- Dec 18, 2013

- 136,707

- 28,029

- 2,180

People didn’t pay their mortgages, banks then sold those bad notes and badda boomExplain how Wall Street failed and why the country had to bail them out in 2008

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

People didn’t pay their mortgages, banks then sold those bad notes and badda boomExplain how Wall Street failed and why the country had to bail them out in 2008

That isnt a bug in their plan. That's the main feature. I mean, if things improve, eventually they'll run out of "the others" to blame for everything.Yep, your way of thinking - so to speak - will put our nation back five centuries

People like you always have a knack for boiling down a complex multi-faceted issue that requires one to have a nuanced discussion into one oversimplified sentence.People didn’t pay their mortgages, banks then sold those bad notes and badda boom

The Ryan, McConnell, Trump Axis cut taxes all right, and our nation's deficit grew and grew with nothing to show for the spending. Of course the Republicans want to eliminate social security, Medicare, Medicaid and the ACA to account for building fences which can be tunneled under, climbed over or knocked down by Hurricanes, Tornadoes, heavy equipment and even wire cutters.Flash

Yup. Cutting taxes brought more money into the economy and Fed coffers than raising them ever did. The Dems never learned that lesson but Kennedy, Reagan and Trump sure did.

Yep, they are known as Idiot-Grams.People like you always have a knack for boiling down a complex multi-faceted issue that requires one to have a nuanced discussion into one oversimplified sentence.

People didn’t pay their mortgages, banks then sold those bad notes and badda boom

An excellent example of creating a caste system, the poor remain poor and the wealthy will thrive. Then, of course the death tax will be eliminated, establishing a Royalty. Yep, your way of thinking - so to speak - will put our nation back five centuries.

- President Joe Biden is expected to raise long-term capital-gains tax for the wealthiest Americans to 43.4%, including a surtax. That would be higher than the top federal tax rate on wage income. How the Biden capital gains tax proposal would hit the wealthy

"Unintended Consequences"...

How the Biden capital gains tax proposal would hit the wealthy

President Joe Biden is expected to double the top long-term capital gains rate to 43.4%. But investors shouldn't necessarily rush for the exits.www.cnbc.com

1) Analyses show that every 10% gain in the capital gains tax rate leads to a 7% change in capital gains realizations. That suggests Biden’s rate increase — which represents a 66% effective increase in the rate, could lead to a 45% to 50% increase in capital gains sales, which could create a large downward force in the market.

So this would mean 401K fund managers would be selling easily 50% reduction in values.

So what are 401ks value today:

About one-third of U.S. adults (35%) said they personally owned stocks, bonds or mutual funds outside of retirement accounts in a Pew Research Center survey from September 2019.

With 39% of the $6 trillion total 401K assets invested in the market..or about $2.4 Trillion will be at risk of dropping at least 50% in value.

Now that is just the affect on stock market and then on 401ks and then on the 60 million Americans with 401ks.

Now what about jobs in America?

At one point under Trump

U.S. companies have repatriated $1 trillion since tax overhaul

U.S. companies have repatriated $1 trillion since tax overhaul

That's still short of the $4 trillion in overseas profits that President Trump would return as a result of the 2017 tax law.www.latimes.com

Corporations have brought back more than $1 trillion of overseas profits to the U.S. since Congress overhauled the international tax system and prodded companies to repatriate offshore funds, a report showed Thursday. (snip)

Investment banks and think tanks have estimated that American corporations held $1.5 trillion to $2.5 trillion in offshore cash at the time the law was enacted. Before the overhaul, companies were incentivized to keep profits overseas because they owed a 35% tax when bringing it back and could defer payment by keeping funds offshore.

The law set a one-time 15.5% tax rate on cash and 8% on non-cash or illiquid assets.

Compare and contrast the way that Presidents Trump and Obama chose to stimulate the American economy, each of them generating roughly a trillion dollars in “stimulus.”

In summary folks... all the economic benefits of the "repatriation" and the capital gains tax cuts will result in nearly $10 trillion in economic losses to 60 million Americans at the minimum!

One trillion dollars have flowed into the American economy as Trump’s tax law changes allowed companies to repatriate profits without tax penalty

President Trump’s tax reform has delivered more than a trillion dollars of stimulus to the American economy through corporations repatriating profits held overseas in order to avoid penalties that the tax law had imposed on bringing home the fu...www.americanthinker.com

Cap gains are already taxed. he didnt "find" anything, dummy.Demoquacks can find a way to tax anything...next up air

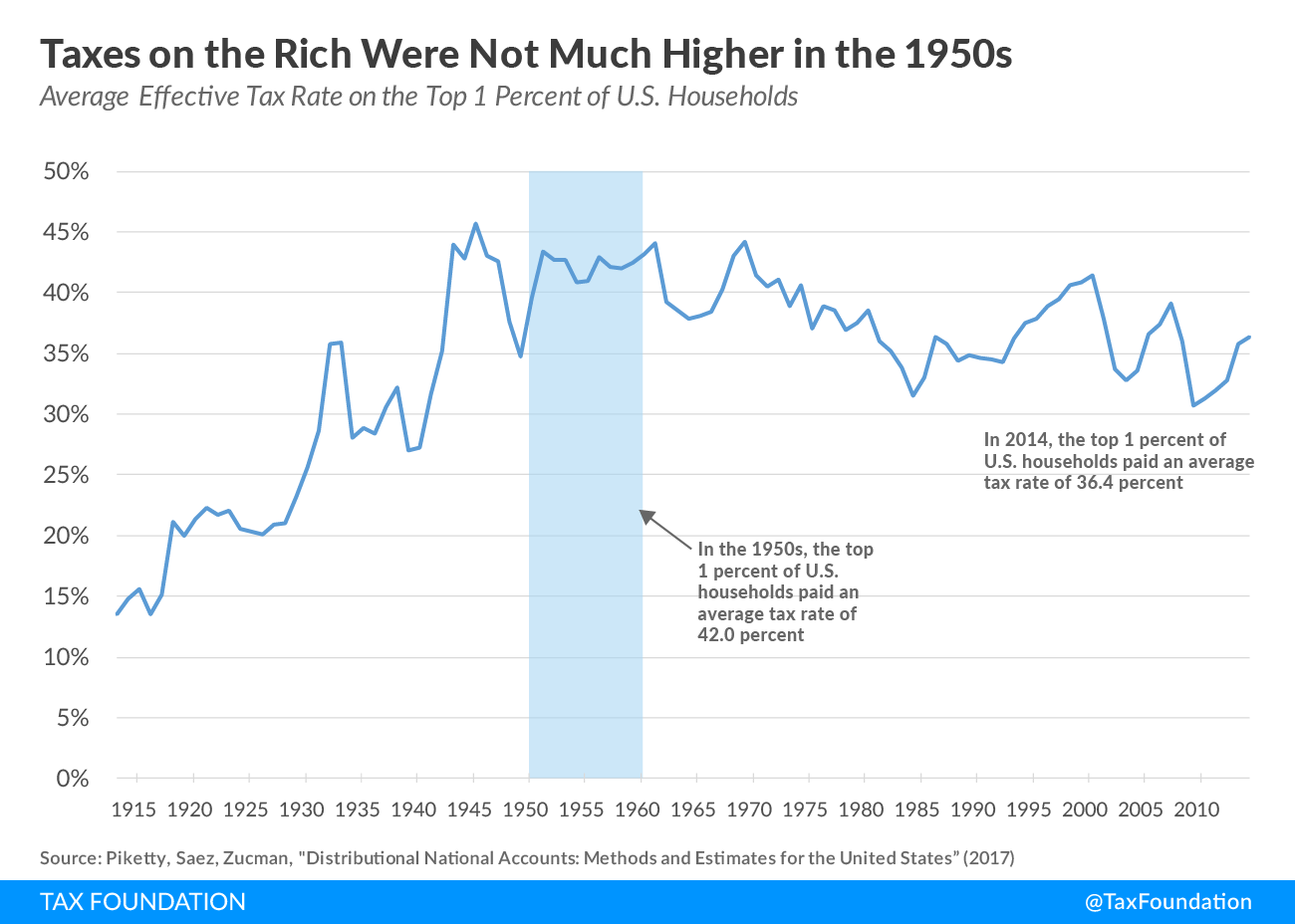

Well, it was 90% with a shitload of loopholes to offset the 90%.The highest bracket in the 50's was 90% during one of the greatest economic booms in American history. That was deemed fair.

The "hard working Americans" that you are referring to will not feel a tax increase. You somehow conflate the wealthiest of Americans with the "hard working Americans". It's pretty amazing.

"The Ryan, McConnell, Trump Axis cut taxes all right, and our nation's deficit grew and grew with nothing to show for the spending. Of course the Republicans want to eliminate social security, Medicare, Medicaid and the ACA to account for building fences which can be tunneled under, climbed over or knocked down by Hurricanes, Tornadoes, heavy equipment and even wire cutters."If you say so even though you explained nothing as far as how this all would happen. (Because you can't)

Cap gains are already taxed. he didnt "find" anything, dummy.

Please post the 90% of loopholes that have been repealed and who benefited from said loopholes and who suffered?Well, it was 90% with a shitload of loopholes to offset the 90%.

We don't have those loopholes today. Thank you Trump.

I merely responded to the words you wrote.Wooosh, right over your tin foiled hat, dummy

You loons can find a way to tax anything and then keep increasing the tax....like you have with capital gains. Or gas taxes

Now sit down, noob

I merely responded to the words you wrote.

Under Nixon, cap gains were also increased in 1969, capping them at 35% by 1972. But I guess Nixon was a RINO, right? LOL!

I know you dont care. You're allergic to facts.Don't care, tinfoil

- President Joe Biden is expected to raise long-term capital-gains tax for the wealthiest Americans to 43.4%, including a surtax. That would be higher than the top federal tax rate on wage income. How the Biden capital gains tax proposal would hit the wealthy

"Unintended Consequences"...

How the Biden capital gains tax proposal would hit the wealthy

President Joe Biden is expected to double the top long-term capital gains rate to 43.4%. But investors shouldn't necessarily rush for the exits.www.cnbc.com

1) Analyses show that every 10% gain in the capital gains tax rate leads to a 7% change in capital gains realizations. That suggests Biden’s rate increase — which represents a 66% effective increase in the rate, could lead to a 45% to 50% increase in capital gains sales, which could create a large downward force in the market.

So this would mean 401K fund managers would be selling easily 50% reduction in values.

So what are 401ks value today:

About one-third of U.S. adults (35%) said they personally owned stocks, bonds or mutual funds outside of retirement accounts in a Pew Research Center survey from September 2019.

With 39% of the $6 trillion total 401K assets invested in the market..or about $2.4 Trillion will be at risk of dropping at least 50% in value.

Now that is just the affect on stock market and then on 401ks and then on the 60 million Americans with 401ks.

Now what about jobs in America?

At one point under Trump

U.S. companies have repatriated $1 trillion since tax overhaul

U.S. companies have repatriated $1 trillion since tax overhaul

That's still short of the $4 trillion in overseas profits that President Trump would return as a result of the 2017 tax law.www.latimes.com

Corporations have brought back more than $1 trillion of overseas profits to the U.S. since Congress overhauled the international tax system and prodded companies to repatriate offshore funds, a report showed Thursday. (snip)

Investment banks and think tanks have estimated that American corporations held $1.5 trillion to $2.5 trillion in offshore cash at the time the law was enacted. Before the overhaul, companies were incentivized to keep profits overseas because they owed a 35% tax when bringing it back and could defer payment by keeping funds offshore.

The law set a one-time 15.5% tax rate on cash and 8% on non-cash or illiquid assets.

Compare and contrast the way that Presidents Trump and Obama chose to stimulate the American economy, each of them generating roughly a trillion dollars in “stimulus.”

In summary folks... all the economic benefits of the "repatriation" and the capital gains tax cuts will result in nearly $10 trillion in economic losses to 60 million Americans at the minimum!

One trillion dollars have flowed into the American economy as Trump’s tax law changes allowed companies to repatriate profits without tax penalty

President Trump’s tax reform has delivered more than a trillion dollars of stimulus to the American economy through corporations repatriating profits held overseas in order to avoid penalties that the tax law had imposed on bringing home the fu...www.americanthinker.com

Don't care, tinfoil