danielpalos

Diamond Member

- Banned

- #3,481

Only the national socialist right wing, is cognitively dissonant enough to "blame the poor" for only paying the taxes they are legally obligated to pay.do they, actually pay that or does an, artificial person do it for them?Should The Rich Be Required To Pay Higher Taxes In the US?

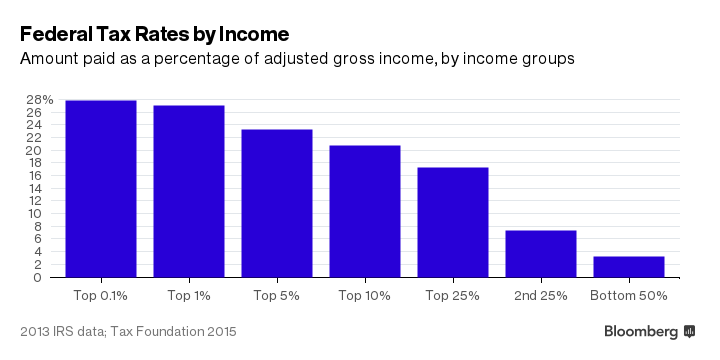

I think the rich should ABSOLUTELY pay more

Just how much more would you have rich people pay? Wealthy people already pay over half the total personal federal income taxes collected.

Mr. Trump did not pay any personal income taxes, recently.

Trump paid what he was legally required to pay, just as most Americans do. Your issue is with your Congressman not Trump.