- Thread starter

- #121

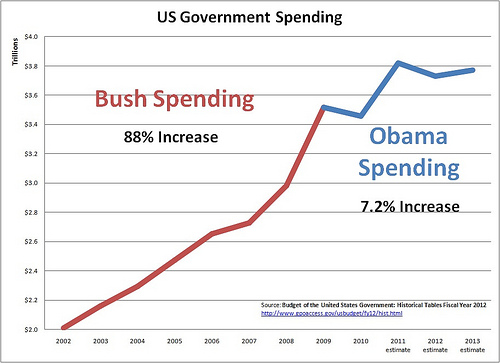

This has nothing to do with creating jobs, in fact, it will cause further unemployment and a further decrease in revenue to the government. The wealthy are responsible for 32 % of consumer spending, you take that away from them, you take it away from the private sector, which is the bill payer's for the nation and the job engine for our economy.You tax the wealthy and they don't buy the yacht, the yacht builder goes out of business and lays off all of his employee's now if that is your fix to promote growth in the private sector, then you need to take econ 101, Obama certainly missed this course at Harvard as he is an economic moron.

No, you are the economic moron.

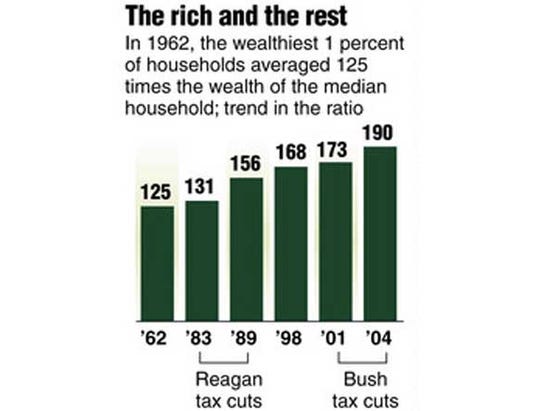

When a government is underfunded and wealth is held in fewer and fewer hands, an economy stagnates.

Who has the fastest growing economy in Europe? Sweden.

Why? BECAUSE THEY INVEST IN THEIR PEOPLE.

Investments in education, healthcare, technology, research, and infrastructure is what drives an economy. Not tax cuts for the rich.

Funny, the 5 fastest growing GDPs in Europe are Turkey, Belarus, Moldova, Georgia, and Bulgaria. Sweden comes in at number 58 in the world, behind countries like Rwanda, Cambodia, and just ahead of Mexico. Your figures are, as always, wonderfully delusional.

Hardly...

STOCKHOLM Almost every developed nation in the world was walloped by the financial crisis, their economies paralyzed, their prospects for the future muddied.

And then theres Sweden, the rock star of the recovery.

This Scandinavian nation of 9 million people has accomplished what the United States, Britain and Japan can only dream of: Growing rapidly, creating jobs and gaining a competitive edge. The banks are lending, the housing market booming. The budget is balanced.

Sweden was far from immune the global downturn of 2008-09. But unlike other countries, it is bouncing back. Its 5.5 percent growth rate last year trounces the 2.8 percent expansion in the United States and was stronger than any other developed nation in Europe. And compared with the United States, unemployment peaked lower (around 9 percent, compared with 10 percent) and has come down faster (it now stands near 7 percent, compared with 9 percent in the U.S.).

Five economic lessons from Sweden, the rock star of the recovery - The Washington Post