Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Were the Bush Tax Cuts Good for Growth?

- Thread starter Toro

- Start date

Revere

Rookie

- Banned

- #42

I favor the lowest possible taxes and least amount of government intervention. Whether or not the bush tax rates affected growth rates is a non-issue and quite frankly, a distraction from what really matters.

You are clearly living in the wrong country. You should try Zimbabwe. Or Quatar. Or Afghanistan.

Detroit and DC have among the highest taxes and government intervention.

What's your point?

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Nothing more Keyensian than printing trillions and pumping it into the economy.

Who controlled Clinton's Congress?

Who controlled congress during the first 6 years of Bush's reign?

How many spending bills did he veto during that time?

How many bills at all did he veto during that time?

I'd take any year from 2001-2007 over this crap.

The deficits were in decline and unemployement was low and stable.

No the deficits were breaking records, stop lying. And the jobless recovery was creating a tiny fraction of the jobs created under Clinton.

Unemployment was low under Bush because folks voluntarily dropped from the workforce because they thought they had an extra $10 trillion in real estate equity.

NOT!

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

I favor the lowest possible taxes and least amount of government intervention. Whether or not the bush tax rates affected growth rates is a non-issue and quite frankly, a distraction from what really matters.

You are clearly living in the wrong country. You should try Zimbabwe. Or Quatar. Or Afghanistan.

Detroit and DC have among the highest taxes and government intervention.

What's your point?

that you can't stop lying to serve your partisanship?

Get thee behind us, Satan.

Revere

Rookie

- Banned

- #45

Who controlled congress during the first 6 years of Bush's reign?

How many spending bills did he veto during that time?

How many bills at all did he veto during that time?

I'd take any year from 2001-2007 over this crap.

The deficits were in decline and unemployement was low and stable.

No the deficits were breaking records, stop lying. And the jobless recovery was creating a tiny fraction of the jobs created under Clinton.

Unemployment was low under Bush because folks voluntarily dropped from the workforce because they thought they had an extra $10 trillion in real estate equity.

NOT!

No, the deficts were in decline were in decline, and jobs were plentiful.

Revere

Rookie

- Banned

- #46

You are clearly living in the wrong country. You should try Zimbabwe. Or Quatar. Or Afghanistan.

Detroit and DC have among the highest taxes and government intervention.

What's your point?

that you can't stop lying to serve your partisanship?

Get thee behind us, Satan.

Democrats are dooming this country to decline. What part of their crap am I supposed to get behind?

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Yeah, Democrats are dead wrong and pushing this country over a cliff.

Everything I stated was accurate.

You NEVER state anything accurately! You are a partisan stoogebot!

Revere

Rookie

- Banned

- #48

Yeah, Democrats are dead wrong and pushing this country over a cliff.

Everything I stated was accurate.

You NEVER state anything accurately! You are a partisan stoogebot!

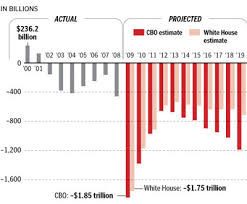

You want an unemployment chart, too, to go with the defict chart I posted more than once in this thread?

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Detroit and DC have among the highest taxes and government intervention.

What's your point?

that you can't stop lying to serve your partisanship?

Get thee behind us, Satan.

Democrats are dooming this country to decline. What part of their crap am I supposed to get behind?

REPUBLICANS are dooming this country to decline TOO.

YOU are dooming this country to decline.

YOU are an enemy of the US.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Yeah, Democrats are dead wrong and pushing this country over a cliff.

Everything I stated was accurate.

You NEVER state anything accurately! You are a partisan stoogebot!

You want an unemployment chart, too, to go with the defict chart I posted more than once in this thread?

the chart won't help your lies take root, liar. Now fuck off n die for the good of the nation.

In 1913 the Federal reserve, taxes, control & laws brought the USA sweeping communism & the Great Depression.

In 1913 the lowest tax bracket paid 1% rate & the top tax bracket paid 7% rate.

by 1918 the lowest tax bracket paid 6% rate & the top tax bracket paid 77% rate.

Taxes & the Great Depression Peaked in 1944.

By 1944 the lowest tax bracket paid 23% rate & the top tax bracket paid 94% rate.

After 1945 tax rates dropped & price controls lifted causing the economy to recover, not the war as myth has it.

By 1946 the lowest tax bracket paid 20% rate & the top tax bracket paid 91% rate.

In 1964 the Kennedy tax cut the lowest tax bracket to 16% rate & the top tax bracket to 70% rate & prosperity made a comeback.

In 1982 the Reagan tax cut set off the largest economic boom the world had ever seen.

In 1913 the lowest tax bracket paid 1% rate & the top tax bracket paid 7% rate.

by 1918 the lowest tax bracket paid 6% rate & the top tax bracket paid 77% rate.

Taxes & the Great Depression Peaked in 1944.

By 1944 the lowest tax bracket paid 23% rate & the top tax bracket paid 94% rate.

After 1945 tax rates dropped & price controls lifted causing the economy to recover, not the war as myth has it.

By 1946 the lowest tax bracket paid 20% rate & the top tax bracket paid 91% rate.

In 1964 the Kennedy tax cut the lowest tax bracket to 16% rate & the top tax bracket to 70% rate & prosperity made a comeback.

In 1982 the Reagan tax cut set off the largest economic boom the world had ever seen.

Last edited:

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Bush's unemployment was 6% at its worst. Shit, I'd take that.

Bush presided over the formation of the recent recession. You can take that too, serial liar.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

In 1913 the Federal reserve, taxes, control & laws brought the USA sweeping communism & the Great Depression.

In 1913 the lowest tax bracket paid 1% rate & the top tax bracket paid 7% rate.

by 1918 the lowest tax bracket paid 6% rate & the top tax bracket paid 77% rate.

Taxes & the Great Depression Peaked in 1944.

By 1944 the lowest tax bracket paid 23% rate & the top tax bracket paid 94% rate.

After 1945 tax rates dropped & price controls lifted causing the economy to recover, not the war as myth has it.

By 1946 the lowest tax bracket paid 20% rate & the top tax bracket paid 91% rate.

In 1964 the Kennedy tax cut the lowest tax bracket to 16% rate & the top tax bracket to 70% rate & prosperity made a comeback.

In 1982 the Reagan tax cut set off the largest economic boom the world had ever seen.

what a crock of shit. As if the tax rates had a god damned thing to do with America's ascent and decline.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Any and all money made honestly ideally should stay in the pockets, there are three exceptions to that rule:I favor the lowest possible taxes and least amount of government intervention. Whether or not the bush tax rates affected growth rates is a non-issue and quite frankly, a distraction from what really matters.

The suppression of malum per se crime to keep criminal syndicates from taking over.

Formed military units with logistical support to deter invasion.

Public health to deal with non-human bad actors.

Any and all laws or taxes that do not deal with one of those three things should be abolished.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

Any and all money made honestly ideally should stay in the pockets, there are three exceptions to that rule:I favor the lowest possible taxes and least amount of government intervention. Whether or not the bush tax rates affected growth rates is a non-issue and quite frankly, a distraction from what really matters.

The suppression of malum per se crime to keep criminal syndicates from taking over.

Formed military units with logistical support to deter invasion.

Public health to deal with non-human bad actors.

Any and all laws or taxes that do not deal with one of those three things should be abolished.

I like it! a 100% dedicated tax system.

We could end all the debate over entitlements by allowing them all and making them voluntary agreements between a citizen and a GOVERNMENT CORPORATION.

I would add infrastucture to the list but that could be a function of the states.

The problem tho is that, this being the economics forum, is that states with powerful central governments have huge advantages when it comes to cultivating industry. And industry is the key to defense and wealth creation. The two core missions of government.

william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

Well infrastructure is logistical train which is why the army corps of engineers handles it.Any and all money made honestly ideally should stay in the pockets, there are three exceptions to that rule:I favor the lowest possible taxes and least amount of government intervention. Whether or not the bush tax rates affected growth rates is a non-issue and quite frankly, a distraction from what really matters.

The suppression of malum per se crime to keep criminal syndicates from taking over.

Formed military units with logistical support to deter invasion.

Public health to deal with non-human bad actors.

Any and all laws or taxes that do not deal with one of those three things should be abolished.

I like it! a 100% dedicated tax system.

We could end all the debate over entitlements by allowing them all and making them voluntary agreements between a citizen and a GOVERNMENT CORPORATION.

Libertarian paternalism with opt out has a large body of literature with Michael Shermer being one of the better known names. Scandinavia has been experimenting with it at the margins (organ donation in Denmark seems to be the most successful) and seems to work well.

I would add infrastucture to the list but that could be a function of the states.

The problem tho is that, this being the economics forum, is that states with powerful central governments have huge advantages when it comes to cultivating industry. And industry is the key to defense and wealth creation. The two core missions of government.

Lets not forget the nearly 5 trillion in excess spending / debt that Bush did.

It had to cause some economic growth.

Where was it? The graph shows miserably little bang for the buck.

Also should you include Bush's last budget (the one with the trillion buck deficit) you will find his debt increase to be more like 6 !/2 trillion.

A high price to pay for almost no growth.

Well infrastructure is logistical train which is why the army corps of engineers handles it.Any and all money made honestly ideally should stay in the pockets, there are three exceptions to that rule:

The suppression of malum per se crime to keep criminal syndicates from taking over.

Formed military units with logistical support to deter invasion.

Public health to deal with non-human bad actors.

Any and all laws or taxes that do not deal with one of those three things should be abolished.

I like it! a 100% dedicated tax system.

We could end all the debate over entitlements by allowing them all and making them voluntary agreements between a citizen and a GOVERNMENT CORPORATION.

Libertarian paternalism with opt out has a large body of literature with Michael Shermer being one of the better known names. Scandinavia has been experimenting with it at the margins (organ donation in Denmark seems to be the most successful) and seems to work well.

I would add infrastucture to the list but that could be a function of the states.

The problem tho is that, this being the economics forum, is that states with powerful central governments have huge advantages when it comes to cultivating industry. And industry is the key to defense and wealth creation. The two core missions of government.

In the above two quotes you have the reason why libertarianism has never been tried, anywhere anytime. It is just too stupid.

Well, maybe at the hunter/gatherer level.

loosecannon

Senior Member

- May 7, 2007

- 4,888

- 269

- 48

That passage you bolded was written by Willie the Wie. I think he made an error in his code when he posted it.

Ideas that may seem extreme in ordinary times are often essential in extraordinary times.

Ideas that may seem extreme in ordinary times are often essential in extraordinary times.

Similar threads

- Replies

- 49

- Views

- 499

- Replies

- 37

- Views

- 521

- Replies

- 12

- Views

- 937

- Replies

- 131

- Views

- 4K

Latest Discussions

- Replies

- 75

- Views

- 162

- Replies

- 242

- Views

- 982

- Replies

- 53

- Views

- 227

Forum List

-

-

-

-

-

Political Satire 8039

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-