- Banned

- #1

Justice Department drops Goldman financial crisis probe | Reuters

Obama is gonna change the way things work huh?

What a crock of shit

Obama is gonna change the way things work huh?

What a crock of shit

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

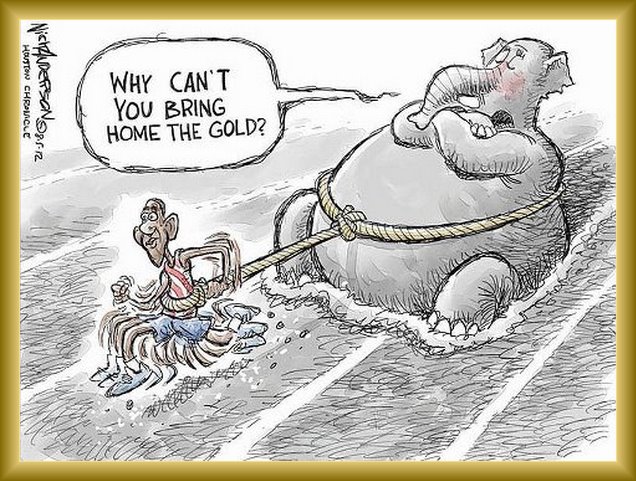

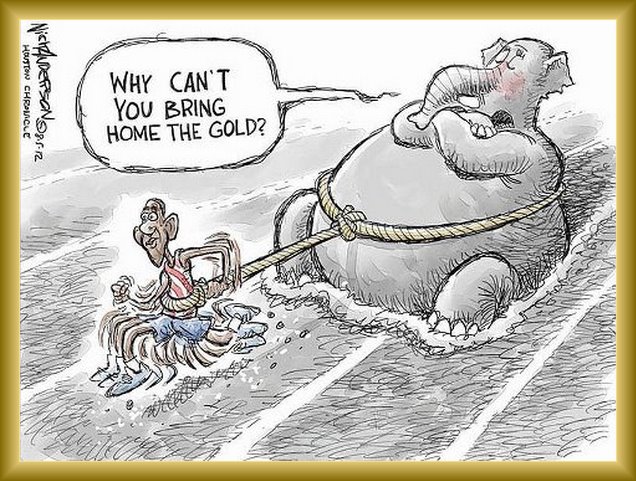

He can't do it all alone...

I looked into this earlier and it seems there is not a firm legal framework to charge anyone with anything. Maybe the Republican house will pass something that makes such murky esoteric cases of fraud illegal, not holding my breath.

I looked into this earlier and it seems there is not a firm legal framework to charge anyone with anything. Maybe the Republican house will pass something that makes such murky esoteric cases of fraud illegal, not holding my breath.

If there was no legal framework then why did we spend millions of dollars on hearings and investigations?

All show huh?

Remember when you ALL claimed that any settlement Cain made with former employees proved guilt?

I do so how do you explain this...

In a related civil case, Goldman settled with the U.S. Securities and Exchange Commission for $550 million in July 2010, without admitting wrongdoing

Remember when you ALL claimed that any settlement Cain made with former employees proved guilt?

I do so how do you explain this...

In a related civil case, Goldman settled with the U.S. Securities and Exchange Commission for $550 million in July 2010, without admitting wrongdoing

Are somehow under the impression that I am in favor of Justice chickening out by barely slapping the wrist of G+S for betting against the worthless crap they were selling to various municipalities and pension funds? I want them to be given the corporate death penalty and broken up into tiny little pieces their board jailed for decades and laws enacted to insure it never happens again, unfortunately too many powerful people are against such "class warfare".

Remember when you ALL claimed that any settlement Cain made with former employees proved guilt?

I do so how do you explain this...

In a related civil case, Goldman settled with the U.S. Securities and Exchange Commission for $550 million in July 2010, without admitting wrongdoing

Are somehow under the impression that I am in favor of Justice chickening out by barely slapping the wrist of G+S for betting against the worthless crap they were selling to various municipalities and pension funds? I want them to be given the corporate death penalty and broken up into tiny little pieces their board jailed for decades and laws enacted to insure it never happens again, unfortunately too many powerful people are against such "class warfare".

Who are these people in the Justice Dept you speak of?

What's the matter grandpaw? Did you just realize that you are against the only piece of legislation passed to confront what you are complaining about? The Dodd-Frank act HAD language to address this kind of double dealing but it seems that it was one of the parts most rigorously attacked by both republican congressmen and the best lawyers Wall Street could buy.

What's the matter grandpaw? Did you just realize that you are against the only piece of legislation passed to confront what you are complaining about? The Dodd-Frank act HAD language to address this kind of double dealing but it seems that it was one of the parts most rigorously attacked by both republican congressmen and the best lawyers Wall Street could buy.

Justice Department drops Goldman financial crisis probe | Reuters

Obama is gonna change the way things work huh?

What a crock of shit

Link to the lawsuit please.Pubs are obstructing implementation of Dodd/Frank...

Until then, most of what Wall St. did is not illegal, just the usual Pub cronyism and big money corruption. Certainly under Romney nothing would be done..