IcebergSlim

Diamond Member

- Oct 11, 2013

- 10,886

- 9,142

- 2,255

- Banned

- #81

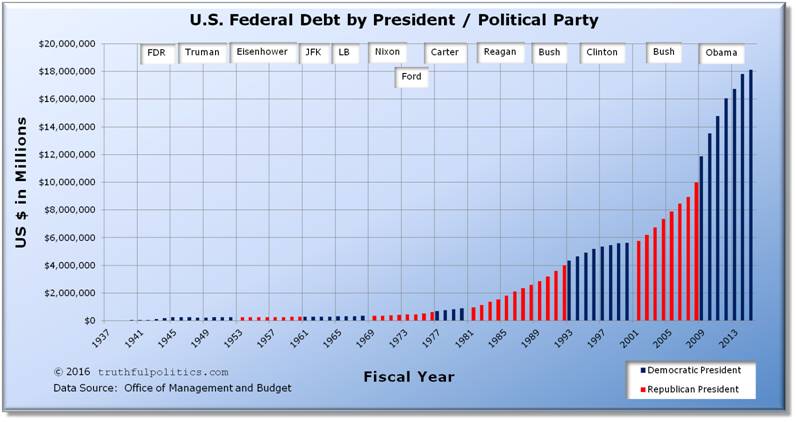

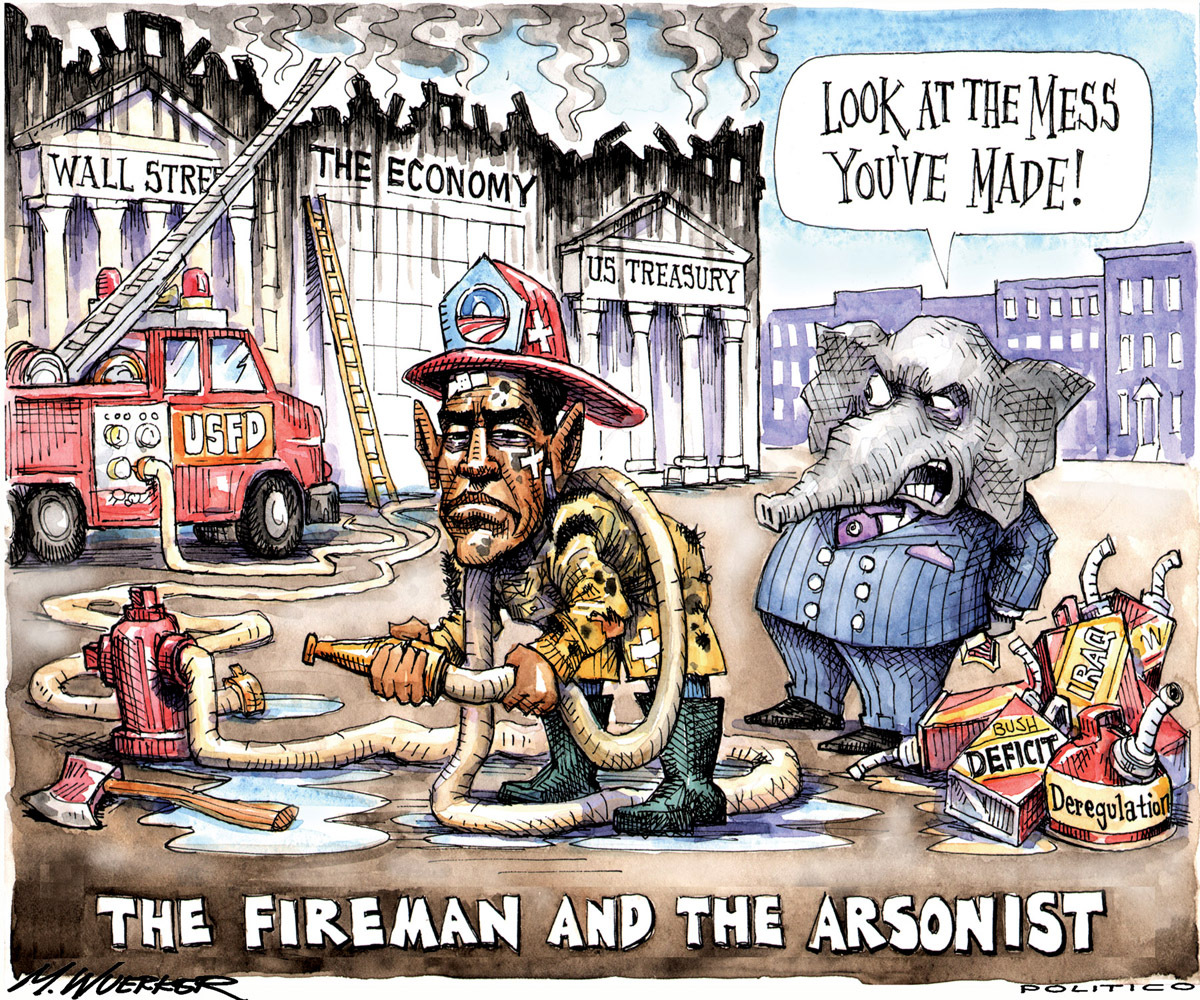

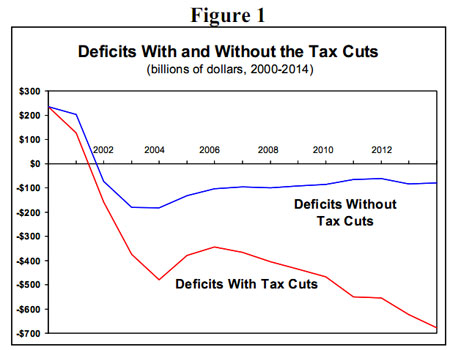

So...we are only allowed to discuss last year's deficit. Is that right?Okay...the dipshit shrub generated huge deficits.

Then, his successor generated even larger deficits, but he gets a pass. Why?

You have no idea what last year's deficit was, do you?

No idea at all.....

Lower every year since FY 2009......Expected to be lower again for FY 2015

Any questions?