McRocket

Gold Member

- Apr 4, 2018

- 5,031

- 707

- 275

- Banned

- #1

'On the left, it’s been applauded. On the right, it’s been widely critiqued and even ridiculed. But theoretically, how much could Ocasio-Cortez’s top tax rate actually raise—and how much difference would that make to the lives of ordinary Americans?

Even under the best possible circumstances, the numbers may disappoint.

According to figures from the Social Security Administration, just 3,755 Americans earned more than $10 million in salary in 2017, for total earnings of around $82.47 billion. Under Ocasio-Cortez’s plan, their earnings over $10 million—some $44.92 billion—would be taxed at 70%, rather than the present 37% rate for all earnings over $500,000 a year.

If this rate were adjusted to 70%, the IRS would receive an additional $14.8 billion each year from this tippy-top 0.0007% of all earners—at the absolute most. (This assumes she would only be raising taxes for earners over $10 million, as mentioned in the CNN interview, rather than a gradual increase for all high earners.)

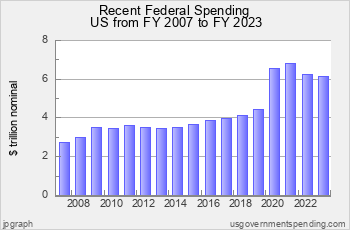

It sounds like a lot, but an extra $14.8 billion a year in government coffers would make very little difference to America’s economy. It’s less than the US spends on NASA, for instance, and only around 2% of the present military budget. If it were given out to Americans as a cash payment, each person would get just $45.50.

At present, the federal budget is at $4.4 trillion, with a $985 billion deficit anticipated for Oct. 2018 through Sept. 2019. This extra income would scarcely make a dent in that sum.'

In theory, how much could Alexandria Ocasio-Cortez’s 70% tax rate bring in?

Are you fucking, kidding me?

All this hype over a lousy $14.8 billion...or only about 1/3 of 1% of the entire budget?

That's it?!?

This is clearly little more than a hate tax on the mega rich (because it sure as shit won't do squat to pay down the deficit or fund some progressive, pipe dream bill).

Even under the best possible circumstances, the numbers may disappoint.

According to figures from the Social Security Administration, just 3,755 Americans earned more than $10 million in salary in 2017, for total earnings of around $82.47 billion. Under Ocasio-Cortez’s plan, their earnings over $10 million—some $44.92 billion—would be taxed at 70%, rather than the present 37% rate for all earnings over $500,000 a year.

If this rate were adjusted to 70%, the IRS would receive an additional $14.8 billion each year from this tippy-top 0.0007% of all earners—at the absolute most. (This assumes she would only be raising taxes for earners over $10 million, as mentioned in the CNN interview, rather than a gradual increase for all high earners.)

It sounds like a lot, but an extra $14.8 billion a year in government coffers would make very little difference to America’s economy. It’s less than the US spends on NASA, for instance, and only around 2% of the present military budget. If it were given out to Americans as a cash payment, each person would get just $45.50.

At present, the federal budget is at $4.4 trillion, with a $985 billion deficit anticipated for Oct. 2018 through Sept. 2019. This extra income would scarcely make a dent in that sum.'

In theory, how much could Alexandria Ocasio-Cortez’s 70% tax rate bring in?

Are you fucking, kidding me?

All this hype over a lousy $14.8 billion...or only about 1/3 of 1% of the entire budget?

That's it?!?

This is clearly little more than a hate tax on the mega rich (because it sure as shit won't do squat to pay down the deficit or fund some progressive, pipe dream bill).

Last edited: