Poll: Were You Paying More Than $328 A Month Prior To Congress Passing Obamacare?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Poll: Were You Paying More Than $328 Prior To Obamacare?

- Thread starter KissMy

- Start date

- Thread starter

- #2

- Jul 16, 2011

- 21,086

- 10,778

- 1,245

No.

I played with the numbers and I am curious how much the tobacco surcharge is.

Oh I found this " In most states, insurers can charge a tobacco surcharge of up to 50% of your total premium before the tax credit. The tax credit cannot be applied to the tobacco surcharge"

For fun, I also input that I have two minor children that are tobacco users.

So does that total premium mean for the whole family or just per person?

I played with the numbers and I am curious how much the tobacco surcharge is.

Oh I found this " In most states, insurers can charge a tobacco surcharge of up to 50% of your total premium before the tax credit. The tax credit cannot be applied to the tobacco surcharge"

For fun, I also input that I have two minor children that are tobacco users.

So does that total premium mean for the whole family or just per person?

Zoom-boing

Platinum Member

My brother is/was paying $170/month.

- Thread starter

- #5

No.

I played with the numbers and I am curious how much the tobacco surcharge is.

Oh I found this " In most states, insurers can charge a tobacco surcharge of up to 50% of your total premium before the tax credit. The tax credit cannot be applied to the tobacco surcharge"

For fun, I also input that I have two minor children that are tobacco users.

So does that total premium mean for the whole family or just per person?

I don't know. The wife & I were paying $130 as a family prior to Obamacare. Then it went to $290 after. That was a 223% increase.

So I assume the average is $328 per family.

Last edited:

Zoom-boing

Platinum Member

All that matters is will you have an increase. 30 million are about to pay 100% more.

Unless they are subsidized.

- Thread starter

- #8

Our 2 doctors charged us $40 per visit prior to Obamacare. Now they charge us $88 per visit. That is a 220% price increase.

Zoom-boing

Platinum Member

Our 2 doctors charged us $40 per visit prior to Obamacare. Now they charge us $88 per visit. That is a 220% price increase.

We have insurance through my hubs workplace. Yeah we only pay the copay at the time of visit but the doc's office charges $75. Insurance makes the small things more expensive.

- Thread starter

- #10

Our 2 doctors charged us $40 per visit prior to Obamacare. Now they charge us $88 per visit. That is a 220% price increase.

We have insurance through my hubs workplace. Yeah we only pay the copay at the time of visit but the doc's office charges $75. Insurance makes the small things more expensive.

I always paid cash without involving insurance unless I meet the deductible. My cash price went up 220%. My insurance rate went up 223%.

All that matters is will you have an increase. 30 million are about to pay 100% more.

Unless they are subsidized.

I didn't include the other 10 million did I?

- Thread starter

- #12

I keep seeing articles & reports about Obamacare lowering healthcare cost. But the cost went up on everyone I know. So I started this poll to extend my search for truth.

The rhetorical claims are we are saving money by treating the poor uninsured before they take an expensive ambulance ride to the expensive Emergency Room. And employers will have to insure their workers instead of the rest of us having to pay for them. So why is it costing me 223% more? This will cause more people to go onto the government dole.

The rhetorical claims are we are saving money by treating the poor uninsured before they take an expensive ambulance ride to the expensive Emergency Room. And employers will have to insure their workers instead of the rest of us having to pay for them. So why is it costing me 223% more? This will cause more people to go onto the government dole.

Poll: Were You Paying More Than $328 A Month Prior To Congress Passing Obamacare?

Most people don't directly pay anything close to the cost of their health plan. Right now, 49% of the country has coverage through an employer-sponsored plan, vs only 5% of people who buy it on their own in the individual market (the rest of the population either has some kind of public insurance, like Medicare or Medicaid, or is uninsured).

And this year, the average employer covered 72% of the premium of his employees' plans. Only in the individual market do people actual pay full freight.

Of course, if you're talking to most people with private insurance (i.e. those with employer-sponsored insurance) we can use those KFF annual survey numbers to answer that right now. The average plan for those folks costs $16,351 ($1,362/month), with the average employee's contribution $380/month. The average deductible among workers who have one (78% of workers) was $1,135 across all plan types this year, so that's probably a little better than a silver plan (silver plans seem to have deductibles in the $1,500-$2,500 range). How much better depends on the other cost-sharing pieces of the plan beyond the deductible, which I don't think the KFF survey got into. So adjusting for different actuarial values--to compare silver to silver--I doubt the difference is much.

If you're talking instead to the 5% of the population that was previously buying plans in the individual market (which is primarily what the ACA overhauls), a slim majority of those people were in "tin" plans with actuarial values below the minimum bronze level in the exchanges. That is to say, they had higher cost sharing and out-of-pocket limits than those in the ACA's bronze plans, which I believe USMB conservatives determined in another thread are unbearably high. But since most people in the individual market, now to be dominated by the new exchanges, will be receiving some kind of affordability tax credit to defray the cost, the change in their actual contribution for those who already had individual market plans will be pretty minimal.

All of which is a roundabout way of saying: know what it is you're asking.

- Thread starter

- #14

Poll: Were You Paying More Than $328 A Month Prior To Congress Passing Obamacare?

Most people don't directly pay anything close to the cost of their health plan. Right now, 49% of the country has coverage through an employer-sponsored plan, vs only 5% of people who buy it on their own in the individual market (the rest of the population either has some kind of public insurance, like Medicare or Medicaid, or is uninsured).

And this year, the average employer covered 72% of the premium of his employees' plans. Only in the individual market do people actual pay full freight.

Of course, if you're talking to most people with private insurance (i.e. those with employer-sponsored insurance) we can use those KFF annual survey numbers to answer that right now. The average plan for those folks costs $16,351 ($1,362/month), with the average employee's contribution $380/month. The average deductible among workers who have one (78% of workers) was $1,135 across all plan types this year, so that's probably a little better than a silver plan (silver plans seem to have deductibles in the $1,500-$2,500 range). How much better depends on the other cost-sharing pieces of the plan beyond the deductible, which I don't think the KFF survey got into. So adjusting for different actuarial values--to compare silver to silver--I doubt the difference is much.

If you're talking instead to the 5% of the population that was previously buying plans in the individual market (which is primarily what the ACA overhauls), a slim majority of those people were in "tin" plans with actuarial values below the minimum bronze level in the exchanges. That is to say, they had higher cost sharing and out-of-pocket limits than those in the ACA's bronze plans, which I believe USMB conservatives determined in another thread are unbearably high. But since most people in the individual market, now to be dominated by the new exchanges, will be receiving some kind of affordability tax credit to defray the cost, the change in their actual contribution for those who already had individual market plans will be pretty minimal.

All of which is a roundabout way of saying: know what it is you're asking.

The highest rate any employer I know was paying $1200 a month prior to Obamacare. I can't believe $1362 a month was the average. Where do you find this data?

- Thread starter

- #15

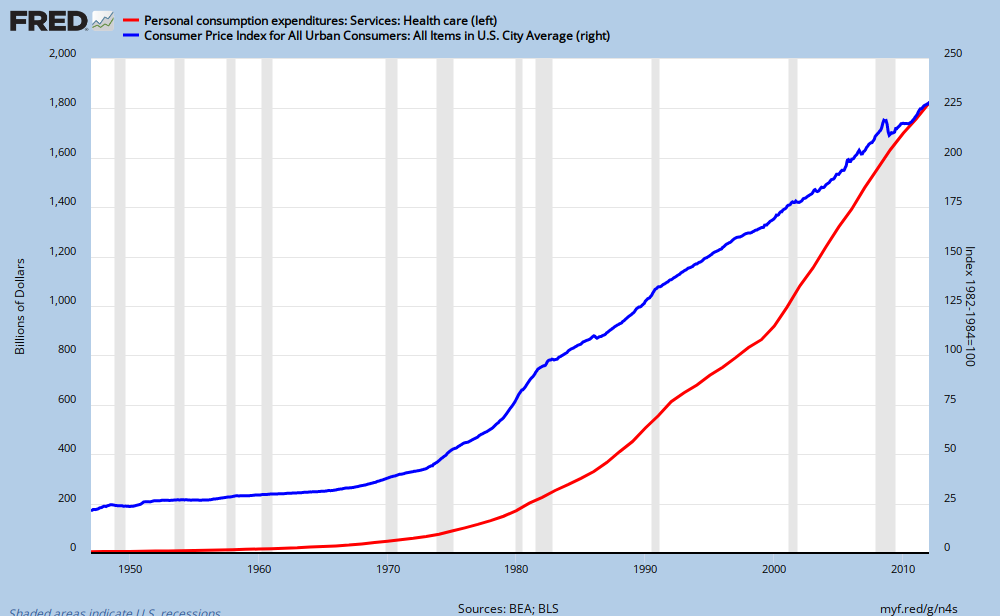

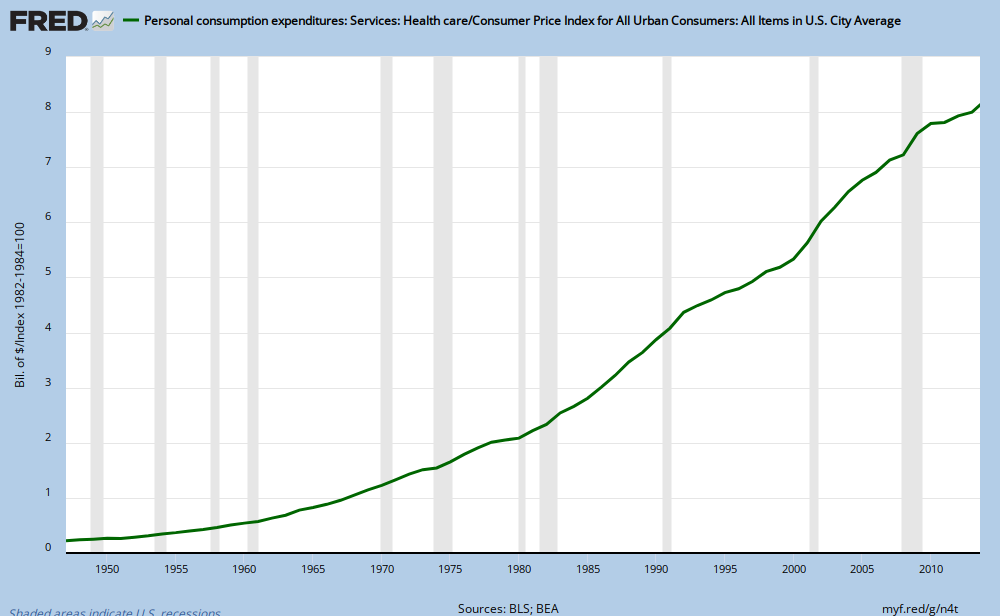

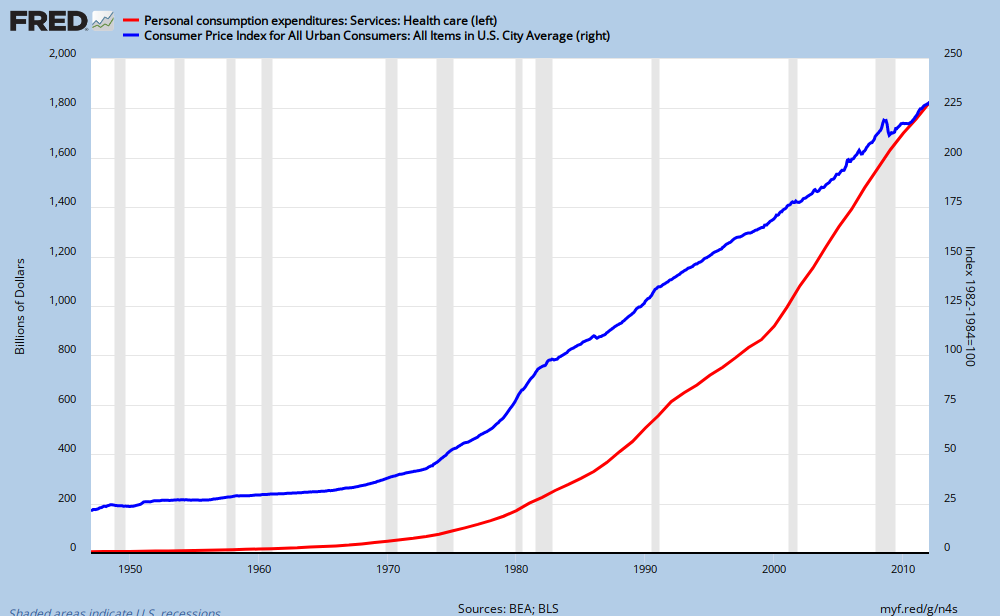

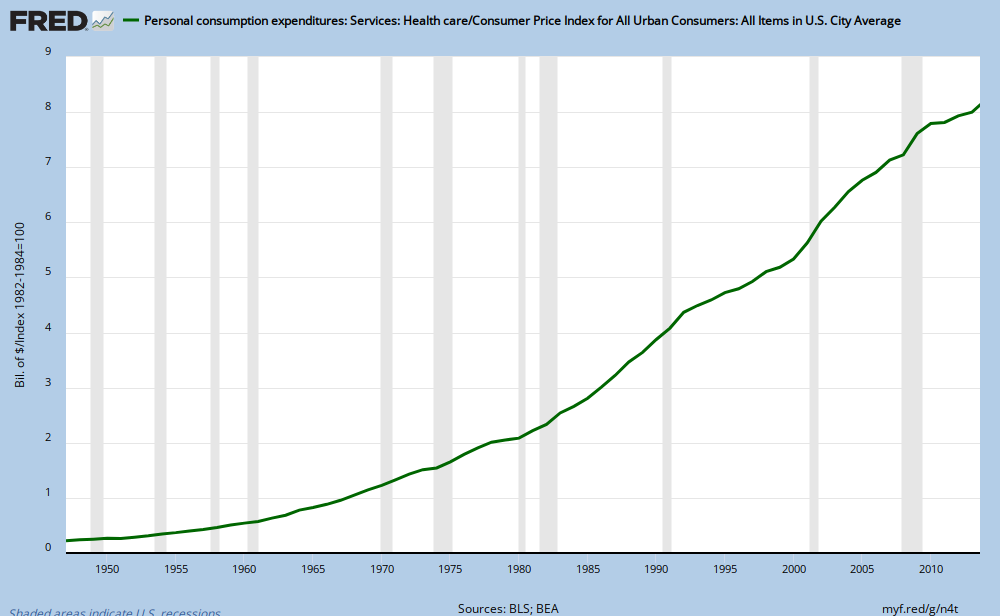

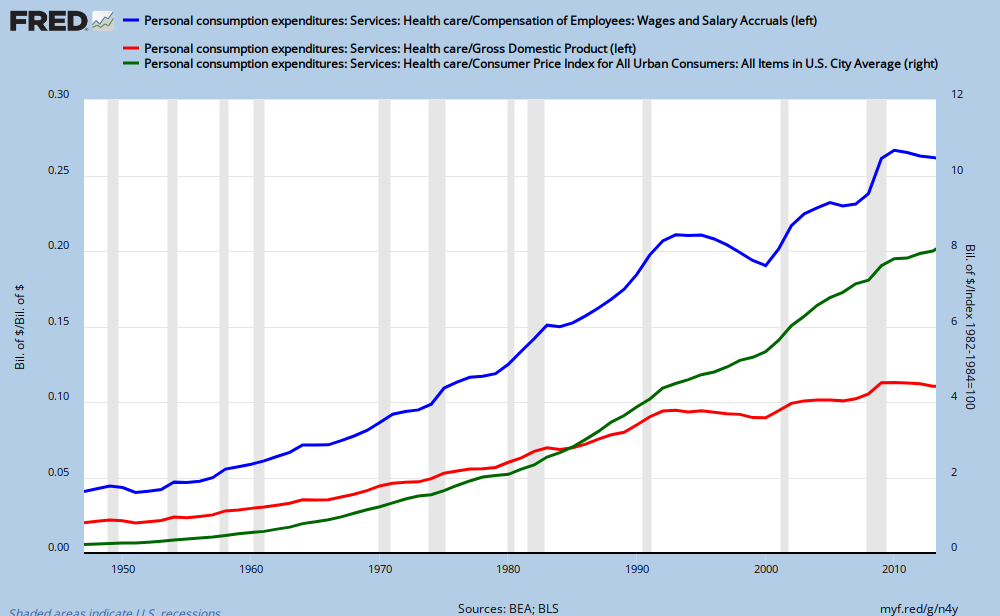

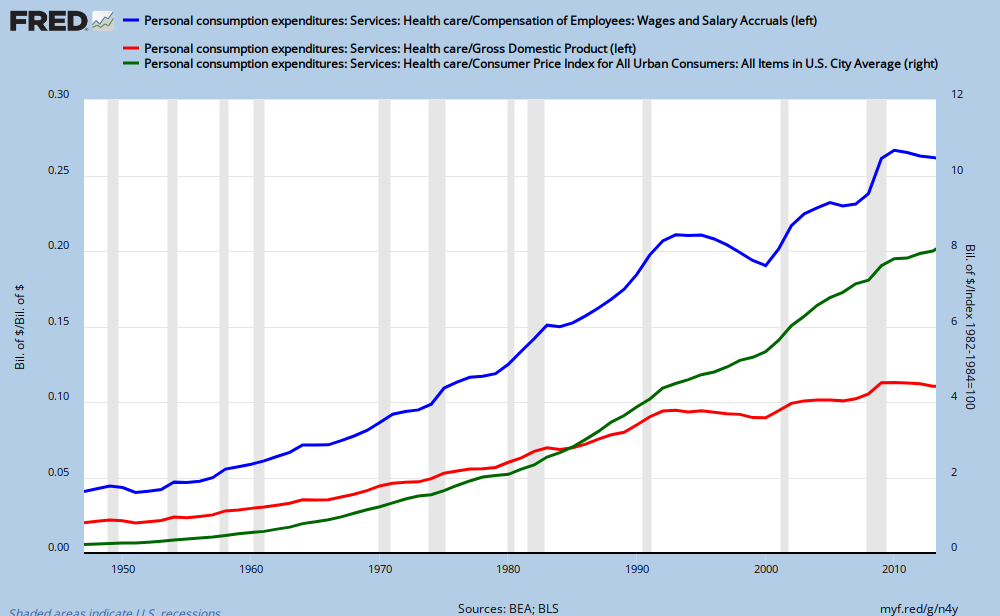

According to the U.S. Department of Commerce: Bureau of Economic Analysis, Healthcare cost are still rising faster than inflation after the PPACA became law. Inflation was 2% last year but Healthcare went up 4%.

Healthcare . . . Inflation

Healthcare vs Inflation

Healthcare . . . Inflation

Healthcare vs Inflation

Last edited:

Granny

Gold Member

Just got my BC/BS renewal notice in the mail yesterday. Now I can relax. I will have a $6/month increase from $63 to $69/month. But, then, I also have GAP coverage rather than employer or self-insurance. What I don't know is how much my monthly premium paid to Medicare will increase. That may set me back on my heels.

The highest rate any employer I know was paying $1200 a month prior to Obamacare. I can't believe $1362 a month was the average. Where do you find this data?

$1,362/month isn't the average employer contribution, it's the average cost of an employer-based family plan. The average employer contribution to that plan cost is 72% of the total, or around $980/month. The average employee picks up the remaining ~$380/month.

This is from the 2013 KFF/HRET Employer Benefits Survey. They've been doing this survey every year for quite some time.

Last edited:

- Thread starter

- #18

The highest rate any employer I know was paying $1200 a month prior to Obamacare. I can't believe $1362 a month was the average. Where do you find this data?

$1,362/month isn't the average employer contribution, it's the average cost of an employer-based family plan. The average employer contribution to that plan cost is 72% of the total, or around $980/month. The average employee picks up the remaining ~$380/month.

This is from the 2013 KFF/HRET Employer Benefits Survey. They've been doing this survey every year for quite some time.

This can't have been the entire workforce paying those rates. Most would have medical problems after seeing a rate that high.

- Aug 10, 2009

- 168,037

- 16,519

- 2,165

- Banned

- #19

That figure is questionable and time will tell.

To the point:

(1) many were paying more than that;

(2) many could not get it at any price.

And the GOP conservative reactionary wing was responsible for the situation.

To the point:

(1) many were paying more than that;

(2) many could not get it at any price.

And the GOP conservative reactionary wing was responsible for the situation.

- Thread starter

- #20

Maybe the curve is bending a little. Why did rising healthcare cost slow much more under Clinton?

Personal consumption expenditures: Services: Health care (DHLCRC1A027NBEA)

VS

Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL)

Compensation of Employees: Wages & Salary Accruals (WASCUR)

Gross Domestic Product (GDP)

Healthcare Expense vs Inflation / Healthcare Expense vs Wages / Healthcare Expense vs GDP

Personal consumption expenditures: Services: Health care (DHLCRC1A027NBEA)

VS

Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL)

Compensation of Employees: Wages & Salary Accruals (WASCUR)

Gross Domestic Product (GDP)

Healthcare Expense vs Inflation / Healthcare Expense vs Wages / Healthcare Expense vs GDP

Similar threads

- Replies

- 250

- Views

- 2K

- Replies

- 1

- Views

- 82

- Replies

- 86

- Views

- 758

Latest Discussions

- Replies

- 110

- Views

- 622

- Replies

- 5

- Views

- 20

- Replies

- 37

- Views

- 163

Forum List

-

-

-

-

-

Political Satire 8051

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-