SeaGal

Gold Member

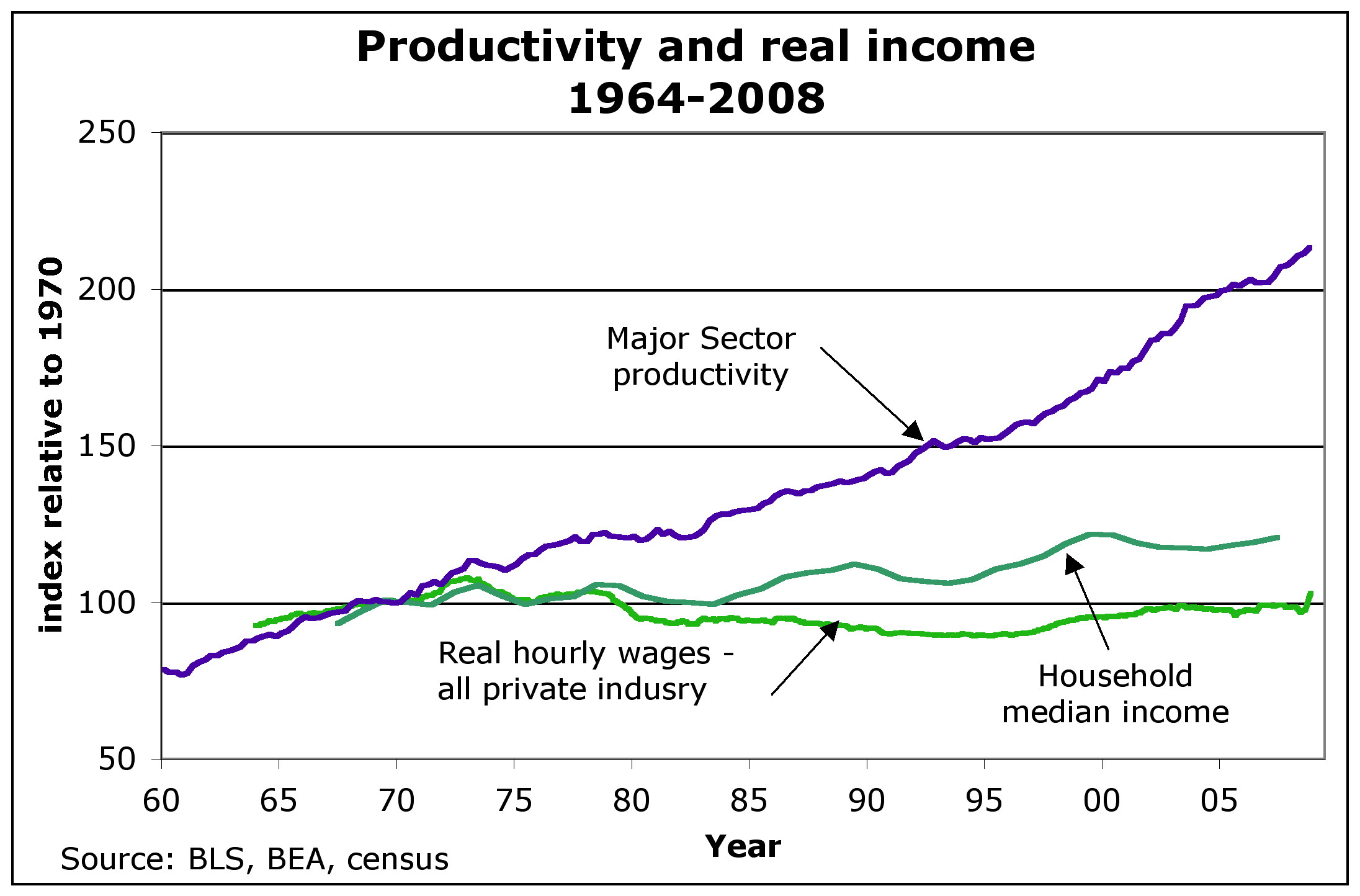

The middle class pays 30% of their total income in taxes, I (a rich guy) pay 3% of my total income in taxes.

I'd be interested to see how you came up with the 30%. The OP refers to federal income taxes. On $50,000 total income (gross, btw) that would be $15,000. Adjusted would be considerably less than $50,000 depending on family size and children's ages. Working parents, 2 children under 17, and their federal income tax liability is reduced to >0. Figuring in the 6.3% payroll tax of around $3,000 - you come up about $12,000 short.

As a rich guy who only pays 3% of his gross in taxes - nothing is forbidding you from paying in as much additional tax as you like. Make the check payable to the IRS...or better yet, do an electronic transfer. We'll all be very grateful.