I believe the author of this article makes a common mistake most people make. He assumes that the outcome is evidence of the hypothesis when in fact the conclusion must include what would have occurred had the tax cuts not taken place. Econometrics attempts to isolate variables to answer this question. The author may be correct, I don't know, though I suspect that growth would have been lower had the Bush tax cuts not been implemented.

However, he does lay out the data.

Were the Bush Tax Cuts Good for Growth? - NYTimes.com

However, he does lay out the data.

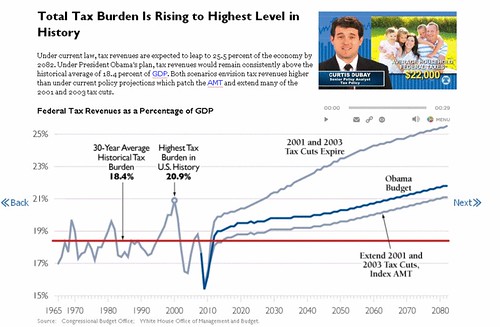

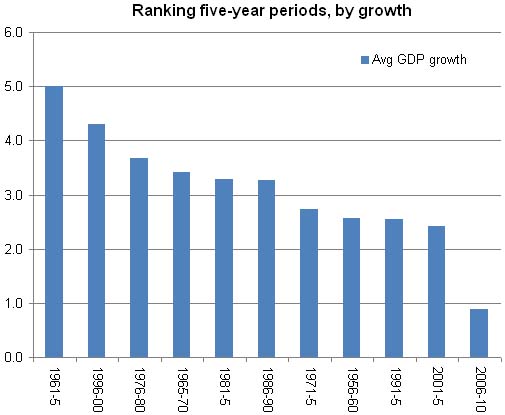

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7.

The competition for slowest growth is not even close, either. Growth from 2001 to 2007 averaged 2.39 percent a year (and growth from 2001 through the third quarter of 2010 averaged 1.66 percent). The decade with the second-worst showing for growth was 1971 to 1980 the dreaded 1970s but it still had 3.21 percent average growth.

The picture does not change if you instead look at five-year periods. Heres a chart ranking five-year periods over the past 50 years, in descending order of average annual growth:

...

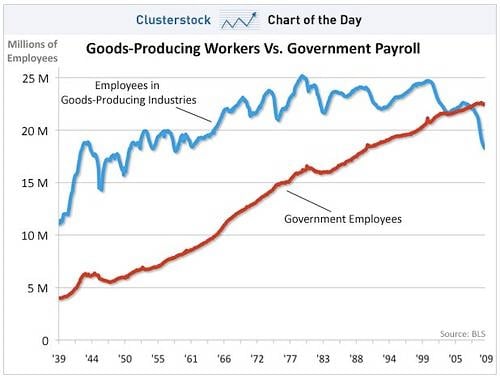

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

The theory for why tax cuts should create growth and jobs is a strong one. When people are allowed to keep more of each dollar they earn, they are likely to work longer and harder. The uncertainty is the magnitude of this effect. With everything else thats happening in a $15 trillion economy, how large of an effect on growth do tax cuts have?

Were the Bush Tax Cuts Good for Growth? - NYTimes.com