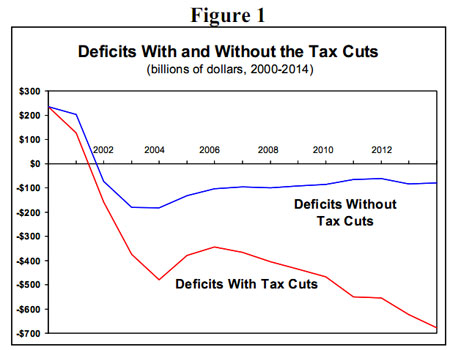

More sheer ignorance and deception from another unread liberal. The Bush tax cuts did not cause the deficit increase. Federal revenue ROSE after the Bush tax cuts (see below). The problem was that Congress then went on a reckless spending spree and jacked up spending so much that it outstripped the huge increase in federal revenue.

Here is what happened to federal revenue in the years after the Bush tax cuts. From 2004 to 2007, federal tax revenue increased by $780 billion, the largest four-year increase in American history. Total federal revenue from 2003 to 2007:

2003 -- $1.78 trillion

2004 -- $1.88 trillion

2005 -- $2.15 trillion

2006 -- $2.40 trillion

2007 -- $2.56 trillion

Total federal revenue for 2008 dropped slightly, down to $2.52 trillion, because a recession started that year, but revenue was still substantially higher than it was in 2003 or 2004. During the same period, income tax revenue rose dramatically, going from $925 billion in 2003 to $1.53 trillion in 2007. As with other types of federal revenue, income tax revenue dropped slightly in 2008, down to $1.45 trillion, due to the fact that a recession began that year.

And before you scream that Congress was under GOP control during the spending spree, let's note that the Democrats wanted to spend even more money (just go read the Congressional Record) and that when the Democrats gained control of Congress in 2007 they jacked up spending even more than the Republicans had done.

Here is what happened to federal revenue in the years after the Bush tax cuts. From 2004 to 2007, federal tax revenue increased by $780 billion, the largest four-year increase in American history. Total federal revenue from 2003 to 2007:

2003 -- $1.78 trillion

2004 -- $1.88 trillion

2005 -- $2.15 trillion

2006 -- $2.40 trillion

2007 -- $2.56 trillion

Total federal revenue for 2008 dropped slightly, down to $2.52 trillion, because a recession started that year, but revenue was still substantially higher than it was in 2003 or 2004. During the same period, income tax revenue rose dramatically, going from $925 billion in 2003 to $1.53 trillion in 2007. As with other types of federal revenue, income tax revenue dropped slightly in 2008, down to $1.45 trillion, due to the fact that a recession began that year.

And before you scream that Congress was under GOP control during the spending spree, let's note that the Democrats wanted to spend even more money (just go read the Congressional Record) and that when the Democrats gained control of Congress in 2007 they jacked up spending even more than the Republicans had done.