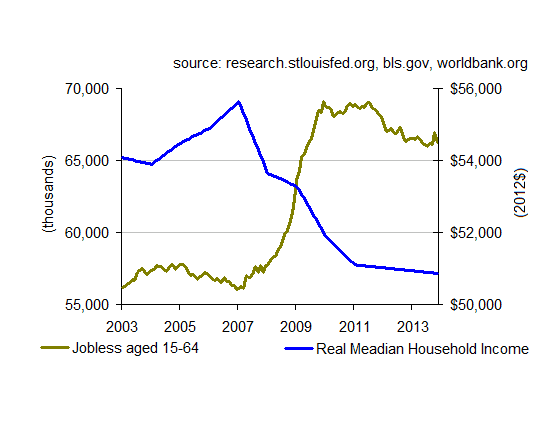

What he doesn't get into is the fact that all this taxing has gotten us to--

--ruined family incomes and soaring unemployment. On top of that, this is a recovery. Just imagine what this 'recover' will look like with even more taxes.

---

Zimbabwe is awesome, I understand ...

We can't compare the US to Zimbabwe. Seriously.

Zimbabwe had around 80% of its productive capacity destroyed due to corruption and civil war, and its had debts denominated in other currencies like the US Dollar.