- Nov 26, 2011

- 123,648

- 56,858

- 2,290

"Sin tax" is a colloquialism for Pigovian tax. They both serve the same purpose, with very little distinction between them.its more of a sin tax, than a pigovian taxTaxes on cigarettes and booze (and now pot) are classic Pigovian taxes.So they don't tax pot, eh?It's so odd. For libs, Weed = Good. Tobacco = Bad.

Wrong!

Colorado Raised More Tax Revenue From Marijuana Than Alcohol

It clocked in at $70 million last fiscal year alone.

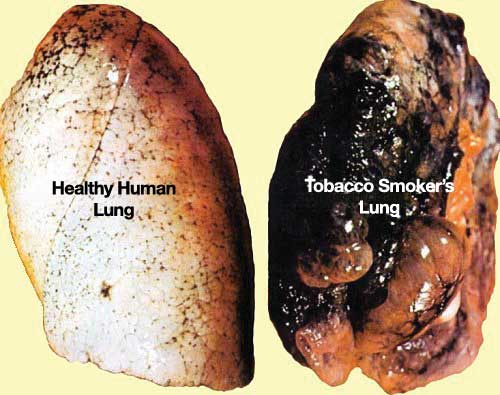

The difference is the Tax on Tobacco is becoming far more punitive than simple revenue enhancement.

The irony of all this is the government is at the same time fighting the "improved cigarette", otherwise known as vaping. It removes all of the detriments of combustion products, and allows nicotine absorption without the said combustion product issues.

I have mixed feelings about Pigovian taxes. On the one hand, they are consumption taxes and thus reduce the pressure to increase taxes on production. On the other hand, they are pure social engineering by the government.