AntonToo

Diamond Member

- Jun 13, 2016

- 30,442

- 8,806

- 1,340

According to Goldman Sachs, this tax bill will only increase growth by 0.3% for 2018-19 and then either flat-line, or contract the economy beginning in 2020.

That's a loser.

According to Goldman Sachs, this tax bill will only increase growth by 0.3% for 2018-19

Oh no! Increased growth.

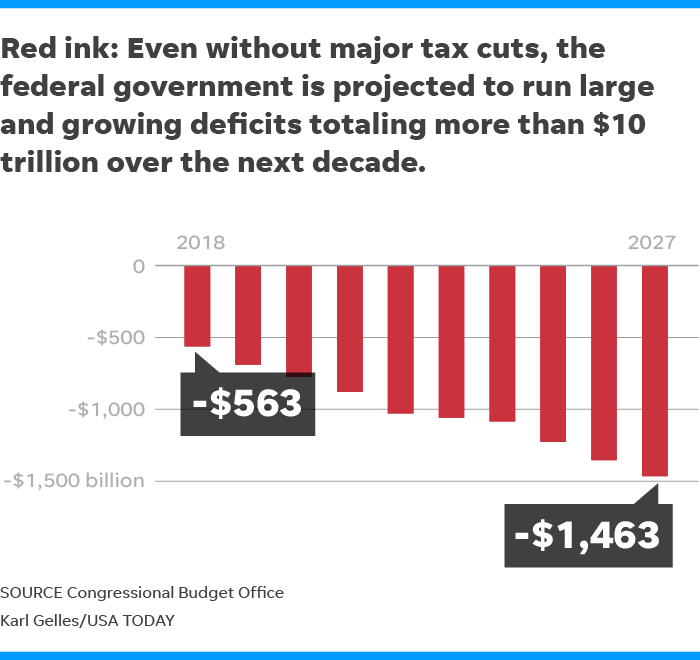

Oh no! Increased growth at time of growth. paid for with DEFICITS that ALREADY look disastrous.

Can ANYONE supporting these tax cuts explain to me why this is a good idea?

Looks like a good time to cut government spending.

Nope, good time to cut spending is BEFORE you fuck up already fucked up budget even further.

And here is another thing about cutting spending - IT IS CONTRACTIONARY. If we cut one trillion dollar in 2027 from government spending economy will contract by around 5% GDP and put us into recession.

And here is another thing about cutting spending - IT IS CONTRACTIONARY.

So are tax hikes. Why do you love deficits?

did you just brain fart?

Yes, reducing deficits is generally contractionary. There is no free lunch.

Given ALREADY deep fiscal hole we are in today's tax-cuts are just tomorrow's taxes plus interest, minus growth.

Last edited: