- Mar 6, 2016

- 2,170

- 7,882

- 2,025

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Silicon Valley Bank

The 16th largest bank in the country with more expected to fail.

This is not good news.

And at the same time, to world is beginning to back away from the US dollar.been busy, so. for those that are interested. I resemble this article.

This page has moved!

You will be redirected in 5 seconds... If you are not automatically re-directed, click here. <meta http-equiv=halturnerradioshow.com

About 186 banks have been identified as failing. In fact, some say all banks are insolvent. The central banks can only prop them up for so long. Add the bank runs and nations moving away from the dollar and you have catastrophic failure.how many more have failed since you post this?

Yes indeed. You might find this interesting.And at the same time, to world is beginning to back away from the US dollar.

About 186 banks have been identified as failing.

Let's see what happens when the adjustable mortgage loans catch up and people abandon their property and stop making car payments. All those people losing jobs right now are going into that mix too!Have they done so?

Let's see what happens when the adjustable mortgage loans catch up and people abandon their property and stop making car payments. All those people losing jobs right now are going into that mix too!

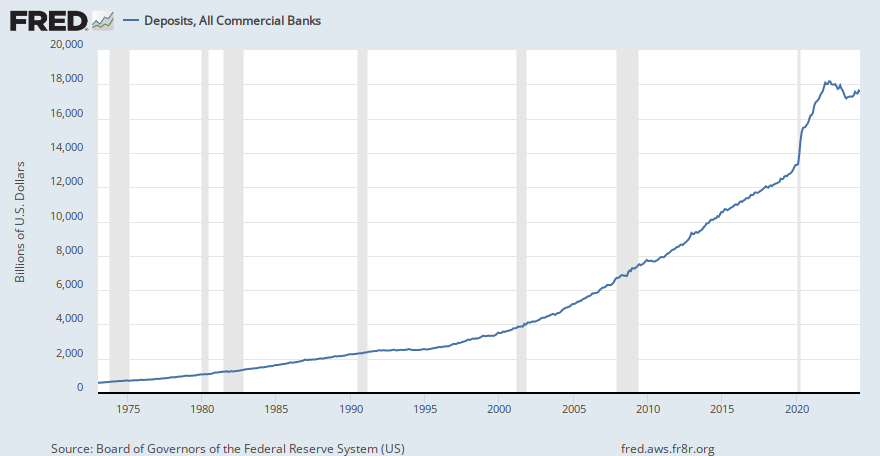

This alarming chart shows the total bank deposits versus time (left axis) and the year-on-year change in bank deposits over time (right axis) in billions of dollars. Deposits are down one trillion dollars in the past year...

Yeah, it's the COVID stimulus.Is the giant spike up the result of COVID stimulus, or is that from something else.

Yeah, it's the COVID stimulus.

There is also a big spike (in both directions) during 9-11 and also during the 2008 financial crisis. I think what happened there, is that the big money moved out of the markets and into banks during the market collapse, and then it moved back in, in order to buy back into the markets at a lower price.

The COVID stimulus looks different. The stimulus money was generally deposited into banks. The huge spike is in March/April 2020, corresponding to the rollout of the stimulus checks.

Now though, we are seeing a steady withdrawal from the banks. Could be a sign of some real trouble.

Regards,

Jim

Yeah, I suspect that is by large the biggest factor. Banks generally don't pay much interest, so, can't leave the money sitting there to slowly lose value. Money is being moved out of these low-interest deposits to put into other investments.Inflation is taking a toll on some people that is for sure. Not sure if that accounts for all of it though

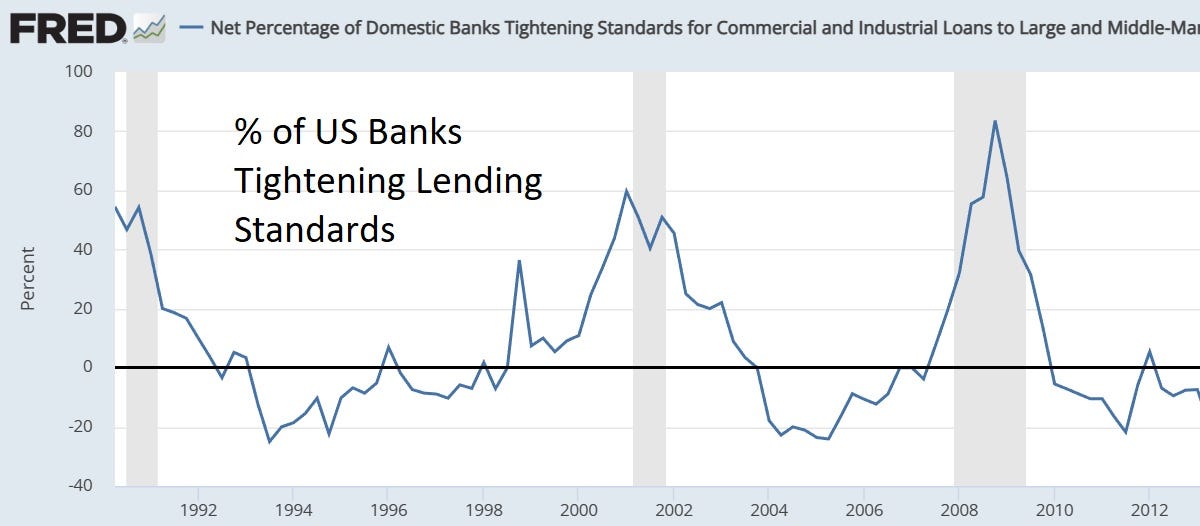

Funny, not much mention in MSM......Banks were already tightening and now...

Recession Watch: Cars and Houses Join The List

As traumatized banks pull back, subprime lending evaporatesrubino.substack.com

Capital One recently closed all credit lines for auto dealers.

USA Auto Sales shut down 39 dealerships after losing its credit line from Ally Bank.

Wells Fargo laid off all its junior auto loan underwriters and dramatically tightened its lending standards

Banks were already tightening and now...

Recession Watch: Cars and Houses Join The List

As traumatized banks pull back, subprime lending evaporatesrubino.substack.com

Capital One recently closed all credit lines for auto dealers.

USA Auto Sales shut down 39 dealerships after losing its credit line from Ally Bank.

Wells Fargo laid off all its junior auto loan underwriters and dramatically tightened its lending standards

The fdic seized first republic and sold it to jp morgan and despite assurances, investors and depositors have no confidence in the fed.

The fdic seized first republic and sold it to jp morgan and despite assurances, investors and depositors have no confidence in the fed.

Three banks that failed this year bigger than 25 that crumbled in 2008

Officials announced Monday that they closed San Francisco-based First Republic Bank, making it the third major US bank to collapse in the past two months.www.dailymail.co.uk