Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why should the rich pay taxes at a lower rate than the rest of us?

- Thread starter Chris

- Start date

EVERYONE OF YOUR LINKS TO YOUR CHARTS--result in NO DATE--NO SOURCE--NO SUBSTANCE OF HOW THEY GOT THEIR NUMBERS--TO DO THE CHART--WHICH EQUALS NO CREDIBILITY

Nice try though--

Now here's something from the CONGRESSIONAL BUDGET OFFICE as reported by the Associated Press.

FACT CHECK: Are rich taxed less than secretaries? - Yahoo! News

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

WASHINGTON, D.C.--The 400 highest-earning taxpayers in the U.S. reported a record $105 billion in total adjusted gross income in 2006, but they paid just $18 billion in tax, new Internal Revenue Service figures show. That works out to an average federal income tax bite of 17%--the lowest rate paid by the richest 400 during the 15-year period covered by the IRS statistics. The average federal tax bite on the top 400 was 30% in 1995 and 23% in 2002.

Richest 400 Earn More, Pay Lower Tax Rate - Forbes.com

They don't pay lower taxes, you confuse the issue, income taxes are based on your income and deductions. The wealthy have already been taxed on their incomes, they are now taxed on their investments, dividends and capitol gains, being that they have already paid taxes on the original money invested ( income taxes), they pay on the profit at a much lower rate. Capitol gains, those held over a year are taxed at 15%. The wealthy, the top 10% pay 70% of all taxes in this country. 46% of americans pay NO income tax what-so-ever. I say tax them, they enjoy the same benefits the rest of us get to pay for, roads, bridges, schools, police, fire etc. They need to have some skin in the game.

" Socialism is the philosophy of failure, the creed of ignorance, the gospel of envy, it's only virtue is the shared equality of misery." Winston Churchill

" The problem with socialism is that you eventuallly run out of other people's money." Margaret Thatcher.

Yes, I saw this on FOX too. It's wrong. It assumes the rich are only older people or people who are now taxed on investments. Tha'ts wrong.

They actually pay less on their income while they're earning it because the tax code gives them additional deductions and the amount of income they make allows them to defer the comp that shows up on their 1040, 1120 or whatever. Something people living paycheck to paycheck, don't have the means to do.

Now before you too, go all whackjob and start screaming I must be some kind of Liberal Obama-Loving shill or whatever - I'm not saying there's anything wrong with this. Hell, I do it. Anyone making a fair income should.

But the idea that someone making even just a million a year, let alone more, pays as high a percentage on their total comp, as someone making $50K is simply not true.

Is the answer to all our problems taxing the rich? Nope.

Do we need an overhaul in our tax system? I think most people would agree that's the case. But neither Dems nor Repubs will let that happen.

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

Nobody is arguing the net effective rate, you overbearing, excessively loquacious gasbag.Helpful hint: Even though bloviating text walls, going into excruciating details of the already understood complexities of the IRC, might score you some points with the port and brie set, they don't impress anyone of consequence around here, with the possible exception of yourself....But you've already shown yourself to be insufferably impressed and pleased with yourself, so that one is pretty much a wash.

Fact remains that the rates remain the same, only the abilities to obtain deductions and credits vary.

So in other words, your ass is kicked because you don't understand shit about how high income earners end up paying a lower net percentage. I'm cool with that!

Now of course, the clueless idiots, think it's as simple some moronic bs bumper sticker phrase like "They have the same rates on income and capital gains!" because FOX told them that is the answer.

Which is usually enough to placate the colosallty stupid morons who are clueless about things like defered comp etc... and can't come up with anything better than "Oh yeah?!? Well, uh, er, uh, You're just so impressed with yourself!"

It's okay. It's not like I expected you to come up with anything intelligent, learned or directly addressing the points I brought up.

And btw, if you weren't such a stupidass, you might have picked up on the whole thing about me saying it's not fair to tax high income earners more, solely because they make more.

But of course, being a mindless sheeple who just regurgitates the bs your thoughtmasters tell you, you did what you've been taught. That's fine junior. No surprise there either. Now go turn on Gleen and see what you opinion will be tomorrow! If you don't know, just ask me about any issue. I'll be happy to tell you what your opinion is - cause it's not like you have any of your own anyway...

Anyone with half a lick of sense can figure out that those with more to protect will find ways to do so more effectively....Hell, I'd most certainly be more than willing to spend more on accountants and tax attorneys over IRS looters, had I that kind of income to protect.

Nonetheless, the rate schedules remain the same..."The wealthy" pay the same rates on their adjusted gross incomes as does anyone else....There is no "rich guy" deduction or credit.

I know these things because I've been filing under a series of corporate & trust veils for years now.

Now, I believe you were sputtering something about regurgitating what others have told you to?

Of course. You're Bill Gates. Everyone is on the internet. Love the "corporate veils" thing!

So you found what to be flawed in my post about the partner paying 20% on his million dollar income? Now you change your tune??? Because I once never claimed the rate schedules were different. I simply pointed out that there are tools and vehicles available for the rich, which others can't take advantage of, and which result them paying a significantly lower amount on their income than the middle or lower classes.

You may now continue your insults there, Bill...

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

^^^^^^^^^^^^^^^I happen to own my own business that nets over a million a year.

I take a portion of my income as stock dividends. I defer taxes via a safe harbor plan. I invest after tax money to the tune of 50K a year I have a couple deferred comp plans via life insurance and i have several other side ventures as a silent partner.

Don't think you can dazzle me little sheep.

And I don't remember saying anything about tax cuts.

What I do remember is saying that the tax rates (which is what this thread is about by the way) paid on earned income and capital gains are the same for everyone. It's you who seem to have problem with that simple fact and seem to feel the need to prove oh how smart you are.

I've found that the people who have to tell everyone how smart they are usually aren't. So run along little sheep. I'm sure there's a politician on TV right now spouting some rah rah sis-boom-bah that will get you all fired up for the night.

So you claim to have all that going and you found what flawed in my post? What specifically did you find that caused you to put on your asshole hat and start slinging bullshit?

NM. You're probably lying anyway.

Total poseur, who has more than likely never seen anything more complicated than form 1040A

So here's where we find out who's real and who's full of bullsh1t and really a posuer. I'll link my corporate website and bio if you'll link yours.

(this would be where you say you don't share private information on the internet).

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

I'm curious about this. I've seen this chart before and it seemed like it had to be bs but the government link backs it.

So okay. I don't know everything and don't claim to. How is it bs? There's something it doesn't show or that I'm missing here, right?

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,099

- 245

WASHINGTON, D.C.--The 400 highest-earning taxpayers in the U.S. reported a record $105 billion in total adjusted gross income in 2006, but they paid just $18 billion in tax, new Internal Revenue Service figures show. That works out to an average federal income tax bite of 17%--the lowest rate paid by the richest 400 during the 15-year period covered by the IRS statistics. The average federal tax bite on the top 400 was 30% in 1995 and 23% in 2002.

Richest 400 Earn More, Pay Lower Tax Rate - Forbes.com

They don't pay lower taxes, you confuse the issue, income taxes are based on your income and deductions. The wealthy have already been taxed on their incomes, they are now taxed on their investments, dividends and capitol gains, being that they have already paid taxes on the original money invested ( income taxes), they pay on the profit at a much lower rate. Capitol gains, those held over a year are taxed at 15%. The wealthy, the top 10% pay 70% of all taxes in this country. 46% of americans pay NO income tax what-so-ever. I say tax them, they enjoy the same benefits the rest of us get to pay for, roads, bridges, schools, police, fire etc. They need to have some skin in the game.

" Socialism is the philosophy of failure, the creed of ignorance, the gospel of envy, it's only virtue is the shared equality of misery." Winston Churchill

" The problem with socialism is that you eventuallly run out of other people's money." Margaret Thatcher.

Yes, I saw this on FOX too. It's wrong. It assumes the rich are only older people or people who are now taxed on investments. Tha'ts wrong.

They actually pay less on their income while they're earning it because the tax code gives them additional deductions and the amount of income they make allows them to defer the comp that shows up on their 1040, 1120 or whatever. Something people living paycheck to paycheck, don't have the means to do.

Now before you too, go all whackjob and start screaming I must be some kind of Liberal Obama-Loving shill or whatever - I'm not saying there's anything wrong with this. Hell, I do it. Anyone making a fair income should.

But the idea that someone making even just a million a year, let alone more, pays as high a percentage on their total comp, as someone making $50K is simply not true.

Is the answer to all our problems taxing the rich? Nope.

Do we need an overhaul in our tax system? I think most people would agree that's the case. But neither Dems nor Repubs will let that happen.

How does the reporting what the IRS says is true assume that rich are all old? If I point out that BLS says that there are people who have stopped looking for work does that mean I am assuming all unemployed are young? Are there rules about how does this assumption thing works, or do you make it up as you go along? For instance, when, exactly, did the IRS become part of Fox News?

What you seem to be missing in your assumptions here is that the deductions available to the rich are actually available to everyone. The reason most people do not take them is actually pretty simple, they are lazy. Not to mention the fact that the standard deduction is usually higher than itemized deductions for the average taxpayer.

While it is true that money usually gets you better accountants and lawyers, and that can help, that actually ends up costing more than you save in taxes, unless you are a major corporation or a complete idiot. The rich do not have lower tax rates than the middle class, nor do they end up paying a lower percentage. The various loopholes and deductions are there for anyone who wants to use them. H&R Block used to make its money by pointing out the obvious, now TurboTax does it.

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

They don't pay lower taxes, you confuse the issue, income taxes are based on your income and deductions. The wealthy have already been taxed on their incomes, they are now taxed on their investments, dividends and capitol gains, being that they have already paid taxes on the original money invested ( income taxes), they pay on the profit at a much lower rate. Capitol gains, those held over a year are taxed at 15%. The wealthy, the top 10% pay 70% of all taxes in this country. 46% of americans pay NO income tax what-so-ever. I say tax them, they enjoy the same benefits the rest of us get to pay for, roads, bridges, schools, police, fire etc. They need to have some skin in the game.

" Socialism is the philosophy of failure, the creed of ignorance, the gospel of envy, it's only virtue is the shared equality of misery." Winston Churchill

" The problem with socialism is that you eventuallly run out of other people's money." Margaret Thatcher.

Yes, I saw this on FOX too. It's wrong. It assumes the rich are only older people or people who are now taxed on investments. Tha'ts wrong.

They actually pay less on their income while they're earning it because the tax code gives them additional deductions and the amount of income they make allows them to defer the comp that shows up on their 1040, 1120 or whatever. Something people living paycheck to paycheck, don't have the means to do.

Now before you too, go all whackjob and start screaming I must be some kind of Liberal Obama-Loving shill or whatever - I'm not saying there's anything wrong with this. Hell, I do it. Anyone making a fair income should.

But the idea that someone making even just a million a year, let alone more, pays as high a percentage on their total comp, as someone making $50K is simply not true.

Is the answer to all our problems taxing the rich? Nope.

Do we need an overhaul in our tax system? I think most people would agree that's the case. But neither Dems nor Repubs will let that happen.

How does the reporting what the IRS says is true assume that rich are all old? If I point out that BLS says that there are people who have stopped looking for work does that mean I am assuming all unemployed are young? Are there rules about how does this assumption thing works, or do you make it up as you go along? For instance, when, exactly, did the IRS become part of Fox News?

What you seem to be missing in your assumptions here is that the deductions available to the rich are actually available to everyone. The reason most people do not take them is actually pretty simple, they are lazy.

No, the reason a waitress making $24K a year doesn't defer a huge part of her income is because she can't afford to. The reason she doesn't take shares of stock or ownership in investment funds is because she can't afford to and it's not offered to her. This applies to most of the tools used to avoid paying taxes on income while earned. Laziness has nothing to do with it.

Not to mention the fact that the standard deduction is usually higher than itemized deductions for the average taxpayer.

This is correct. They don't get to deduct their cars, phones, planes etc...

While it is true that money usually gets you better accountants and lawyers, and that can help, that actually ends up costing more than you save in taxes, unless you are a major corporation or a complete idiot.

This is definitely wrong. The rich aren't stupid. They don't pay a JD / CPA $500+ an hour unless they get a lot more in return.

The rich do not have lower tax rates than the middle class,

Never said they do.

nor do they end up paying a lower percentage.

This is where we disagree and I showed an example of how it's done.

The various loopholes and deductions are there for anyone who wants to use them. H&R Block used to make its money by pointing out the obvious, now TurboTax does it.

Turbo-tax? LOL! Um yeah Okay. I'm sure Steve Wynn uses Turbo-Tax...

No, those loopholes are not there for anyone who wants to use them. They are there for anyone who has the legal entity structure necessary to take advantage of them e.g. C-corp, LLP or whatever, who has sufficient income to defer a significant portion of it, and who has a position that offers those specific tax-avoidance opportunities.

Bob the cleaner for Ace Carpets has none of these.

For the 5th time, I'm not saying there's anything wrong with people using the code to their advantage. I have and will in the future. I'm just saying that this latest mantra of "Oh the only people this refers to, are people who make all their income from investments." is not accurate.

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,099

- 245

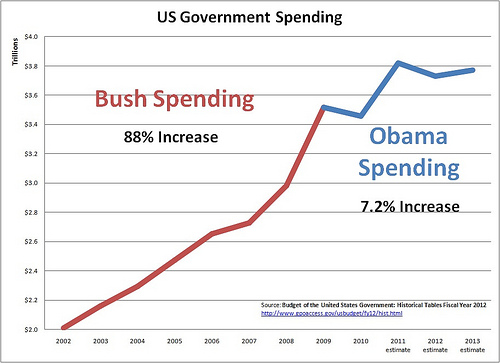

I'm curious about this. I've seen this chart before and it seemed like it had to be bs but the government link backs it.

So okay. I don't know everything and don't claim to. How is it bs? There's something it doesn't show or that I'm missing here, right?

The ability to think critically? You are comparing 20 years of federal spending under 4 different presidents (those figures actually combine the Clinton era spending with Reagan era spending) with 2 years of federal spending under 1 president, and comparing the totals as percentages of each other. That, even if the figure do back it up, is BS.

Here is a chart showing the revenue and the spending through 2010, and the projected spending until 2016.

Historical Federal Receipt and Outlay Summary

If you look at the numbers you can see that was spending like a madman, spending almost $21 trillion in 8 years. Obama, not wanting to be outdone, spent $7 trillion dollars in his first two years. Think about those numbers and tell me what you think of Chris's charts now.

Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,099

- 245

Turbo-tax? LOL! Um yeah Okay. I'm sure Steve Wynn uses Turbo-Tax...

No, those loopholes are not there for anyone who wants to use them. They are there for anyone who has the legal entity structure necessary to take advantage of them e.g. C-corp, LLP or whatever, who has sufficient income to defer a significant portion of it, and who has a position that offers those specific tax-avoidance opportunities.

Bob the cleaner for Ace Carpets has none of these.

For the 5th time, I'm not saying there's anything wrong with people using the code to their advantage. I have and will in the future. I'm just saying that this latest mantra of "Oh the only people this refers to, are people who make all their income from investments." is not accurate.

Anyone can restructure their income if they want to, I actually helped a friend do it with his reenlistment bonus in the Navy. Since I just spent an entire post arguing that those tricks are there for anyone that wants to take advantage of them, I think you are going to have a hard time trying to argue that I said it being only people who take their income as an investment that do so.

Tell me something, if you actually agree with me, why are you trying to argue?

IndependntLogic

Senior Member

- Jul 14, 2011

- 2,997

- 399

- 48

Criss your chart is B.S.

Nice try though---

I'm curious about this. I've seen this chart before and it seemed like it had to be bs but the government link backs it.

So okay. I don't know everything and don't claim to. How is it bs? There's something it doesn't show or that I'm missing here, right?

The ability to think critically? You are comparing 20 years of federal spending under 4 different presidents (those figures actually combine the Clinton era spending with Reagan era spending) with 2 years of federal spending under 1 president, and comparing the totals as percentages of each other. That, even if the figure do back it up, is BS.

Where did I compare anything? Where did I say I find the chart to be valid? While you're doing your usual little snide thing, you missed the part where I said it seemed like bs, didn't you? I get it. You can't help yourself. I guess it's just part of your personality. Sad that.

Here is a chart showing the revenue and the spending through 2010, and the projected spending until 2016.

Historical Federal Receipt and Outlay Summary

Thank you. When I said it seemed there was something missing, this was what I was referring to.

If you look at the numbers you can see that was spending like a madman, spending almost $21 trillion in 8 years. Obama, not wanting to be outdone, spent $7 trillion dollars in his first two years. Think about those numbers and tell me what you think of Chris's charts now.

What is it you think I thought of Chris' chart before? Are you like this with people in real life?

Last edited:

asterism

Congress != Progress

7.2% increase? How so?

asterism

Congress != Progress

According to Government - Historical Debt Outstanding - Annual 1950 - 1999, the debt at the end of the 1980 fiscal year, on September 30th, 1980, was $907,701,000,000. On September 30th, 1981, it was $997,855,000,000. Averaging it out over the year gives a debt of $246,997,260.27 per day.

Reagan took office 112 days later on January 20th, 1981. The debt on that date could be estimated as $907,701,000,000 plus 112 x $246,997,260.27, or $935,364,693,151.

Bill Clinton was the first president to slow the rate of the accrual of debt after the current out-of-control spending began with the Borrow and Spend Republicans in 1981.

The final amount of the senior Bush debt was $4,174,218,594,232.91 (according to Debt to the Penny (Daily History Search Application)), and Clinton became president on January 20th, 1993. Bill Clinton saw $1,553,558,144,071.73 added to the national debt during the eight years of his presidency.

However, from the start of fiscal year 1994 (7 months after Clinton became president), until the start of fiscal year 2002 (7 months after Bush took office), the amount of money paid toward interest on the existing Federal debt was $2,767,282,794,374.59 (Government - Interest Expense on the Debt Outstanding).

Therefore, no amount of the national debt is attributable to Bill Clinton - his policies of higher taxes and reduced spending actually simultaneously reduced the debt and brought about the strongest economy since World War II, despite the fiscal disaster left in the wake of Reagan and the first Bush.

The debt was at $5,727,776,738,304.64 on January 19th, 2001, the last business day before George W. Bush took the office of president. The debt was at $10,628,881,485,510.23 on January 16th, 2009, the last business day before Barack H. Obama became president.

During his administration, George W. Bush

increased the national debt by $4,901,104,747,205.59

and personally approved of the creation of 46% of the entire national debt,

in only 8 years.

ReaganBushDebt.org Calculation Details

Bush increased the debt by $4 Trillion on 8 years. Obama did that in 2 years.

Your point?

asterism

Congress != Progress

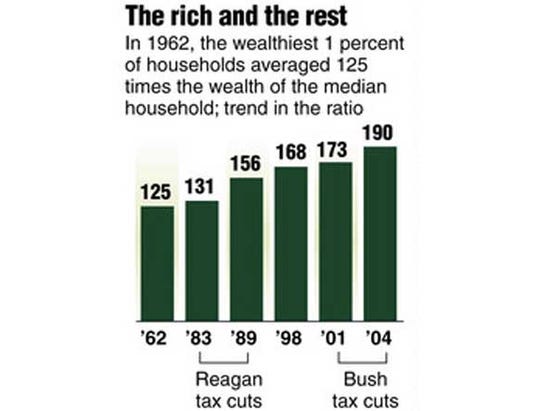

That's an interesting statistic. So it seems that when tax rates are cut the economy expands and the rich make more money and pay more in aggregate taxes.

Are you suggesting the economy should contract?

Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

Ahhh. Okay. Sorry. Didn't realize you were a stupid whackjob. Here, since it's so simple, why don't you pick this apart. This is the kind of deal we structure all the time. Since you're so uh "sophisticated" in this regard, it should be easy for you and the aptly named Oddball!

People with higher incomes have almost always paid less in taxes. Their rate doesn't matter because they have so many more tools at their disposal for avoidance (as opposed to evasion).

For example, we just structured the comp for a partner at a law firm. He'll get a million a year but it's broken down in a few different ways. $200K will come as shares in the firm - which have a guaranteed buyout plus interest for every year he stays. No taxes on that money until he takes it, when it will be offset with other vehicles.

Some will go to the firm's investment fund. Think about the value of that. These guys know who is going to Merge / Acquire etc... before it ever happens. Not that they would ever use that info to their advantage Then there is the retirement account, life insurance etc... which is not taxed until received and then again, it is offset in other ways or put into a trust and not taxed at all.

So he'll end up with an actual income of about $500K. But wait there's more! As a partner, he gets a company car - a Mercedes 500CLS. His Learjet (which isn't as great as a Gulfstream but it's still COOL!) is deductible. So are his phones, computers, membership in the country club and so on.

So even though he uses these things for personal purposes (as well as business of course), he'll get at least another $100K off the top.

Then of course, his wife owns an interior decorating business. She has to buy all kinds of expensive furniture for their home because she uses it as a showcase. Her business loses about $100K for two years and then shows a profit of $20K for one year. That means once every three years they pay an extra $10K in taxes - but 2 out of 3 years, they save $50K in taxes PLUS they get to write of the cost of a lot of their funrinture! (We're talking $30K for a dining room set folks).

So he'll end up paying income taxes on about $350 - $400K. Probably around 20% or so of his income. Now this isn't a bad guy. He's not doing anything wrong. That's just how our tax code is written. The moment I started my own business (a legal recruiting firm), I got a couple dozen deductions you don't get. The more I make, the more I can avoid paying taxes on. It's just how it works.

Now. Can a manager at a retail store making $50K a year afford to defer or divert half their income? Nope. Would they get the same tax breaks if they did? A few but not most of them because they're not a business owner like those 400 people to whom you refer.

Can a small business owner who makes $50K a year do what these folks do? Legally they can but in application, it's probably not practical. They'd starve.

So yes, the tax codes favor the rich. Oh well. As things are picking up for us (the legal biz is benefitting right now), I'm ambivalent. But would I lose sleep over two points on the NET? Not really.

I do find it interesting that the very people who have claimed all our problems would be solved if only we lowered taxes on "job creators", are now complaining about Obama's jobs bill - which is substantially tax cuts.

So Bush's temporary tax cuts were great but Obama's are terrible. Check.

Now you notice how my post is not just whackjob bumper-sticker bullsh1t sold by RW media OR LW media? Just observation of fact which of course, because it doesn't agree with that nice little kindergarten phrase from your memorized soundbites, stirs the implanted reaction.

So since I don't just parrot your cute little mantras, instead of intelligently discussing issues, you cute little whackjobs get your panties in a bunch and start with the petty insults about how "other people" are sheep, unintelligent etc...

So how much deferred income are your taking this year? Do you work with DC or DB? Are you avoiding those pesky 10b's? Doin a lot of work on those 1120's? Do you have a nice GP guaranteed as long as you adhere to your NCA? Or is it more of a GH?

Surely Mensa members like yourselves deal with those hassles every day!

I happen to own my own business that nets over a million a year.

I take a portion of my income as stock dividends. I defer taxes via a safe harbor plan. I invest after tax money to the tune of 50K a year I have a couple deferred comp plans via life insurance and i have several other side ventures as a silent partner.

Don't think you can dazzle me little sheep.

And I don't remember saying anything about tax cuts.

What I do remember is saying that the tax rates (which is what this thread is about by the way) paid on earned income and capital gains are the same for everyone. It's you who seem to have problem with that simple fact and seem to feel the need to prove oh how smart you are.

I've found that the people who have to tell everyone how smart they are usually aren't. So run along little sheep. I'm sure there's a politician on TV right now spouting some rah rah sis-boom-bah that will get you all fired up for the night.

So you claim to have all that going and you found what flawed in my post? What specifically did you find that caused you to put on your asshole hat and start slinging bullshit?

NM. You're probably lying anyway.

You really do have an exposed nerve here don't you. Are you feeling a little inadequate?

I know just a much as you about taxes and vehicles that can be used to conserve wealth so you don't really impress me at all.

The implication of the title of this thread is that rich people pay lower tax rates than others. That is not true.

A simple statement proved false by definition sends you into a tizzy to try and prove yourself by long winded posts laced with a little jargon. Well it doesn't impress anyone with a clue.

SO now are you saying that my income tax rates are different than yours or my capital gains rates are different than yours simply because of my income?

You know that's wrong and my rates are the same. I just have more disposable income to invest in options that I use to my advantage. And so what if i do? I earned that money and want to keep the fucking government from taking it.

Maybe if you sheep got more serious about your own finances you'd have less time to covet what others have.

Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

I happen to own my own business that nets over a million a year.

I take a portion of my income as stock dividends. I defer taxes via a safe harbor plan. I invest after tax money to the tune of 50K a year I have a couple deferred comp plans via life insurance and i have several other side ventures as a silent partner.

Don't think you can dazzle me little sheep.

And I don't remember saying anything about tax cuts.

What I do remember is saying that the tax rates (which is what this thread is about by the way) paid on earned income and capital gains are the same for everyone. It's you who seem to have problem with that simple fact and seem to feel the need to prove oh how smart you are.

I've found that the people who have to tell everyone how smart they are usually aren't. So run along little sheep. I'm sure there's a politician on TV right now spouting some rah rah sis-boom-bah that will get you all fired up for the night.

So you claim to have all that going and you found what flawed in my post? What specifically did you find that caused you to put on your asshole hat and start slinging bullshit?

NM. You're probably lying anyway.

You really do have an exposed nerve here don't you. Are you feeling a little inadequate?

I know just a much as you about taxes and vehicles that can be used to conserve wealth so you don't really impress me at all.

The implication of the title of this thread is that rich people pay lower tax rates than others. That is not true.

A simple statement proved false by definition sends you into a tizzy to try and prove yourself by long winded posts laced with a little jargon. Well it doesn't impress anyone with a clue.

SO now are you saying that my income tax rates are different than yours or my capital gains rates are different than yours simply because of my income?

You know that's wrong and my rates are the same. I just have more disposable income to invest in options that I use to my advantage. And so what if i do? I earned that money and want to keep the fucking government from taking it.

Maybe if you sheep got more serious about your own finances you'd have less time to covet what others have.

You must understand Marxist ideology... it isn't your money, it belongs to the state. In Karl Marx land, the state decides how much you deserve to keep.

this thread is nothing more than left wing lies and propaganda !! the rich pay much more in taxes than the Average American !!WASHINGTON, D.C.--The 400 highest-earning taxpayers in the U.S. reported a record $105 billion in total adjusted gross income in 2006, but they paid just $18 billion in tax, new Internal Revenue Service figures show. That works out to an average federal income tax bite of 17%--the lowest rate paid by the richest 400 during the 15-year period covered by the IRS statistics. The average federal tax bite on the top 400 was 30% in 1995 and 23% in 2002.

Richest 400 Earn More, Pay Lower Tax Rate - Forbes.com

I'm not changing any tune....The base rates aren't lower just because you're a rich guy...This is a matter of fact.Nobody is arguing the net effective rate, you overbearing, excessively loquacious gasbag.So in other words, your ass is kicked because you don't understand shit about how high income earners end up paying a lower net percentage. I'm cool with that!

Now of course, the clueless idiots, think it's as simple some moronic bs bumper sticker phrase like "They have the same rates on income and capital gains!" because FOX told them that is the answer.

Which is usually enough to placate the colosallty stupid morons who are clueless about things like defered comp etc... and can't come up with anything better than "Oh yeah?!? Well, uh, er, uh, You're just so impressed with yourself!"

It's okay. It's not like I expected you to come up with anything intelligent, learned or directly addressing the points I brought up.

And btw, if you weren't such a stupidass, you might have picked up on the whole thing about me saying it's not fair to tax high income earners more, solely because they make more.

But of course, being a mindless sheeple who just regurgitates the bs your thoughtmasters tell you, you did what you've been taught. That's fine junior. No surprise there either. Now go turn on Gleen and see what you opinion will be tomorrow! If you don't know, just ask me about any issue. I'll be happy to tell you what your opinion is - cause it's not like you have any of your own anyway...

Anyone with half a lick of sense can figure out that those with more to protect will find ways to do so more effectively....Hell, I'd most certainly be more than willing to spend more on accountants and tax attorneys over IRS looters, had I that kind of income to protect.

Nonetheless, the rate schedules remain the same..."The wealthy" pay the same rates on their adjusted gross incomes as does anyone else....There is no "rich guy" deduction or credit.

I know these things because I've been filing under a series of corporate & trust veils for years now.

Now, I believe you were sputtering something about regurgitating what others have told you to?

Of course. You're Bill Gates. Everyone is on the internet. Love the "corporate veils" thing!

So you found what to be flawed in my post about the partner paying 20% on his million dollar income? Now you change your tune??? Because I once never claimed the rate schedules were different. I simply pointed out that there are tools and vehicles available for the rich, which others can't take advantage of, and which result them paying a significantly lower amount on their income than the middle or lower classes.

You may now continue your insults there, Bill...

The deductions, credits, abilities to file C-Corp or S-Corp, form trusts and other legal entities to minimize one's tax liabilities, are available to anyone, no matter how much that they make....Ergo the agitprop implication that the evil and reviled "wealthy" pay a lower rate on their AGI is disingenuous at best, if not an outright lie.

But I imagine that if the subject gives you the opportunity to go around blustering about what a big fucking wheel you are, it's all good, huh?

- Oct 12, 2009

- 58,613

- 10,629

- 2,030

IndepnedntLogic has lost all credibility with me. If he was truly versed in tax code, there would be an admission from him by now that we are correct in our statements.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

How many Obamabots are going to start this exact thread with this exact message?

Whether or not you want taxes raised on evil demagogue rich people, your hero didn't do it when he had a full 2 year window with almost nothing but democrats in office with him.

Your dream of taxing the rich isn't shared by your messiah or your other cape-wearing democrats.

So, you're looking FORWARD to BUSHCO's....

*

[ame=http://www.youtube.com/watch?v=8wDdWJcpJj0]Maddow: GOP plan to extend tax cuts for the rich - YouTube[/ame]

....tax-cut demise???

*

[ame=http://www.youtube.com/watch?v=8wDdWJcpJj0]Maddow: GOP plan to extend tax cuts for the rich - YouTube[/ame]

Similar threads

- Replies

- 47

- Views

- 694

- Replies

- 275

- Views

- 3K

- Replies

- 10

- Views

- 161

Latest Discussions

- Replies

- 66

- Views

- 333

- Replies

- 30

- Views

- 105

- Replies

- 253

- Views

- 2K

- Replies

- 4

- Views

- 21

Forum List

-

-

-

-

-

Political Satire 8089

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-