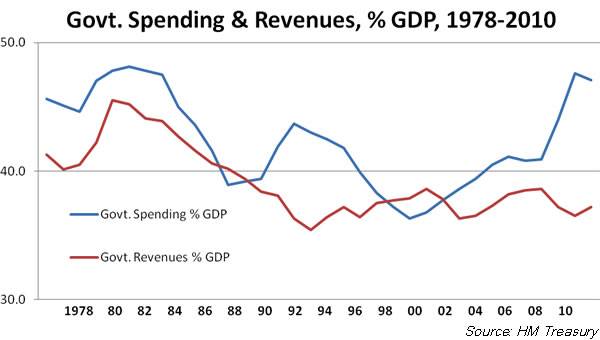

No one is 'lying' about the Bush tax cuts, as they in fact contributed to the growing deficit, having no positive impact on economic growth:

"The 2001 tax cut did nothing to stimulate the economy, yet Republicans pushed for additional tax cuts in 2002, 2003, 2004, 2006 and 2008. The economy continued to languish even as the Treasury hemorrhaged revenue, which fell to 17.5 percent of the gross domestic product in 2008 from 20.6 percent in 2000. Republicans abolished Paygo in 2002, and spending rose to 20.7 percent of G.D.P. in 2008 from 18.2 percent in 2001.

According to the C.B.O., by the end of the Bush administration, legislated tax cuts reduced revenues and increased the national debt by $1.6 trillion. Slower-than-expected growth further reduced revenues by $1.4 trillion."

http://economix.blogs.nytimes.com/2012/06/12/the-fiscal-legacy-of-george-w-bush/

"The 2001 tax cut did nothing to stimulate the economy, yet Republicans pushed for additional tax cuts in 2002, 2003, 2004, 2006 and 2008. The economy continued to languish even as the Treasury hemorrhaged revenue, which fell to 17.5 percent of the gross domestic product in 2008 from 20.6 percent in 2000. Republicans abolished Paygo in 2002, and spending rose to 20.7 percent of G.D.P. in 2008 from 18.2 percent in 2001.

According to the C.B.O., by the end of the Bush administration, legislated tax cuts reduced revenues and increased the national debt by $1.6 trillion. Slower-than-expected growth further reduced revenues by $1.4 trillion."

http://economix.blogs.nytimes.com/2012/06/12/the-fiscal-legacy-of-george-w-bush/