It is true that the Federal Reserve had to be created in order to have a uniform common currency.

It is also true, that the common currency allowed for an income tax, where it would not have been possible without a common currency.

That said, I don't think the Federal Reserve could not operating without an income tax. Of course it could. There were many central banks that governments had, which existed before a universal income tax.

The Federal Reserve could operate from any tax base at all. Sales tax. Estate tax. Tariffs. You name it.

Nevertheless, none of that really matters. Here's the bottom line....

We're not going back to a commodity backed currency. Just write that down, and memorize it, and move on. It will never happen.

Fed this, and 1913 that... it's nice to have little history lessons, but we're not going back to a pre-1913 era. It will never happen.

Better to spend your time arguing for positions that have the possibility of happening, then living in a dream land where we could get rid of the Fed. It's not happening.

If we did that... if we had some sort of revolution in the US, and revolutionaries somehow got into government, and wiped out the Federal Reserve, and went back to a gold standard or something, the net result would be to utterly wipe out the US as a world super power. It would push us back not only to the policies of 1913, but we'd end up being 1913. We would regress as a nation a 100 years.

I think we're witnessing the end of the Fed by its own doing anyway. It's clearly demonstrating that it's lost control of the cost of money.

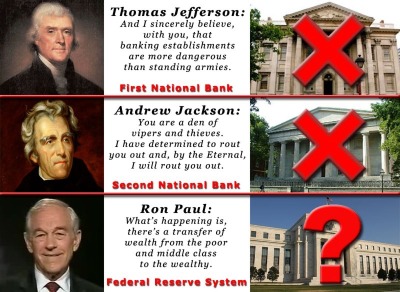

I'm told those that ignore history are

doomed to repeat it.

The Jekyll island contingent first met after a '

run on banks' a few years prior, convincing then governance

centralization was the key to a stabilized monetary system

Of note would be those original players

ancestors still rule the roost

The Federal Reserve Cartel – Eight Families own the USA #BIS, IMF, World Bank – Dean Henderson - Herland Report

not more than 15 years after the creation of our Fed reserve,came the '29 crash

after which Congressional response was the Glass Steagal 'leash' ,, mitigating to extent the '

bank profits via public risk'

FF this through 1/2 century of keynesian policies , then another 1/2 century after leaving the gold standard , and into the Financial Services Modernization Act, essentially allowing commercial banking to follow Wall Street's high-risk speculative crap shoot

Ending in a Congressional crescendo with this blabbering fool hat in hand...

followed by this banking executive's 'fix'>>>

as well as the cast of wall street tools

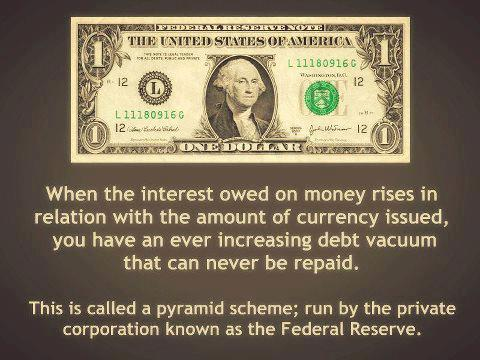

and we start to see how our debt driven system really works

socialism for the rich.....capitalism for the rest of us....

2020, and this isn't even news worthy anymore....

~S~