Every month or so we a liberal thread about how the Bush tax cuts led to huge deficits and an explosion in the national debt. We are also told that the Bush tax cuts mostly benefited the rich. Some liberals even still claim that somehow the Bush tax cuts contributed to the Great Recession (right, because letting people keep more of their money somehow, someway harms the economy!). Here are the facts:

* The Bush tax cuts were followed by huge increases in federal revenue. As anyone can confirm by looking at federal tax revenue data, here's what happened to federal revenue following the Bush tax cuts:

2003 -- $1.78 trillion

2004 -- $1.88 trillion

2005 -- $2.15 trillion

2006 -- $2.40 trillion

2007 -- $2.56 trillion

In other words, from 2004 to 2007, federal tax revenue increased by $780 billion, the largest four-year increase in American history.

Total federal revenue for 2008 dropped slightly, down to $2.52 trillion, because a recession started that year, but revenue was still substantially higher than it was in 2003 or 2004. (See The Facts About Tax Cuts, Revenue, and Growth for more info.)

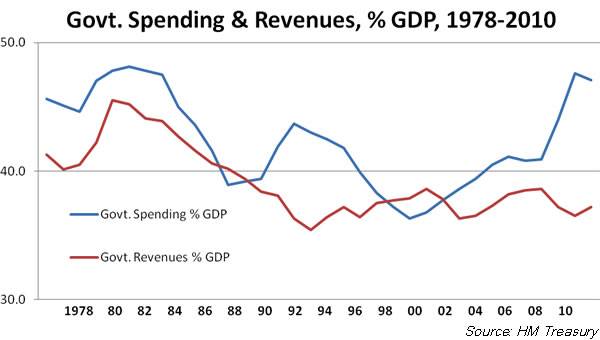

So why did the deficit explode? Because Congress went on a spending spree and raised spending at an even faster rate than revenue was rising. It's that simple. If Congress had merely limited spending hikes to match inflation, we would have been operating well in the black.

* The Bush tax cuts were followed by 52 consecutive months of economic growth. We have had nothing close to that since Bush left office.

* The Bush tax cuts benefited everyone, not just the rich. Some of the largest rate cuts went to the middle class/the poor. In fact, after the Bush tax cuts, the rich paid a larger share of federal tax revenue. (See Who Really Benefited From the Bush Tax Cuts? and Why America Is Going To Miss The Bush Tax Cuts and George W. Bush, Middle Class Champion for more info.)

* The Bush tax cuts were followed by huge increases in federal revenue. As anyone can confirm by looking at federal tax revenue data, here's what happened to federal revenue following the Bush tax cuts:

2003 -- $1.78 trillion

2004 -- $1.88 trillion

2005 -- $2.15 trillion

2006 -- $2.40 trillion

2007 -- $2.56 trillion

In other words, from 2004 to 2007, federal tax revenue increased by $780 billion, the largest four-year increase in American history.

Total federal revenue for 2008 dropped slightly, down to $2.52 trillion, because a recession started that year, but revenue was still substantially higher than it was in 2003 or 2004. (See The Facts About Tax Cuts, Revenue, and Growth for more info.)

So why did the deficit explode? Because Congress went on a spending spree and raised spending at an even faster rate than revenue was rising. It's that simple. If Congress had merely limited spending hikes to match inflation, we would have been operating well in the black.

* The Bush tax cuts were followed by 52 consecutive months of economic growth. We have had nothing close to that since Bush left office.

* The Bush tax cuts benefited everyone, not just the rich. Some of the largest rate cuts went to the middle class/the poor. In fact, after the Bush tax cuts, the rich paid a larger share of federal tax revenue. (See Who Really Benefited From the Bush Tax Cuts? and Why America Is Going To Miss The Bush Tax Cuts and George W. Bush, Middle Class Champion for more info.)