Confounding

Gold Member

- Jan 31, 2016

- 7,073

- 1,557

- 280

- Banned

- #1

They're extorting the government and cheating Americans with the support of both parties.

Democrats and Republicans Are Quietly Planning a Corporate Giveaway—to the Tune of $400 Billion

Democrats and Republicans Are Quietly Planning a Corporate Giveaway—to the Tune of $400 Billion

Young people are the good news of 2016. They see the stressful realities of American life more clearly than their elders and are rallying around the straight talk of Bernie Sanders. Meanwhile, the big hitters back in Washington politics are working on an ugly surprise not just for the kids but for all of us—another monster tax break for US multinational corporations. The bad news is that key leaders of the Democratic Party—including the president—are getting on board with Republicans, despite some talk about confronting income inequality. Influential Democrats intend to negotiate with Republican counterparts on the size and terms of post-facto tax “forgiveness” for America’s globalized companies. This is real money they’re talking about—a giveaway of hundreds of billions.

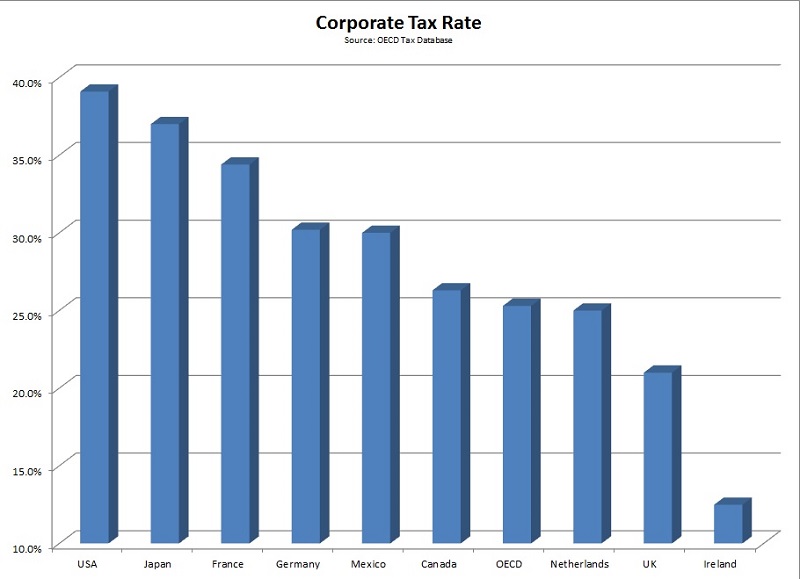

Why haven’t voters heard about this from candidates? Because Republicans and Democrats both know it would make angry voters even angrier. The major multinationals complain about a tax problem that most citizens would love to have for themselves: Thanks to a loophole in the tax code, the companies do not have to pay US taxes on profits they have earned in foreign countries until they bring the money home to American shores. Altogether, the globalized US companies have accumulated $2.1 trillion in untaxed profits, most of it parked in overseas tax havens.

The multinationals are waiting for Congress to forgive them their debts. That is, the US companies insist they won’t bring the money home and pay the taxes they owe until Washington pols steeply reduce the rate to bargain-basement levels. That’s tax “forgiveness” on a grand scale. What the companies also demand is a permanently lowered tax rate on their future earnings. Some leading Republicans advocate eliminating taxation of foreign corporate income entirely. Imagine if average citizens were given this kind of discretion for their personal income tax. You could tell the IRS you regard your tax liability as unfair, so you’re not going to pay it until Congress enacts a lower rate. Don’t try this dodge in real life. They will come after you.