- Apr 10, 2013

- 23,667

- 1,880

- 265

The DOW went up 200 points today. Which Wall Street are you referring to?

Investors want to make as much money before it gets tough again, ie, the Republican caused crash of 2008.

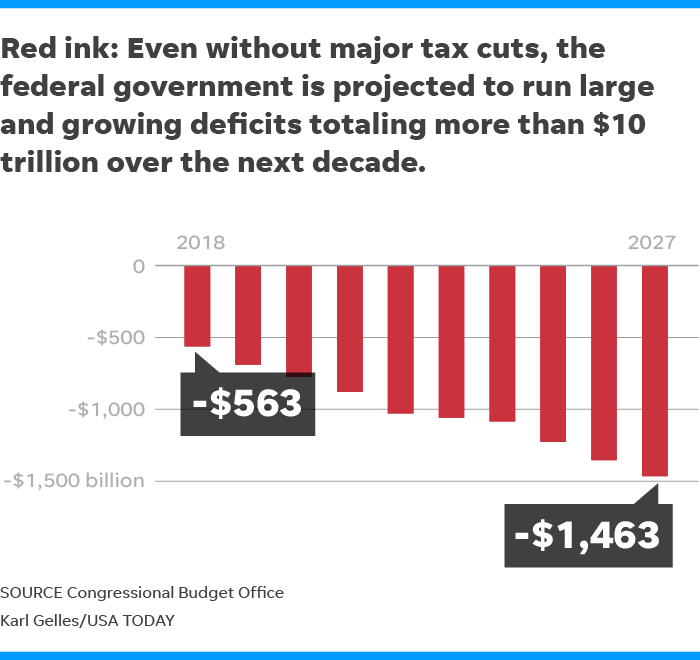

Sixty plus percent of the economy is middle class spending. Trumps tax bill HURTS the middle class.

Look its not rocket science, if the people agreed with Obama and the left they would still be in charge. The left didn't suffer some minor setback their party has been obliterated. Historical losses so epic you have to go back almost 100 years to find a time when Dem's took a beating that epic. So there's reality, and well your opinions.

Look its not rocket science, if the people agreed with Obama and the left they would still be in charge. The left didn't suffer some minor setback their party has been obliterated. Historical losses so epic you have to go back almost 100 years to find a time when Dem's took a beating that epic. So there's reality, and well your opinions.