Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

It is always better when people keep more of their own money

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

cut discretionary spending.It is always better when people keep more of their own money

I'm going to go more with the former, than the latter.

Hoover cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I know this was unintentional, but at least 2 of your examples 1929 and 2008 are examples of Federal Reserve caused recessions.

In at least both of those examples the FED kept interest rates artificially low for a long time.

Trump's tax cuts may lead to a recession or at least contribute to one, but not in the way you are thinking.

You had the bailouts, the "stimulus package", QE 1-whatever. Companies hoarded the money. Trump is trying to release all that money which will cause inflation which will probably cause a very overdue recession.

That will in part cause a recession. The other thing that I think will cause one is the vastly over valuation of companies like Amazon and Facebook.

I do think Facebook in the end will go under, but that is a different discussion all together.

Actually, Hayek's theories of cutting interest rates leading to over-investment & thus a boom & bust cycle, would also apply to cutting taxes, which also lead to over-investment & thus a boom & bust cycle.

You are ignoring a couple of things:

The difference between whatever damage the money from a tax cut would cause vs low interest rate is that the money from a tax cut already exists.

The banks have to get money from somewhere. If interest rates are low the money the banks get must come from the Fed who gets it from printing it (or now just adding zeros to balance sheets).

Also if the free market controlled interest rates banks would adjust rates accordingly and that would negate "cutting taxes, which also lead to over-investment & thus a boom & bust cycle".

It is always better when people keep more of their own money

I'm going to go more with the former, than the latter.

Hoover cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Bust & Boom cycle.

Even Libertarians like Austrian economist Hayek have spoken of Bust & Boom cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Bust & Boom cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

BAM?

No mention of the mechanism?

I didn't mention the mechanism??

Oh I did in fact, I theorized that Tax-Cuts cause inflated markets such as in Housing & Stock which cause BOOM & BUST cycle.

That's kind of what happened with W. Bush, No?

I'm going to go more with the former, than the latter.

Hoover cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Bust & Boom cycle.

Even Libertarians like Austrian economist Hayek have spoken of Bust & Boom cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Bust & Boom cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

BAM?

No mention of the mechanism?

I didn't mention the mechanism??

Oh I did in fact, I theorized that Tax-Cuts cause inflated markets such as in Housing & Stock which cause BOOM & BUST cycle.

That's kind of what happened with W. Bush, No?

No, that's not what happened with Bush. At all.

You're one of those idiots that thinks all money belongs to the government.I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I think what is missing are the words temporary.

During a recession, tax breaks are often enacted to serve as a stimulus. But if not short term, they will do as you say.

Trump borrowed 1.5 trillion to stimulate the economy. Most permanent, So,me will expire in something like 8 years. Way too long.

The debt from these will at this country alive. Pile onto the deficits from the unfunded increase in military spending, we are in serious trouble.

You're one of those idiots that thinks all money belongs to the government.I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I think what is missing are the words temporary.

During a recession, tax breaks are often enacted to serve as a stimulus. But if not short term, they will do as you say.

Trump borrowed 1.5 trillion to stimulate the economy. Most permanent, So,me will expire in something like 8 years. Way too long.

The debt from these will at this country alive. Pile onto the deficits from the unfunded increase in military spending, we are in serious trouble.

You really need to post references with your claims.I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

Obama cut taxes, BAM, lackluster economy.

Trump cut taxes, BAM, booming economy.

Seems the moral to this story is there's a whole lot more going on than just taxes.

Obama added a bunch of regulations, BAM, lackluster economy.

Trump dumped a bunch of regulations, BAM booming economy.

If only that were a fact, it's actually more of a fact that Trump's America is seeing a very slight decline in real wages, because inflation has sky-rocketed.

O.2% real wage decrease last year.

Bloomberg - Are you a robot?

Nonsense.You really need to post references with your claims.I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

Obama cut taxes, BAM, lackluster economy.

Trump cut taxes, BAM, booming economy.

Seems the moral to this story is there's a whole lot more going on than just taxes.

Obama added a bunch of regulations, BAM, lackluster economy.

Trump dumped a bunch of regulations, BAM booming economy.

If only that were a fact, it's actually more of a fact that Trump's America is seeing a very slight decline in real wages, because inflation has sky-rocketed.

O.2% real wage decrease last year.

Bloomberg - Are you a robot?

No.You're one of those idiots that thinks all money belongs to the government.I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I think what is missing are the words temporary.

During a recession, tax breaks are often enacted to serve as a stimulus. But if not short term, they will do as you say.

Trump borrowed 1.5 trillion to stimulate the economy. Most permanent, So,me will expire in something like 8 years. Way too long.

The debt from these will at this country alive. Pile onto the deficits from the unfunded increase in military spending, we are in serious trouble.

You are one of those fucking idiots that think the government can spend money & just add it to the credit card.,

It is always better when people keep more of their own money

It is always better when people keep more of their own money

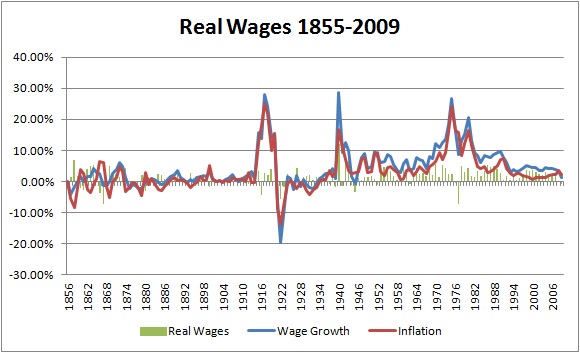

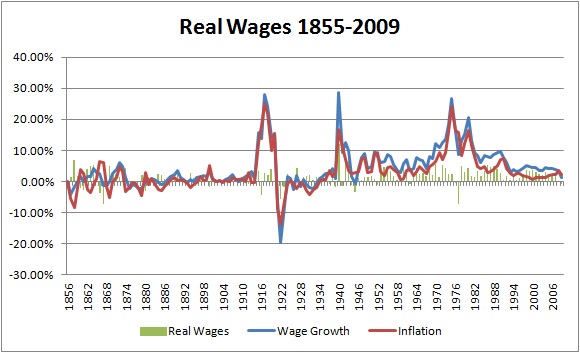

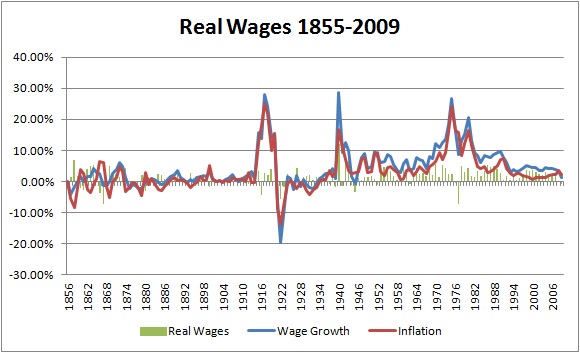

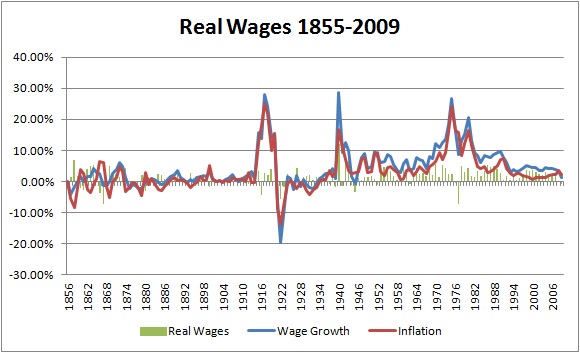

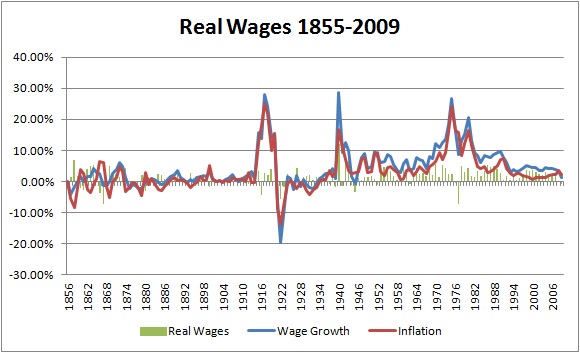

This chart proves American real wages have barely budged since 1850.

https://www.economicshelp.org/wp-content/uploads/2011/09/Real-Wages-1855-2009.jpg

It is always better when people keep more of their own money

This chart proves American real wages have barely budged since 1850.

https://www.economicshelp.org/wp-content/uploads/2011/09/Real-Wages-1855-2009.jpg

I knew you were an idiot.

Your inability to read the chart is further proof.

It is always better when people keep more of their own money

This chart proves American real wages have barely budged since 1850.

https://www.economicshelp.org/wp-content/uploads/2011/09/Real-Wages-1855-2009.jpg

I knew you were an idiot.

Your inability to read the chart is further proof.

I'm going to go more with the former, than the latter.

Coolridge cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

Cut wasteful spending damn it!...I'm sick of people saying that the people that pay the bills shouldn't enjoy a tax cut...especially after Obama's 8 year recession and joblessness....Right now I do not worry nor care about increased national debt...we are bringing in a record amount of revenue into our treasury due to nearly full employment and massive investment......so stop the bellyaching over tax cuts...they work every time they are tried.....all of those examples like the Reagan and Bush cuts had one problem...a democrat house....so get out and vote to keep the house in the hands of the GOP.....and enjoy your tax cut worry free.....

The debt is not our biggest problem and it will be dealt with by the increased tax revenue to the Treasury......illegal immigration must be stopped and job growth must be continued...so vote GOP.....Look; the Republicans FINALLY admit, they don't care about DEBT

It is always better when people keep more of their own money

This chart proves American real wages have barely budged since 1850.

https://www.economicshelp.org/wp-content/uploads/2011/09/Real-Wages-1855-2009.jpg

I knew you were an idiot.

Your inability to read the chart is further proof.

It is always better when people keep more of their own money

It is always better when people keep more of their own money

This chart proves American real wages have barely budged since 1850.

https://www.economicshelp.org/wp-content/uploads/2011/09/Real-Wages-1855-2009.jpg

I knew you were an idiot.

Your inability to read the chart is further proof.

Maybe you're the idiot because there's clearly a lack of real wage growth for 100's of years.

Maybe its time to try something different because our system stagnates???????

I'm going to go more with the former, than the latter.

Hoover cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I know this was unintentional, but at least 2 of your examples 1929 and 2008 are examples of Federal Reserve caused recessions.

In at least both of those examples the FED kept interest rates artificially low for a long time.

Trump's tax cuts may lead to a recession or at least contribute to one, but not in the way you are thinking.

You had the bailouts, the "stimulus package", QE 1-whatever. Companies hoarded the money. Trump is trying to release all that money which will cause inflation which will probably cause a very overdue recession.

That will in part cause a recession. The other thing that I think will cause one is the vastly over valuation of companies like Amazon and Facebook.

I do think Facebook in the end will go under, but that is a different discussion all together.

Actually, Hayek's theories of cutting interest rates leading to over-investment & thus a boom & bust cycle, would also apply to cutting taxes, which also lead to over-investment & thus a boom & bust cycle.

You are ignoring a couple of things:

The difference between whatever damage the money from a tax cut would cause vs low interest rate is that the money from a tax cut already exists.

The banks have to get money from somewhere. If interest rates are low the money the banks get must come from the Fed who gets it from printing it (or now just adding zeros to balance sheets).

Also if the free market controlled interest rates banks would adjust rates accordingly and that would negate "cutting taxes, which also lead to over-investment & thus a boom & bust cycle".

The difference between whatever damage the money from a tax cut would cause

Damage? My tax cuts cause nothing but benefits.

If interest rates are low the money the banks get must come from the Fed

Banks don't get money from people and corporations when rates are low?

I'm going to go more with the former, than the latter.

Hoover cut taxes BAM the great depresssion of 1929.

Reagan cut taxes BAM the recession of 1982.

W. Bush cut taxes BAM the Great recession of 2007.

It seems there's absolutely no evidence that cutting taxes does much of anything positive for the economy.

It seems quite the opposite, we have more evidence that cutting taxes cause recessions.

Which could make a ton of sense, considering when the rich get tax cuts, they tend to buy up housing investments, and stocks causing a inflated market, which bursts into a bad economy AKA Boom & Bust cycle.

Even Libertarians like Austrian economist Hayek have spoken of Boom & Bust cycle, by Hayek's own account he theorized that cutting interest rates inflated the market investment, forming a Boom & Bust cycle.

Now, expland that to NOT JUST cutting interest rates, but also cutting taxes, and you're having very similar over-inflation of the market.

I know this was unintentional, but at least 2 of your examples 1929 and 2008 are examples of Federal Reserve caused recessions.

In at least both of those examples the FED kept interest rates artificially low for a long time.

Trump's tax cuts may lead to a recession or at least contribute to one, but not in the way you are thinking.

You had the bailouts, the "stimulus package", QE 1-whatever. Companies hoarded the money. Trump is trying to release all that money which will cause inflation which will probably cause a very overdue recession.

That will in part cause a recession. The other thing that I think will cause one is the vastly over valuation of companies like Amazon and Facebook.

I do think Facebook in the end will go under, but that is a different discussion all together.

Actually, Hayek's theories of cutting interest rates leading to over-investment & thus a boom & bust cycle, would also apply to cutting taxes, which also lead to over-investment & thus a boom & bust cycle.

You are ignoring a couple of things:

The difference between whatever damage the money from a tax cut would cause vs low interest rate is that the money from a tax cut already exists.

The banks have to get money from somewhere. If interest rates are low the money the banks get must come from the Fed who gets it from printing it (or now just adding zeros to balance sheets).

Also if the free market controlled interest rates banks would adjust rates accordingly and that would negate "cutting taxes, which also lead to over-investment & thus a boom & bust cycle".

The difference between whatever damage the money from a tax cut would cause

Damage? My tax cuts cause nothing but benefits.

If interest rates are low the money the banks get must come from the Fed

Banks don't get money from people and corporations when rates are low?

"The difference between whatever damage the money from a tax cut would cause

Damage? My tax cuts cause nothing but benefits."

I agree. The other poster was saying that people keeping their money was going to have the same affect as artificially low interest rates.

I was simply pointing out higher interest rates would counter act that.

"If interest rates are low the money the banks get must come from the Fed

Banks don't get money from people and corporations when rates are low?"

They do, but not as much as when interest rates are high.