leftwinger

Diamond Member

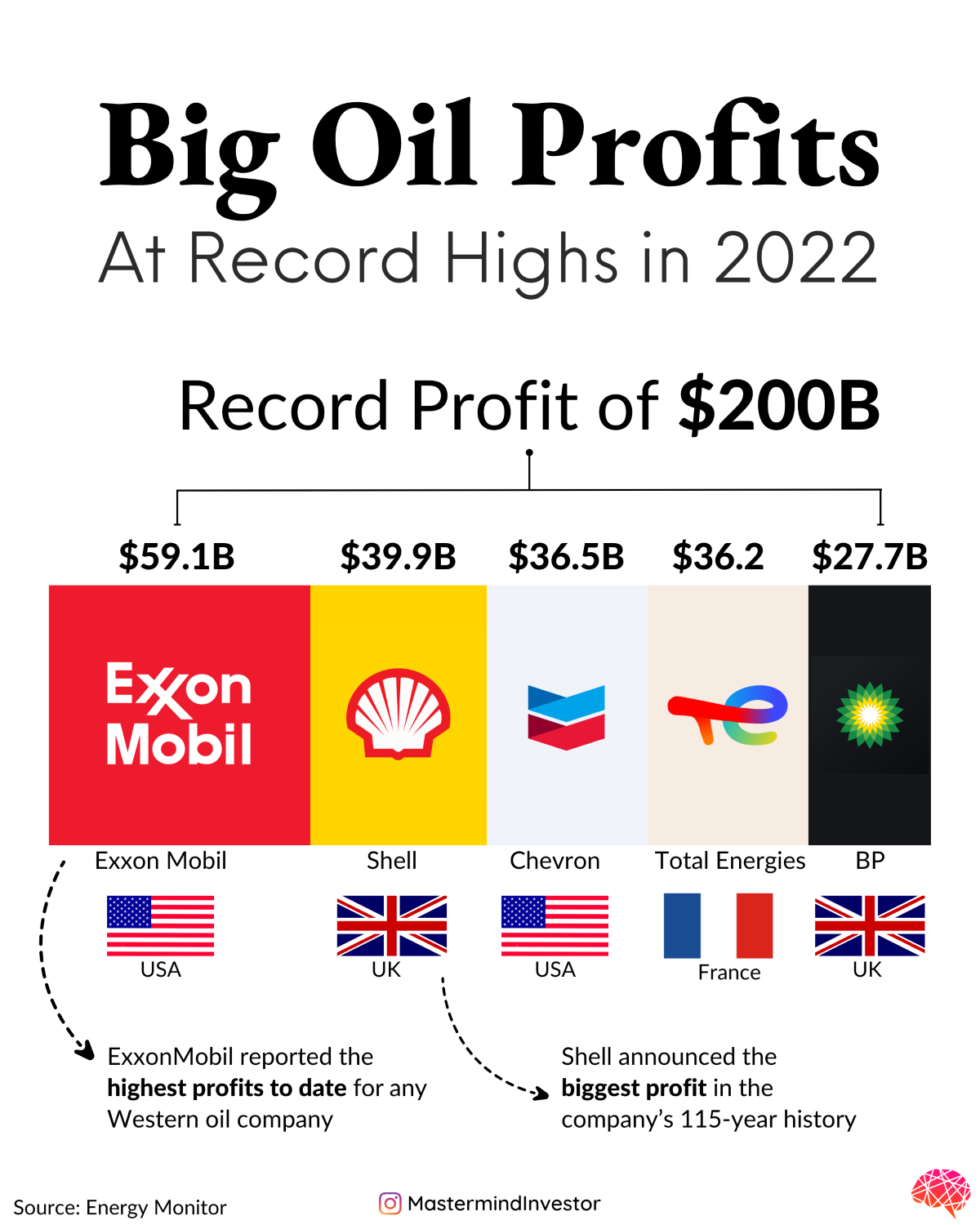

It looks like CVX made ~$30B/$214B (~14%) so far this year? $35B/$235B last year?

AAPL ended up with $94B/$384B (~24%)

Apple Inc financial statements, including revenue, expenses, profit, and loss The total revenue of AAPL for the last quarter is 81.80B USD, and it's 13.75% lower compared to the previous quarter. The net income of Q3 23 is 19.88B USD. $20B/$82B == (~24%)

I am no expert but the numbers are on the Financial page.

Once again, Big evil OIL is ripping you poor bustereds off? How did you drive to the store? To the worksite? At ~15mpg I would assume.

AAPL ended up with $94B/$384B (~24%)

Apple Inc financial statements, including revenue, expenses, profit, and loss The total revenue of AAPL for the last quarter is 81.80B USD, and it's 13.75% lower compared to the previous quarter. The net income of Q3 23 is 19.88B USD. $20B/$82B == (~24%)

I am no expert but the numbers are on the Financial page.

Once again, Big evil OIL is ripping you poor bustereds off? How did you drive to the store? To the worksite? At ~15mpg I would assume.

Featured Creator

Featured Creator