Siete

Platinum Member

- May 19, 2014

- 34,325

- 3,988

- 1,130

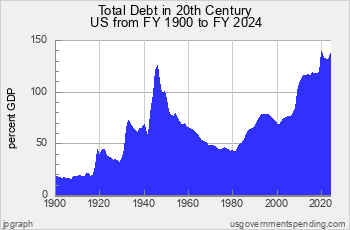

I don't need to prove that wrong. I am proving a different point which is obviously over your head.Your fun little chart looks to be trending downward after Ws spike

these RW toads dont know the difference between debt and deficit or how one effects the other. Their credibility is lower than their IQ. You dont expect then to be able to read a chart do you ?

The only thing that you don't seem to grasp is how much Obama spent, and how much he increased the debt. All other talk is irrelevant.

Obams deficit blossomed to 1.4 trillion dollars in 09 when he took office .. a figure that was responsible for the deepest recession since WWII, and it belonged to 43.. The deficit dropped $1 Trillion dollars during Obamas terms leaving $4 billion that automatically gets added to the National Debt ..

like I said, prove that wrong or bust Clintons ass for a thread or two... the deficit/debt isnt the forte' for RW partisan shitsacks.

I don't need to prove it wrong, it's irrelevant. He spent the most since WWII and increased the debt more than anyone. Prove that wrong!

you didnt get the memo ? historical data is totally wrong, and RW's are the only ones who know how to calculate the debt down to the exact penny.

and dont forget it ...

es