- Moderator

- #201

Income tax is based on percentage of income. The only people who are surprised that the top earners pay the lion's share are those who suck at math.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Income tax is based on percentage of income. The only people who are surprised that the top earners pay the lion's share are those who suck at math.

I wonder who first came up with this lame-ass talking point. It sounds stupid enough to be Ann Coulter.As a rich guy who only pays 3% of his gross in taxes - nothing is forbidding you from paying in as much additional tax as you like. Make the check payable to the IRS...or better yet, do an electronic transfer. We'll all be very grateful.

Cop outThe middle class pays 30% of their total income in taxes, I (a rich guy) pay 3% of my total income in taxes.

I'd be interested to see how you came up with the 30%. The OP refers to federal income taxes. On $50,000 total income (gross, btw) that would be $15,000. Adjusted would be considerably less than $50,000 depending on family size and children's ages. Working parents, 2 children under 17, and their federal income tax liability is reduced to >0. Figuring in the 6.3% payroll tax of around $3,000 - you come up about $12,000 short.

As a rich guy who only pays 3% of his gross in taxes - nothing is forbidding you from paying in as much additional tax as you like. Make the check payable to the IRS...or better yet, do an electronic transfer. We'll all be very grateful.

The problem with our tax structure is not a lack of volunteerism

Truth is never a cop out.

The problem with our tax structure is a lack of the Federal government living within its means...and volunteerism is the American way. Those who believe their percentile group isn't paying their fair share of federal income tax should put their money where their mouth is and pony up. It's the right thing to do.

Nobody consumes more than the rich and corporationsI think the richest 10% should pay 50% of the taxes.......which would mean that their taxes should drop another 20%....because they 70% already.

I think all taxes should be based on consumption.

If you're consuming then you should be assessed 15% for everything you buy.

Oh, and your 15% cannot be subsidized by the government.

It is the dumbest analogyI wonder who first came up with this lame-ass talking point. It sounds stupid enough to be Ann Coulter.As a rich guy who only pays 3% of his gross in taxes - nothing is forbidding you from paying in as much additional tax as you like. Make the check payable to the IRS...or better yet, do an electronic transfer. We'll all be very grateful.

As a rich guy who only pays 3% of his gross in taxes - nothing is forbidding you from paying in as much additional tax as you like. Make the check payable to the IRS...or better yet, do an electronic transfer. We'll all be very grateful.

I wonder who first came up with this lame-ass talking point. It sounds stupid enough to be Ann Coulter.

It is the dumbest analogy

Like saying if you want schools, you should just pay more to fund them

If you want wars....you pay for it

what is it exactly do you want?

No, delusions are for denying the discomfort of reality. You had your chance - let's revisit this when we acquire another 10 Trillion in debt, wages stay stagnant and economic growth hovers around 1.5%. Until then...

Everyone pays some type of taxeswhat is it exactly do you want?

What every American wants, for everyone to have some skin in the game. If you live in this country, you owe something to pay our way.

Nope. I have and stand by the fact that the middle class doesn't pay that much and if they get a tax cut, their taxes will go lower. After all, what you asked was, "What would happen if the middle class gets a tax cut? I said, their taxes would go lower.

We all have skin in the game. That's how a market economy works.

Everyone pays some type of taxes

Why go after our poorest citizens for additional revenue when the wealthy have so much?

Except the government is holding the interest rates at 0% which makes holding any savings very unattractive.

According to the left....the rich need to be punished.I agree with the Socialist Regressives that the rich aren't paying their fair share. They are paying way too much and it's time to lower the tax rates.

OMB: Top 20% pay 95% of taxes, middle class 'single digits'

Ouch! - that's gonna shatter some painful delusions.

As a matter of fact, they should just hand liberals their check book and turn over the keys to their homes and cars....because they are all ill-gotten gains.

But only in America.

The wealthy in Europe get a pass.

You tax where the money isEveryone pays some type of taxes

Why go after our poorest citizens for additional revenue when the wealthy have so much?

Not "going after anyone". Everyone who lives here owes something for the privilege. They also pay closer attention to what is being spent if they're not getting paid to live here and have to get out and help pull the wagon!

Then how are we going to pay for everything?

Well, in a household budget, if more goes out than comes in, we have basically two choices. Earn more, or spend less...a combination of the two works well. Simply taking money from my neighbor is generally frowned upon.

Raise income -

The majority of the federal budget goes to Medicare, Social Security, Medicaid, other social services and interest on the debt. Means test the first two, both in payouts and rates. Raising the employer contribution rate will be counterproductive.

Make more taxpayers - via a job friendly economic environment.

Reduce outgo -

Spend less.

Will it be painless?...nope.

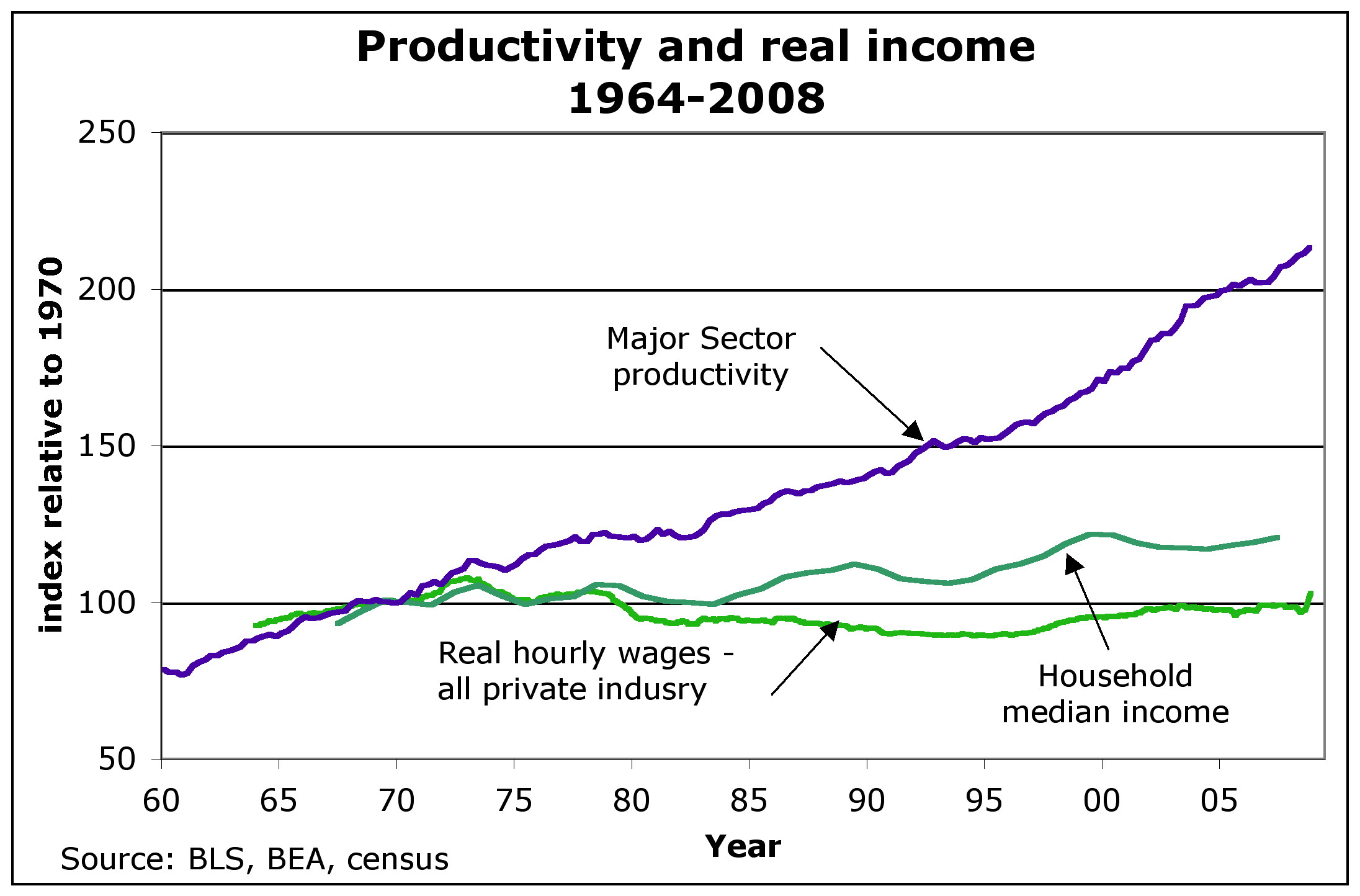

Why are incomes stagnant in comparison to a booming productivity?