- Sep 15, 2008

- 25,881

- 4,471

- 0

- Banned

- #21

As does every single frigging economist in the World.

Just what we need, the return of the completely theoretical Laffer Curve.

While we are at it, can anyone tell me with any degree of confidence if the Laffer Curve is a perfect Bell or skewed to the right or left.

I mean, if we are going to preach the miracles of it, we should at least be able to describe it's shape.

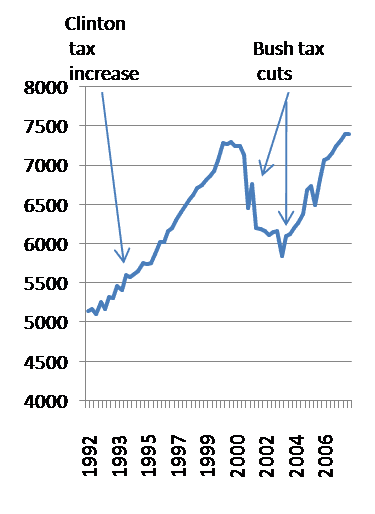

don't be silly. its obviously very imprecise but deadly accurate in terms of the relationship between tax revenue and the size of the economy

Whose being silly?

Here:

Here is a theoretical Laffer Curve (that assumes a perfect bell). Now show me where we are at on the curve and why.

Numbers please. Not opinions.

Oh, by the way. As you see: t* lays at the 50% line. The income tax for the highest income bracket in this country is currently 35%.

the top bracket was around 70 when the curve was invented.